Corporate News|Highlights of Delta's (2308) Q3 2022 Press Conference

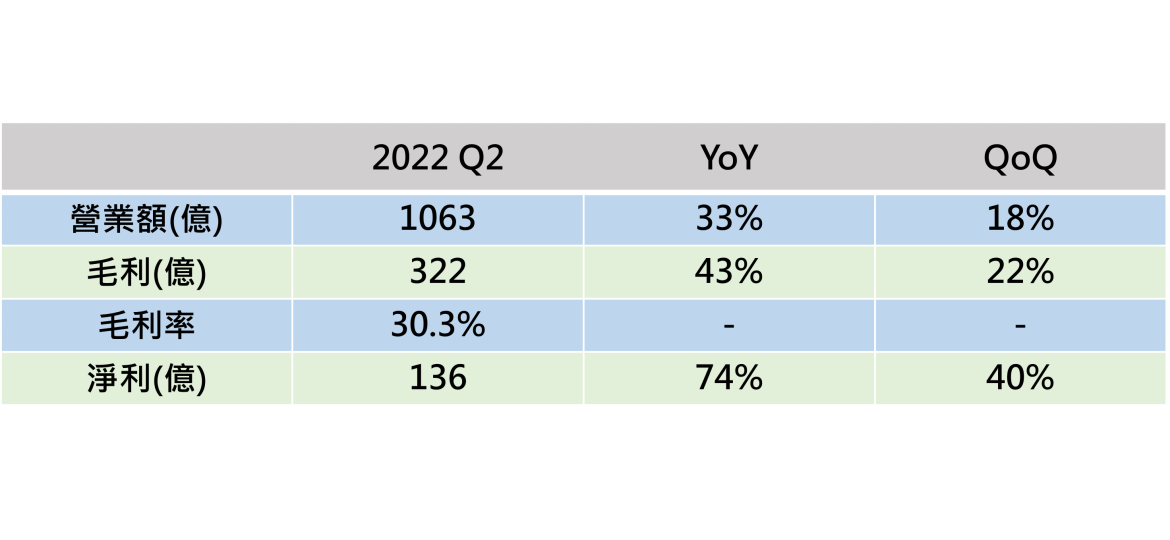

Delta Electronics (2308) announced its Q3 revenue and operating results on October 28, 2022 at a press conference. Q3 revenue of 105.3 billion increased by 33.0% year-on-year, an increase of 18% compared to the previous quarter; gross profit of 32.2 billion increased by 43% year-on-year, an increase of 22% compared to Q2; pre-tax net profit of 13.6 billion set a record for a single quarter of the highest in the history of the year, an increase of 74% year-on-year growth of 40% compared to Q2. 2022 Q3, due to the opening of the epidemic. Travel expenses in Q3 2022 increased 111 TP3T from Q2 due to the opening of the epidemic.

Delta's three major divisions, Power Electronic and Infrastructure, performed well, while Automation was more seriously affected by the macro-environment.

Power Electronic, one of the company's three major divisions, saw year-on-year revenue growth of 33% and profit growth of 76%. The fastest-growing segment under Power Electronic is EV products.

Infrastructure, another major division, grew 38% and 1,15% in revenue and surplus respectively because of the lower base period last year. CEO Ping Cheng mentioned that EV charge and Data Center products are the main source of growth for the third quarter, of which Data Center will grow 30~40% this year; and besides Google, Microsoft and Amazon, telecommunication companies have already started to build information centers. In addition to Google, Microsoft, and Amazon, telecommunication companies have already started to build information centers, and it is conservatively estimated that there will be a growth of more than 20% in 2024.

The third largest division, Automation, grew less significantly due to the general economy, with revenue and earnings increasing by $22% and $11% year-over-year, respectively, while Automation's Industrial Automation division grew more slowly than the other divisions in the third quarter, and is expected to see a small decline from the fourth quarter to the first quarter of 2023.

Inventories were up in Q3 and will see a drop in Q4

Delta's inventory was 78.4 billion in the third quarter, up 10% from 71.3 billion in the second quarter, with inventory turnover days down 9 days. Regarding the inventory situation, Delta's CFO stated that in the third quarter, the inventory structure was 40% of raw materials, 10% of remanufactured products, and 50% of finished products, and the overall impact of the price drop loss of 1.38 billion dollars fell to around 1%. In the fourth quarter, the inventory of raw materials will be adjusted according to the low season in the first quarter of 2023, and the growth momentum in the fourth quarter will remain unchanged, so it is estimated that the overall inventory will decrease in the fourth quarter.

Chairman: Delta's customers are mostly B-to-B (business-to-business) users, and the impact of the economic slowdown is still under control.

In response to concerns about inflation and economic slowdown, Chairman Hai Ying-jun said that since most of Delta's customers are corporate users, the impact on product sales is still within control. In response to changes in the international situation, Delta's strategy is to diversify its operations into different regions. Currently, Delta is planning to enter the U.S. (Dallas, Detroit, etc.), Holland, Thailand, India, and Eastern Europe to invest in the expansion of its production lines and research and development bases, and the capital expenditures for the current year's investments are still being calculated, but it is expected that they will be more than $16 billion.

In 2022, Delta's revenue for EV products will be $700-800 million, and next year, it is expected to exceed $1 billion to turn a loss into a profit.

Under the trend of strong demand for electric vehicles, European orders grew by more than 50% in the third quarter. This year's revenue is expected to be $700~800 million, and next year's revenue is expected to be over $1 billion and will turn from a loss to a profit. In terms of market penetration, the current share of several large EV manufacturers in the US, Japan and Europe is around 10%.

There are two main reasons for Delta to invest in the EV field: 1) The larger size of the finished product after the modularization of the motor system into a 3- or 4-unit system will result in an increase in transportation costs, and the demand for local assembly will rise. 2) The U.S. IRA Act has a subsidy requirement for the local assembly of EVs, and the amount of the subsidy is very large, which will have a direct impact on the willingness to purchase the vehicle. For these two reasons, Delta will invest in factories in Dallas and Detroit for finished product assembly.