Industry Trend Report|See how exosome makers are planning their development by deploying new highlights ahead of time

High Technical Barrier for Exosomes for Medical Use

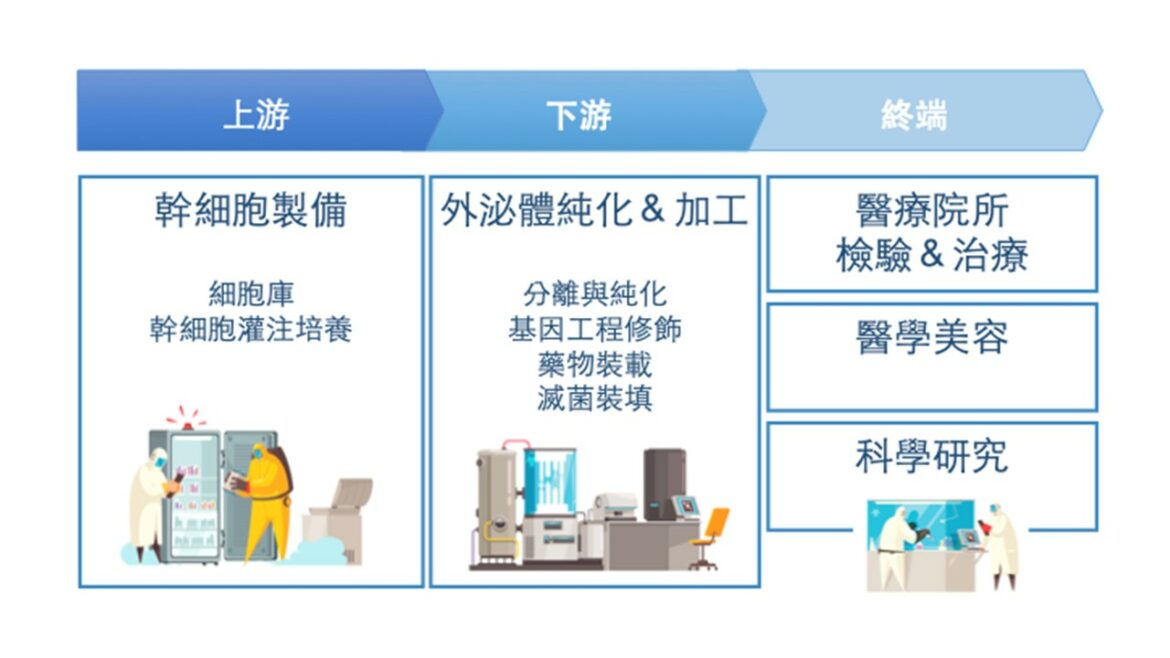

The exosome drug industry chain roughly overlaps with that of biologics/cell therapy contract development manufacturing services (CDMO) vendors, and the demand for talent is similar. In the early stages of drug development, specific types of stem cells are selected from upstream cell banks, their exosome targets and suitable protein scaffolds are identified, active ingredients are selected, and the loading process is confirmed to be feasible and effective before entering the production stage. After mass infusion of cultured stem cells in the factory, the exosomes will be separated, purified and genetically engineered for modification, and then loaded with suitable nucleic acids/antibodies/small molecules using electroporation and other techniques, and then cultured and processed again and tested for quality, and then made into cryopreserved crystals or other dosage forms before they can be turned into therapeutic drugs (Fig. 1). After entering the production stage, it is the most difficult patented technology to break through the production scale-up to be able to control the environmental parameters and produce large quantities of exosomes with stable quality and high purity for specific applications. The feasibility of purification by centrifugation is higher in the market, but the efficiency, recovery rate, and purity are relatively low, which is unsuitable for large-scale production; obtaining exosomes from magnetic beads coated with exosome surface markers to capture antibodies and purifying them by photoluminescence or microfluidic lysis is a newer technology. The purification of exosomes by light or microfluidic cleavage is a newer technology. In addition, drug loading involves surface protein scaffold modification engineering and transfection technology, as well as the cost and time spent on clinical trials of new drugs for different indications, all of which are technically difficult and have a long research period, and must pay attention to the high-precision and high-threshold industries with patent protection.

Figure 1: Overview of exosome processing flow

Multinational pharmaceutical company alliance to obtain R&D and manufacturing production capital.

Currently, there are about 55 companies in the global exosome pharmaceutical industry, with one-third of them focusing on testing business and the other two-thirds on developing new drugs for different diseases. Companies with larger financing amounts and greater scale and visibility include:

Bio-Techne's ExosomeDx

Founded in 2008 in the United States, the company was acquired by Bio-Techne in 2018 for a total price of $575 million to develop the world's first liquid biopsy exosome merchandise, and in 2019 ExoDx, a liquid biopsy merchandise for prostate cancer, was the first to be approved by the FDA as a breakthrough medical material. The company owns 250 patents, and its diagnostic products division brings in $274 million in revenue, with a growth rate of 21% in mid-2022, and its ExoDx product is still growing over 10% in its third year on the market, and its assay has reached record highs, demonstrating high market acceptance. 2022, the company will collaborate with biotech genetic testing superstar Thermo Fisher Science to develop a kidney cancer exosome. In 2022, we will collaborate with Thermo Fisher Science, a leading biotech genetic testing company, to develop an exosome biopsy product for kidney cancer.

Codiak BioSciences

Founded in 2015 in the U.S. and listed on Nasdaq in October 2020, has raised US$700 million. Owns natural exosome mass production manufacturing and loading technology, develops PTGFRN and BASP1 as exosome internal and external linking protein scaffolds. It also possesses chromatography and filtration technologies that replace the traditional ultracentrifugation method, which have significantly improved the production efficiency and purity of exosomes. With a focus on cancer applications, its engEx drug carrier platform for cutaneous T-cell lymphoma is also in clinical trials. 1 billion strategic commercialization agreement with Ireland's Jazz Pharmaceuticals in 2019 to develop therapeutic solutions for five cancers, and collaborations with gene therapy companies such as Sarepta and Dyno Therapeutics. 2021 Sale In 2021, we sold our cGMP exosome manufacturing plant to our partner Lonza, a Swiss pharmaceutical company, but retained our cancer drug R&D. We have recently reissued shares to raise capital, and we have recently reorganized our R&D pipeline by suspending two Phase II studies and focusing on the Phase I trial of exoASO-STAT6. Revenue for the past year was $34.7 million.

Evox Therapeutics (United Kingdom)

Founded in 2016 at the University of Oxford, UK, the company has raised US$500 million to develop its patented Deliver EX exosome drug platform, which engineers and loads natural exosomes with protein modifications and nucleic acids to deliver proteins, and currently owns a total of 81 patents in Europe, the U.S., and Japan, with a focus on rare diseases and central nervous system of the brain. 2020 is the year of cooperation with Takeda Pharmaceuticals in the development of technology for rare diseases and with Lilly in the research and development of neurodegenerative diseases, respectively. In 2020, we will collaborate with Takeda Pharmaceuticals on rare disease technology and Lilly Pharmaceuticals on neurodegenerative diseases.

Pharmaceutical start-up exosome maker makes progress in new coronary pneumonia treatment and rare diseases

In contrast to exosome R&D companies with large financing and both manufacturing and R&D functions, start-ups with limited capital have chosen to enter with new drugs for the treatment of neococcal pneumonia and rare diseases in order to make rapid progress. Exosome-related clinical trials are relatively advanced, including Capricor, Direct Biologics, Vitti, and Organicell, which have conducted Phase I to Phase III clinical trials for the treatment of pneumonia caused by neococcal pneumonia. Capricor's CAP-1002, which uses exosomes from heart cells to treat the rare disease of muscular dystrophy, Duchenne muscular dystrophy (DMD), has been the first to obtain FDA approval as an orphan drug and is in phase III clinical trials. Aegle Therapeutics' AGLE-102, a new drug for children with rare skin diseases, has also obtained its first exosome clinical IND for a Phase IIa trial in 2020.

Korea FactoryExoCoBioExosome Technology for Medical Products930$10,000 in financing

Founded in 2017, ExoCoBio is the world's fourth largest exosome producer, and has raised US$1.68 billion in successive capital raisings. In August 2021, it will build a new GMP plant specialized in the production of exosomes, which is expected to be completed by the end of 2022. It owns the patented technology of ExoSCRT exosome, and produces the patented exosome extracted from mesenchymal stem cells, which is not only used to research and develop anti-inflammatory skin medicines, but also put into production of a wide range of nutritional products from 2018, including hair growth and sensitive skin cosmetic to the medical aesthetic pathway, as well as developing exosome medicines. In addition to the development of anti-inflammatory skin medicines based on ASC-Exosome, the company has also started to produce a variety of skin care products since 2018, including hair growth and sensitive skin cosmetics to medical aesthetics, as well as the development of exosome drugs.