Industry Trend Report|Global Type III Semiconductor Major Manufacturers Development Status

carbonizesilicon (chemistry)industryChain

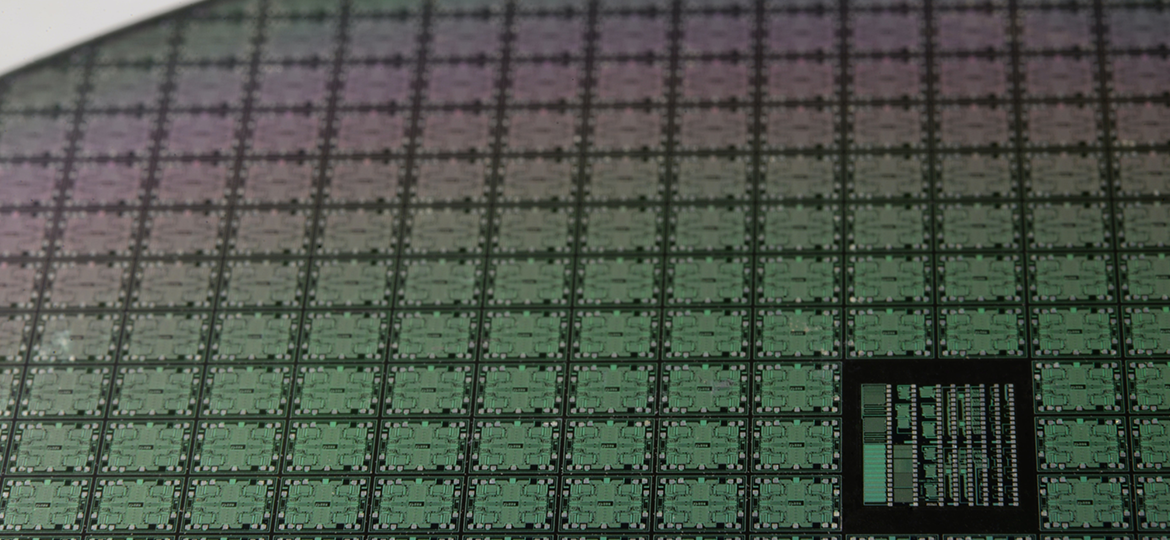

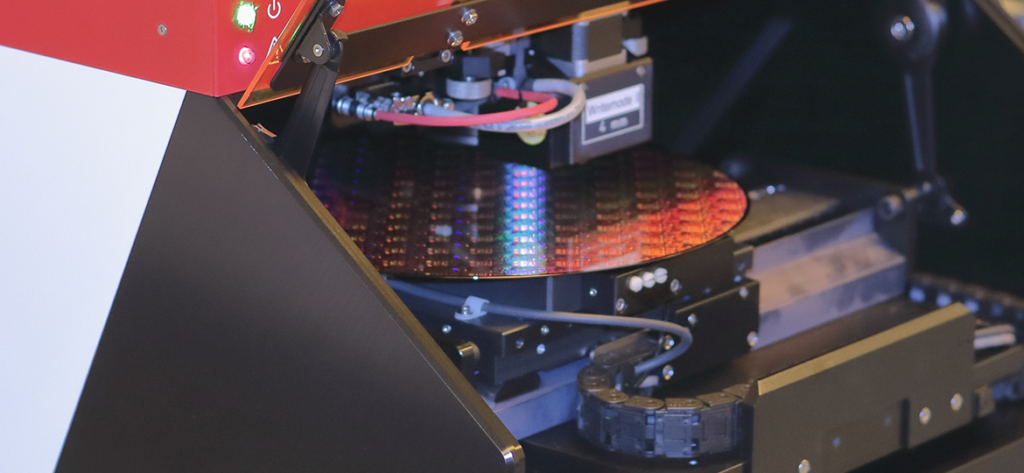

The silicon carbide industry can be divided into upstream substrate/epitaxial, midstream components/modules, and downstream systems, etc. Silicon carbide has a variety of isotropic structures, which can be divided into two main categories, the first is diamond-like sphalerite crystal structure of 3C-SiC (β-SiC), and the other is the hexagonal crystal structure of fibrous zinc ore, typically 6H-SiC, 4H-SiC, 15R-SiC (α-SiC). Typically, 6H-SiC, 4H-SiC, 15R-SiC (α-SiC), 4H-SiC and 6H-SiC are the most commonly used in the semiconductor field. In terms of wafers (substrates), silicon carbide wafers are in a state of oversupply, with foreign suppliers such as II-VI, Wolfspeed, Norstel, STMicroelectronics, Dow DuPont, and others. One of the major reasons for the high cost of silicon carbide components is the difficulty of wafer manufacturing, which accounts for about 50% of the cost of components, followed by 25% of epitaxial, 20% of component manufacturing, and 5% of packaging.Currently, the production of silicon carbide wafers is mainly in the range of 4-6 inches, and 4-inch wafers have been gradually replaced by 6-inch wafers since 2017, and the current production volume is the first one. Although some fabs have begun to produce 8-inch wafers, crystal defects still cause a decline in the yield of the subsequent component manufacturing process, so no component fabs have yet to enter mass production. Market research firm Fuji General Research estimates that 4-inch and 6-inch wafers will be produced in 2025 at 20,500m2 and 20,500m2 respectively.2780m2Foreign suppliers include II-VI, Wolfspeed, SiCrystal, Rohm, Norstel, Showa Denko, Transform, Dow DuPont, Nippon Seitetsu, Novasic, Denso, Aymont, and Siltronic. The quality and surface characteristics of silicon carbide substrates do not meet the requirements of device manufacturing, so an additional layer of high-quality epitaxial material must be deposited on the surface of the substrate before manufacturing various devices. Due to the problem of sublimation, the epitaxial temperature cannot exceed 1,800℃, thus the growth rate is slow. Currently, foreign epitaxial manufacturers include II-VI, Wolfspeed, SiCrystal, GTAT, Rohm, Ascatron, Denso, GE, Bosch, Mitsubishi Electric, Toshiba, Panasonic, ST Microelectronics, Infineon, On Semiconductor, Microsemi, Norstel, Showa Denko and others. Since wafer supply is a key factor in the development of the silicon carbide industry, major component companies are targeting upstream material manufacturers for mergers and acquisitions or booking production capacity in advance. For example, Infineon will sign a five-year wafer supply contract with GTAT in 2020, and ST Microelectronics has expanded its long-term wafer supply agreement with Wolfspeed, which will continue to supply 6-inch wafers and epitaxial wafers for a few years. The latter will continue to supply 6-inch wafers and epitaxial chips for several years, totaling over US$800 million. Foreign IDM suppliers include Littelfuse, Infineon, ST Microelectronics, II-VI, Wolfspeed, SiCrystal, Rohm, GE, Bosch, Mitsubishi Electric, Toshiba, Panasonic, Fuji Electric, GeneSiC. IC designers include Bruckewell, Littelfuse, and Monolith Semiconductor. The major vendors in the industry chain are shown in Figure 1.