December_ 2024 Outlook|Electric Vehicle Market Review 2023 and Trends 2024(Part2)

Electric Vehicle Trends in Three Major Markets by 2024

China: Sales Surpassed $10 Million, Market Moving Toward Oligopoly, Battery Leader Position Challenged

As mentioned earlier, China's EV market will still maintain a growth rate of more than 38% in 2023, and a number of Chinese car makers, including BYD, SAIC MG, Ideal, Azure, and Xiaopeng, etc., have all delivered a beautiful report card, especially BYD's 526,000 BEVs in the fourth quarter of 2023, and a total of 3.05 million new energy vehicles (BEVs + PHEVs) for the whole year, making it the new brother of Tesla in the EV world. It also overshadowed Tesla to become the new electric car industry. The domestic market has also begun a series of price cuts to compete with the mature technology, bringing forward the era of low-cost EVs, all of which will affect the trend of the domestic and global EV market. According to the data from the Federation of Industry Associations (FIA) until November 2023, the penetration rate of EVs below RMB300,000 is only 35.2%, which is the absolute mainstream of the EV market in China. Therefore, looking ahead to 2024, under the impetus of policies, EV infrastructure will continue to be built, and a perfect ecosystem will continue to help increase EV penetration (already reaching 36% in 2023). With a high growth rate of more than 35%, the sales volume will exceed 10.5 million, and low-priced EVs will be the mainstream. In Europe and the United States have not yet been able to build electric vehicles to compete with the Chinese brands will be rolled into the warring states era, the trend of retaining the strong and eliminating the weak gradually began to appear, the market share competition will move towards oligopoly, and the current tighter economic environment will accelerate this process, some can not keep up with the cost of vehicle manufacturers will be eliminated by the market.

In terms of technology, the battery, which accounts for the highest percentage of the cost of electric vehicles, has always been one of the focuses of attention. According to SNE Research, the global market share of battery leader NindeShi has been maintained at over 32% since 2021, and even as high as 36% as at the end of the third quarter of 2023, however, if you look closely at the third-quarter financial results, you can find that the net profit margin has declined in the second quarter, compared with the second quarter, despite the growth in revenue. However, a closer look at the Q3 results shows that net margins declined compared to Q2, despite revenue growth. The market share of electric vehicles in China is even more threatened, for the first time in 2023, it will be lower than 50% to 42%, on the contrary, BYD is fueled by the sales of its electric vehicles, and its own brand of batteries with a high growth rate of 78% has helped its penetration rate in China reach 28%. Under the impact of the introduction of its own batteries by one kind of car makers, such as Azure, Chang'an and BYD, etc., Nindeiso will be the first to introduce its own batteries in 2024. In 2024, Nindezo's market share in China will be challenged for the first time.

Europe: Driving habits help small EVs grow, EU anti-dumping investigation affects EV growth

In 2023, Europe will close with about 3 million EV sales, and Germany's three largest car manufacturers, BMW, VW, and Mecedes, will continue to launch mid-range and high-end EVs in an attempt to catch up with Tesla. bmw will sell more than 500,000 EVs in a full year, followed by Volkswagen with more than 450,000, and Mededes with a scorecard of 400,000. Due to the European road and driving characteristics, in the past few years, in addition to small cars suitable for the city and small roads, the price is also more affordable, has been the first choice of European consumers to buy, according to WSJ data, accounting for the total sales of sedan 81%. However, because of the electric car technology is not yet mature and cost reasons, the European car manufacturers on small electric cars are still unable to launch the production of the model into the market, and in Europe Tesla, which has the best sales in Europe, does not have a corresponding model (Model Y is overpriced). On the contrary, at the Munich Motor Show in September 2023, we can already see a series of corresponding models proposed by Chinese car makers, such as Xiaopeng, Aviator, Dongfeng Fengxing, and SAIC, which are ready to enter the European market at any time. It is estimated that by 2024, small EVs will become the driving force behind the penetration rate in Europe. In the face of the red tide, the European Union has already rumored that it will target Chinese EV brands and investigate whether subsidies have been used to create unfair competition. Therefore, under the situation that European and American carmakers do not have small EV models to satisfy the market, the restriction on Chinese brands will affect the growth momentum of EVs in Europe in 2024.

U.S.: Policies Affecting Sales, Lower Interest Rates Expected to Stimulate Buying, Electric Pickups Will Be a Key Focus in 2024

The U.S. market is developing slower than the other two markets, just breaking the one million mark in 2023, and due to the introduction of the IRA bill at the end of 2022, there are strict restrictions on EV purchase subsidies, attempting to de-neutralize the EV supply chain, and under the premise of requiring that the final assembly of the vehicle and the battery must be done in the U.S., it will be difficult to reduce the cost of vehicle manufacturing, and it will be difficult for the penetration rate to increase rapidly. In terms of market share, Tesla is leading the way with a dominant market share, although it finally dropped to 50% in the second quarter of 2023, but after the strike by the United Auto Workers in the third quarter of 2023, Tesla regained its market share of 57%.

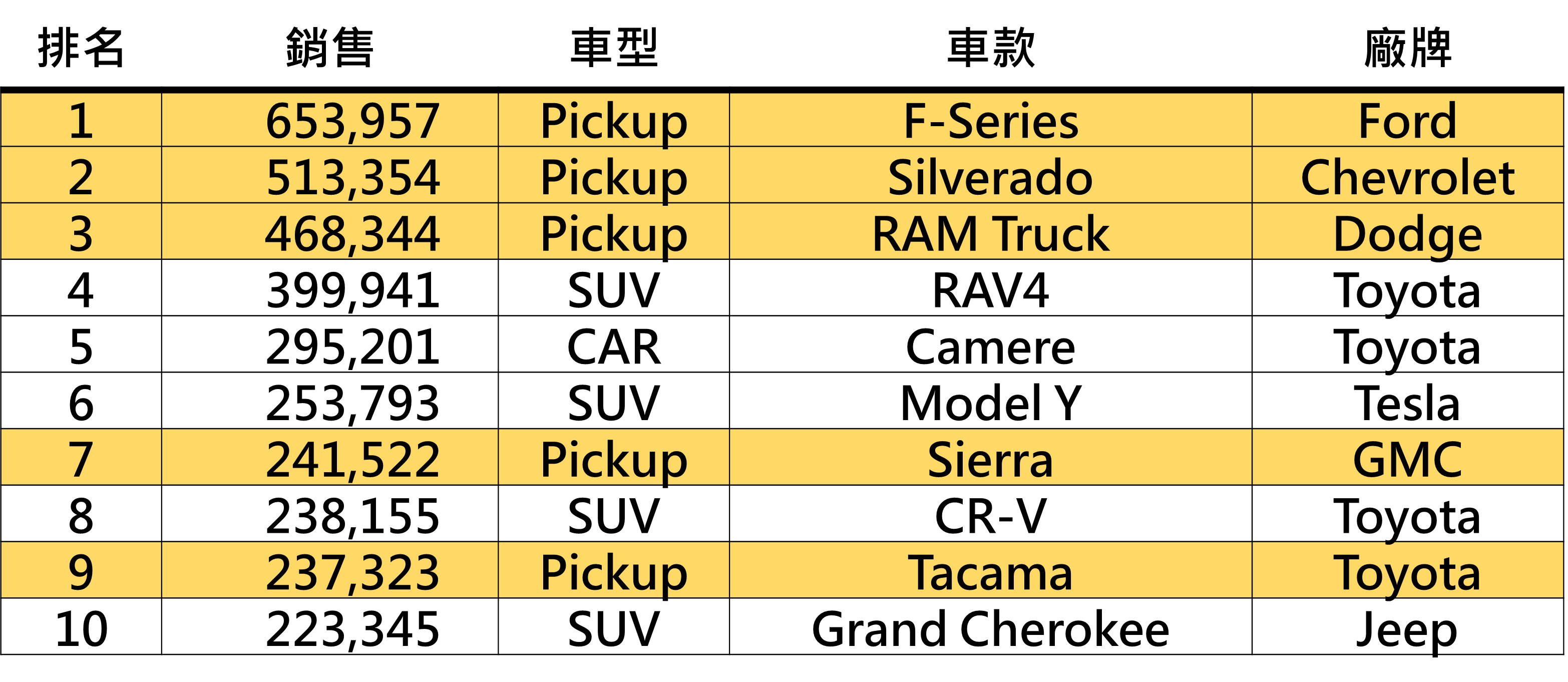

In 2024, the growth of electric vehicles in the U.S. will be mainly affected by environmental factors. First of all, in order to fight inflation, the U.S. will maintain a high interest rate environment throughout the whole year of 2023, and the high interest rate will bring about not only higher investment costs for enterprises, but also affect the consumers' purchasing of commodities such as houses and cars. As mentioned above, EVs are generally more expensive than fuel vehicles, and the impact of interest rates is even more severe. Therefore, EV purchasing is not expected to take off until the Federal Reserve Board lowers interest rates in 2024. In addition, due to the policy of de-Chinaization, the U.S. market is also facing the problem of insufficient choices of models. According to Marksline, the number of models available in the U.S. is around 100, while in the Chinese market on the other side of the ocean, it is as high as 400 models. In addition to Tesla, the top five EV manufacturers in North America (Ford, GM, Stellantis, Lucid, and Rivian) are all experiencing production capacity problems, so EV penetration in the U.S. will continue to grow slowly for some time to come. In addition, because the U.S. is a sparsely populated country with major cities on both the east and west coasts, the market favors large pickup trucks with high horsepower, long mileage, and large cargo capacity. According to Marksline, pickup trucks will account for five of the top ten selling vehicles in the U.S. in 2022, with a sales share of 60% (Figure 2).

Fig. 2 Top 10 selling models in the US

Source: Marksline

Tesla's newest pickup truck, the Cybertruck, will come online at the end of 2023, which is just enough to meet this demand. As long as the Cybertruck can be produced as planned, North America will still be dominated by Tesla in 2024; the only thing that needs to be worried about is the price, as the Cybertruck is currently priced at 60,000 US dollars and it has been rumored that it cannot be included in the list of purchase subsidies due to the problem with the source of the batteries. The only thing to worry about is the price. Competitor Ford F-150 dropped its price after the Cybertruck came on line, and the current price is $10,000 cheaper compared to the Cybertruck. However, the Ford F-150 has the same capacity problem as the Cybertruck, so whether electric pickup trucks can drive the U.S. electric car market growth in 2024, the only obstacle will be the production capacity.