Industry Trend Report|Introduction of Carbon Border Adjustment Mechanism (CBAM)

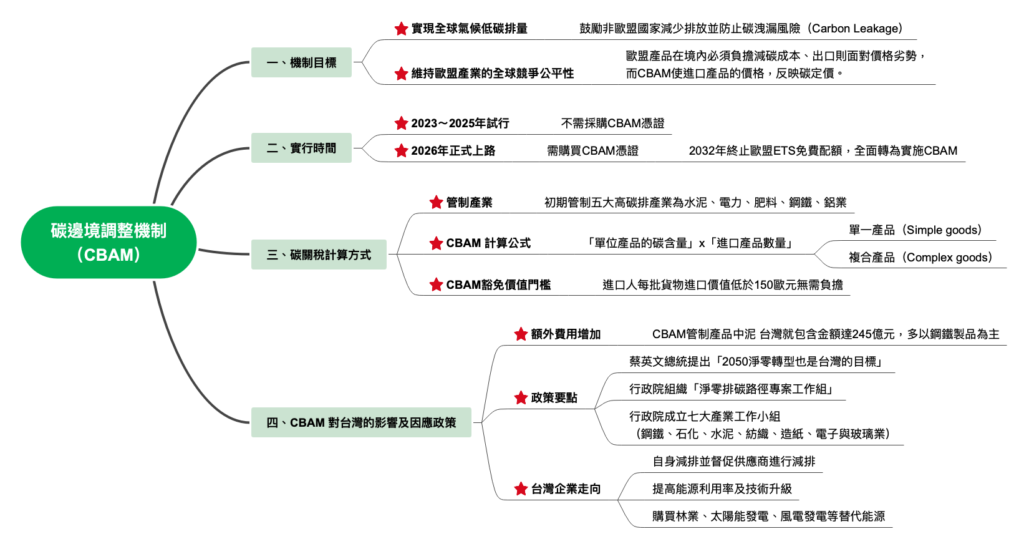

CBAM is a carbon intensive product that is imported into the EU. Based on carbon emissions, importers are required to complete the procurement of a corresponding CBAM Certificate before the product can enter the EU. However, for non-EU manufacturers, importers can offset the cost of purchasing EU CBAM Certificates as long as they provide proof that the product has been paid for according to the carbon price in non-EU countries. EU officials said that CBAM is not a tax system, but rather a way to check carbon emissions through regulations, and first of all, there must be a "carbon price". Carbon pricing must be in line with WTO regulations, and all manufacturers in the EU must bear the carbon cost and adjust the price according to the carbon trading situation within the EU. There will also be carbon credits for European manufacturers. CBAM is summarized below in four areas:

I. Objectives of the Mechanism

- Realizing low carbon emissions from global climate change: Encourage non-EU countries to reduce emissions and prevent carbon leakage risks (Carbon Leakage)Note 1To prevent industries from relocating their production to third countries or to other countries with less stringent carbon control under the greenhouse gas control regime, so as to circumvent the relevant carbon reduction policies. In order to reduce global carbon emissions and fulfill the EU and global climate targets, the Government will continue to implement the GHG control measures.

- Maintaining global competitive equity for EU industries: EU products have to bear the cost of carbon reduction at home and face a price disadvantage when exported, and CBAM enables the price of imported products to reflect carbon pricing.

II. Implementation Time

- 2023~2025 Pilot: CBAM certificates do not need to be purchased. Quarterly CBAM reports are required to be submitted to report the carbon emissions and product volume of imported products.Note 2The

- 2026Year officially on the roadThe EU Emissions Trading System (EU ETS) will be reduced from 2027 until 2032 when the EU ETS free allowances will be terminated. The European Union Emissions Trading System (EU ETS) will be reduced annually from 2027 until 2032, when the EU ETS free allowances will be terminated and CBAM will be fully implemented. CBAM import declarations will be formalized, targeting the quantity of goods imported into the EU in the previous year, as well as the amount of carbon emissions contained in the goods.

Calculation of Carbon Tariff

- control industry: Initially, the five major high-carbon emission industries were cement, electricity, fertilizers, iron and steel, and aluminum.

- CBAM Calculation formula: "Carbon content per unit of product" x "Quantity of imported productsNote 3Each country currently has a different explicit carbon tax. Currently, the explicit carbon tax varies from country to country, but according to the World Bank's assessment of the 2°C reduction target under the Paris Agreement, $40 to $80 per ton of carbon emissions should be charged.

- Simple goods: Considering the intensity of direct emissions from the manufacturing process, excluding emissions from raw materials and fuel inputs. Complex goods: In addition to the direct emissions of the manufacturing process, the carbon emissions of raw materials also need to be considered.

- CBAM revenues: the Parliament proposed that revenues from the sale of CBAM certificates should go to the EU budget and that the EU should provide financial assistance to Least Developed Countries (LDCs) at least equivalent to CBAM revenues.

- The carbon tax avoids double counting: goods that have paid a carbon fee in the country of origin will be deducted when imported into the EU. In addition, certain countries, such as Norway, will be treated as EU member states for the purposes of CBAM.

- CBAM Exemption Value Threshold: Importers are not liable for import value below €150 per shipment.

Impact of CBAM on Taiwan and Policy Responses

- Impact: According to Taiwan's Ministry of Economic Affairs (MOEA), CBAM controls 248 products, including cement, electricity, fertilizer, steel, and aluminum. The direct impact is to increase the additional cost, Taiwan in the five control contains 212 items, the amount of $ 24.5 billion, mostly steel products, the initial estimate of the new NT $ 600 million to 4.7 billion Taiwan dollars in export costs. For Taiwan as a whole, these industries are not the bulk of Taiwan's exports, accounting for only 0.4% of Taiwan's total exports. The carbon border tax will be adjusted through a gradual mechanism, and will be extended to other sectors in the second phase.

- Key Points of China's PolicyPresident Tsai Ing-wen proposed that "2050 net-zero transformation is also a goal for Taiwan", and the Executive Yuan also organized the Net-Zero Carbon Emission Pathway Project Working Group and the Industry and Energy Efficiency Working Circle, which set up seven industry working groups (steel, petrochemicals, cement, textile, paper, electronics, and glass) to reduce carbon emissions and decarbonize the economy in the areas of energy efficiency, low-carbon energy, process improvement, and the circular economy, which overlap with part of the European Union CBAM standard (cement, steel, cement, paper, electronics and glass). These seven industries also overlap with the European Union's CBAM regulations (cement, iron and steel).

- TriviaIn general, enterprises need to actively develop low-carbon technologies and look for new types of alternative energy sources. In addition, Taiwan still needs to formulate issues such as carbon pricing, carbon inventory system, carbon inventory manpower, third-party verification companies, and carbon trading system.

- Enterprises should clarify their own carbon emissions and those of their upstream and downstream supply chains, deepen their understanding of the carbon footprints of their products, and urge their suppliers to reduce emissions while reducing their own.

- This is achieved through improved energy efficiency, technological upgrades to reduce the use of raw materials, and so on.

- Businesses can offset their own carbon dioxide emissions by purchasing forests, solar power, wind power, and so on.

Note 1: Carbon Leakage: A phenomenon whereby high carbon emitting industries choose to relocate to countries with less stringent carbon regulations in order to avoid them. When production is shifted outside the country, it also leads to an increase in the demand for imported products from within the country, which in turn leads to an increase in the carbon content.

Note 2: The above report includes the direct and indirect carbon emissions of each type of product, as well as the carbon price paid for the direct emissions in the country of origin.

Note 3: When importers are unable to come up with a carbon emission calculation, they will apply the EU's carbon emission pre-set value.