Presentation|Electric Vehicle Industry Focus in 2023 (Next)

Smart Cabin Trends and Major Developments in Taiwan

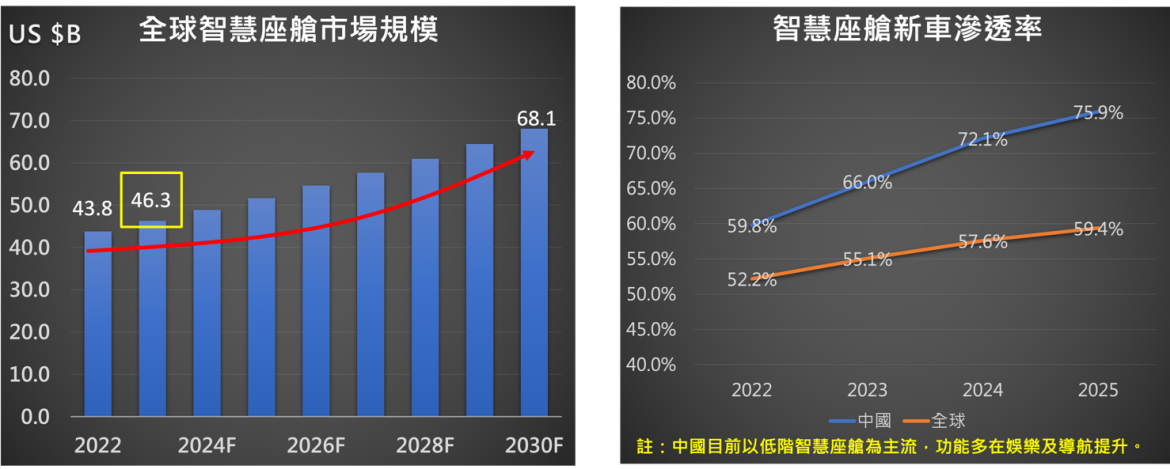

The smart cabin market is expected to grow steadily to $46.3 billion in 2023 and $68.1 billion in 2030 at an average compounded growth rate of 5.6%. China's smart cabin penetration will reach 66%, with two out of three cars sold equipped with smart cabins. (Note: Low-end smart cabins are now the mainstream in China, and their functions are mostly entertainment and navigation enhancement.)

Figure 1 Global Smart Cabin Market Estimates/Smart Cabin Penetration Rate

Source: IHS Markit; collated by Ji-Pu Industrial Trend Research Institute 2022/10

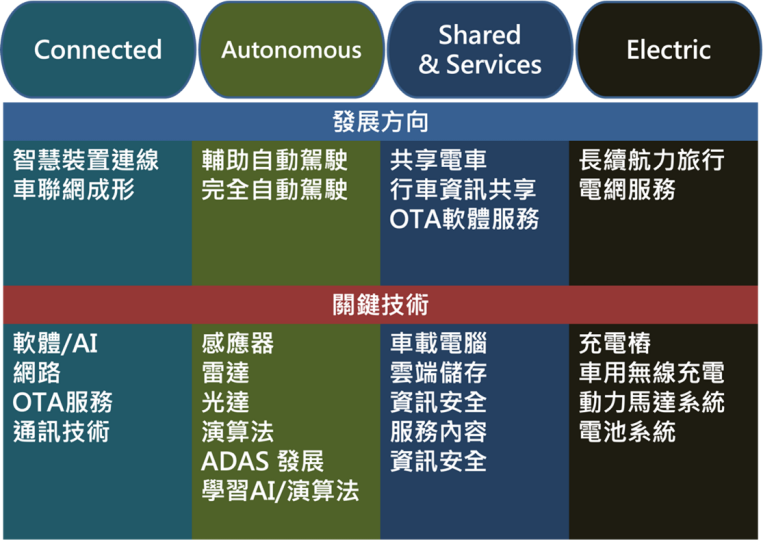

Smart Cabin features three main points: 1. on-board computer as the core, 2. multi-module can be coordinated with the technology overlap, 3. different technologies are developed independently. In terms of strategy, the smart cabin is mainly oriented to serve C.A.S.E. for function enhancement. The key technology advancement of C.A.S.E. is actually equivalent to the advancement of smart cabin technology (Figure 2). In terms of technology, we are moving towards the centralization of the electronic control domain, integrating systems with different functions through the advancement of SoCs in order to reduce the complexity of hardware and software. Overall, in 2023, smart cabins will develop towards enhanced interaction, enhanced vision, self-driving function Level 3 on board, and more personalization (Figure 3). In terms of focus technology, we are concerned that head-up displays and multi-screen panels will revolutionize the driving experience in 2023 due to the improved visual experience and the technology has reached mass production.

Figure 2 C.A.S.E. Organization, Development Direction, Key Technology Modules

Source:Ji Pu Industrial Trend Research Institute 2022/10

Figure 3 Direction of Smart Cabin Development

Source: Images (AUO, BMW); Collated by Ji-Pu Industrial Trend Research Institute 2022/10

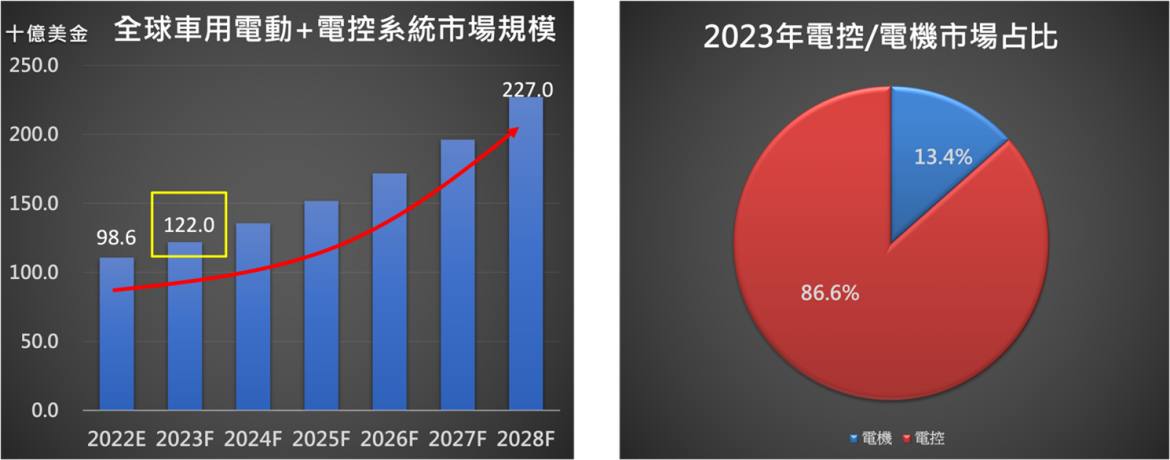

Global Automotive Electrical and Electronic Controls Market Growth

The global automotive motor plus electronic control market will grow from 98.6 billion in 2022 to 122 billion in 2023, a growth of 23.7%, of which 105.6 billion U.S. dollars accounted for 86.6%. motor/electronic control system features: 1. the three electric power when the motor electric control system costs account for a relatively low proportion of the motor system. 2. motor system is less complex than the natural system of the fuel vehicle. 3. electronic control system is an extension of the cockpit area, the different functional components are different, low substitutability between different component manufacturers in the industry chain. The system is an extension of the cockpit area, the difference between different functional components is large, and the substitutability between different component manufacturers in the industry chain is low. Taiwan's advantage lies in the fact that all components, ranging from large automotive motors to small DCDC converters, have been delivered, and the industrial structure is complete. 2023 development will be oriented toward motor-based three-machine integration.

Figure 4 Automotive Global Electrical/Electronic Controls Market Size Estimates/ Electrical/Electronic Controls Market Share by 2023

Source: Strategy Analiytics; GII; organized by Chipotle Industry Trend Research Institute 2022/10

In 2023, the general direction of motor and electronic control will be towards modularization and standardization to facilitate rapid introduction into the platform, and each module will have different technological upgrades, and the motor, gearbox, and motor controller will be realized as a three-machine integrated system in order to achieve the purpose of size and manpower reduction. The power efficiency is expected to increase by 20%, the weight will be reduced by 25% and the cost will be optimized by 33% due to the reduction of wires after modularization.

Figure 5 Advantages of Modularization of Electric Control Systems for Automotive Electric Motors

Source: Azure Drive; Nissan I; collated by Chipotle Industrial Trends Research Institute 2022/10

Electric Vehicle Summary

- Battery development and will welcome the mass production of solid-state batteries: the competitive situation between China and the United States led to the electric vehicle industry chain from 2023 to enter the dual-track; major battery manufacturers on solid-state battery research is expected to be the next two years will have results. 2023 Taiwan manufacturers Hui can solid-state battery according to the schedule into mass production stage will be the key.

- Intelligent Cockpit is moving towards more interaction, more vision, more automation and personalization: under the C.A.S.E. framework in 2023, it will be moving towards interaction, vision, automation and personalization; Head-up Display and Multi-Display Panels will revolutionize the driving experience in 2023 as the technology has already reached mass production.

- The three-machine route for motors and electronic control systems has been established: In 2023, on the way toward three-machine modularization of electrical systems, system manufacturers including FUTA Electric and Delta Electric have growth potential. The electronic control system is moving toward modularization and standardization, which will increase the efficiency of EV integration and save manufacturers' costs.

You may have interesting articles:Presentation|Electric Vehicle Industry Focus in 2023 (Top)

You may have interesting articles:Conference|Highlights of Green Energy Industry Trends 2023

-For more information, please clickContact Us -