May_Tariff War|Information Service Industry: In an Uncertain Market, Seeing Certain Opportunities

The year 2025 is destined to be a year of dramatic structural shocks for global politics and economics. As Trump returns to the center of power, policy coherence and market stability are being challenged like never before. From the 4/2 global tariffs and pressure to lower interest rates to the unblocking of AI and the liberalization of regulations, Trump has shown his usual "fickle" style. And the underlying logic behind this is that the "systemic pressure" on U.S. debt has quietly surfaced.

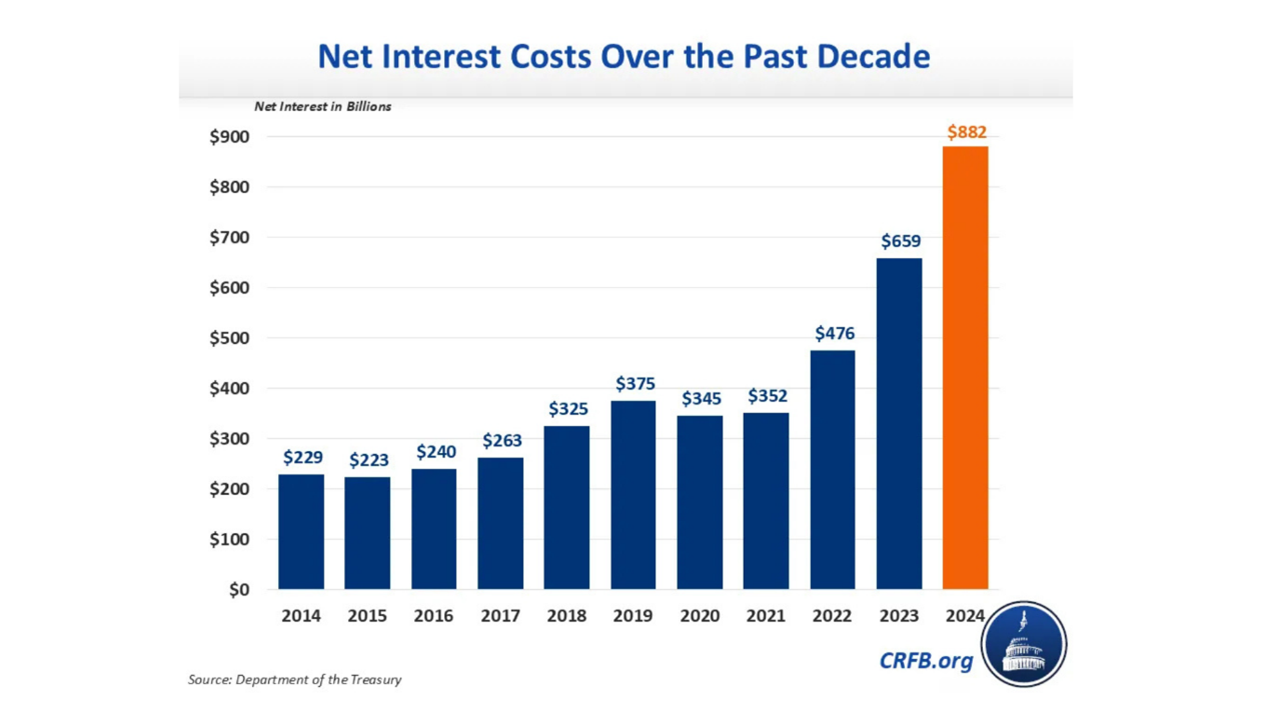

As of 2025, the size of the U.S. debt has already exceeded 36 trillion U.S. dollars, and last year, interest payments alone reached 880 billion, equivalent to the entire U.S. national defense budget. What is even more worrying is that the U.S. debt due to mature in 2025 will be as high as 9.2 trillion, accounting for more than 25%.

Chart 1 Interest Expenditures on U.S. Treasury Bonds in the Past Ten Years

Source: U.S. Federal Government website

What is more worrying is that the average interest rate of these U.S. bonds falls at 2.5%, which means that under the premise of issuing new bonds to repay the old ones in the future and borrowing at the current interest rate of 4.5%, the interest rate in the future will aggravate the fiscal deficit. Against this backdrop, the logic behind Trump's "policy swing", in which he asks countries to come to the negotiating table by raising tariffs on the one hand, and keeps pressuring the Federal Reserve to lower interest rates on the other, in the hope of lowering the cost of debt financing, is obvious. It is true that high tariffs will lead to inflation and recession, the former hindering interest rate cuts and the latter indirectly affecting the return of manufacturing industries. Therefore, by negotiating a 10~15% "full tariff" as a final destination, we can generate US$180-330 billion in revenue per year and retain the flexibility of governance. But even so.