July_GAI Topic|Analyzing the market competition among Intel, AMD and NVIDIA from the perspective of computing architecture development (Next)

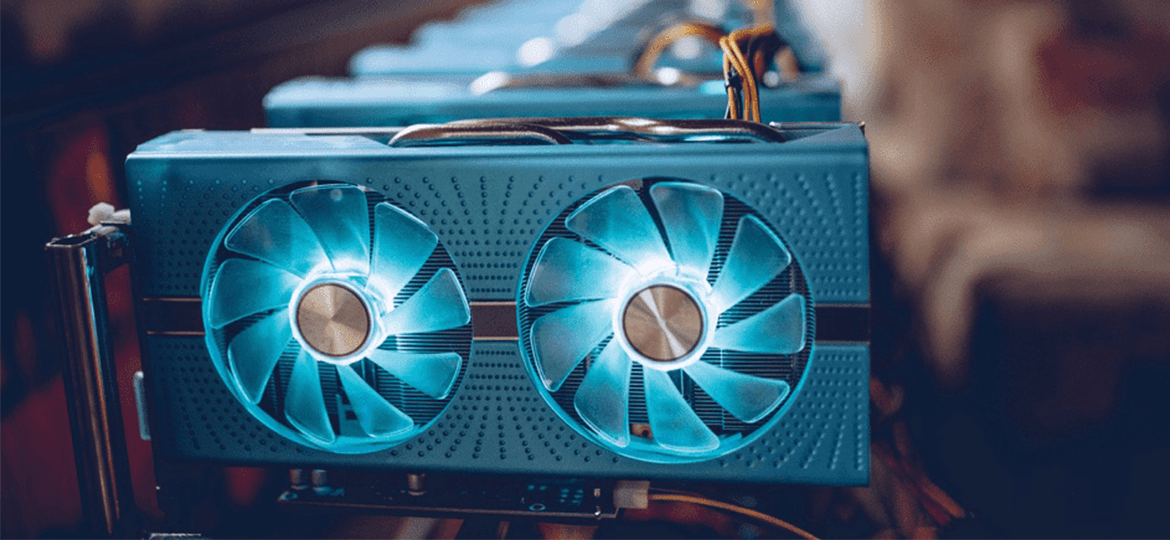

Recently, because of the ChatGPT fever, AI and its hardware layout have become the focus of the market, and we can analyze the advantages and disadvantages of the three major chip companies, Intel, AMD, and NVIDIA, from the products they have launched. After the introduction of the A100 and H100, NVIDIA has followed the same practice or even further expanded to launch larger scale multi-server solutions based on data center needs, so as to thickly cultivate NVIDIA's influence in the ecosystem of the server industry. Even though Intel and AMD's CPU products were not affected at that time, the situation began to change after NVIDIA announced that it would enter the server CPU in 2021. As NVIDIA has completed the acquisition of Mellanox and strengthened its DPU, Ethernet and InfiniBand technologies in one go, and now with Grace CPUs in place, it can be said that it has almost completed the jigsaw puzzle of the important components required by data centers, and NVIDIA has transformed itself from a supplier of chips and graphics cards to an important supplier of server hardware and software. NVIDIA has also changed from a supplier of chips and graphics cards to an important supplier of server hardware and software. NVIDIA's image of the market is no longer that of a professional gaming graphics card manufacturer, but rather that of a synonym for AI chips; NVIDIA's leadership in the field of AI model training has been further expanded with the Telsa V100, and then with the Ampere-based A100, which has also enabled the world's major CSP industry players to develop their own ASPs, and has led to a significant growth in the number of CSPs. NVIDIA's leadership in the field has been further strengthened by the Ampere architecture based A100, which has also enabled major CSP companies around the world to purchase chips from NVIDIA as if they had no one else to turn to. Even in the context of the U.S.-China technology war, the U.S. government has imposed a ban on the sale of A100 and the next-generation H100 chips to China, which demonstrates that NVIDIA's position in the global AI Model Training market is almost unshakeable. Although Intel has been a leader in the server and data center market for many years, it has not promoted AI GPU products to capture the market with a system-level solution strategy like NVIDIA. Originally, Intel's data center business was dragged down by its own manufacturing process delays, resulting in poor revenue performance. Coupled with NVIDIA's introduction of Grace CPU products, Intel's future development in the data center and server markets has been cast in a different light than AMD's. Although AMD's acquisition of NVIDIA has been a major factor in the company's success in the data center market, NVIDIA is still in the process of acquiring NVIDIA's AI GPUs. Although AMD has acquired Xilinx and Pensando to strengthen its FPGA and DPU business, its product line is still less complete than NVIDIA's, and it is afraid that AMD will not be able to build a data center system-level solution.

If we look at NVIDIA's dominance in the AI chip market from the perspective of market analysis, in addition to the GPU's leading technological development in the above description, its software integration, the launch of the unified computing architecture CUDA, simulation space Omniverse, and so on, to build a complete platform ecosystem is the key to its competitiveness. Since NVIDIA has been operating the CUDA ecosystem for quite a long time, from development tools, APIs, libraries, and even its own cloud environment are all available, and NVIDIA's investment in the AI field with the CUDA architecture is much earlier than that of AMD and Intel, so even though AMD has acquired Xilinx, or Intel has its own specialized AI acceleration chips such as Habana, etc., it is not possible for the company to compete in the AI market. Therefore, even if AMD acquires Xilinx, or Intel also has Habana and other specialized AI acceleration chips, it is still not easy to shake NVIDIA's leading position in AI. Of course, Intel and AMD also understand the importance of the software side of the AI field, so in recent years, the two companies have been constantly asking customers to develop software results from the NIVIDIA platform can be easily transferred to their own hardware platform, but in the current situation, the results are still not satisfactory. how to catch up with the NVIDIA Intel and AMD to further seize its share? With their own strengths, the establishment of platforms, ecosystems will be a necessary effort, we also believe that these two big companies also see this pain point, and actively deployed in the construction.