December_Industry Review|Jishengger stepping down, where does Intel go from here?

Main news content:

U.S. chip maker Intel announced that former CEO Pat Gelsinger officially retired on December 1, and that the company has appointed CFO David Zinsner and senior executive Michelle Johnston Holthaus as interim co-CEOs, and board member Frank Yeary as interim executive chairman. Frank Yeary, a member of the Board of Directors, as Interim Executive Chairman.

According to a CNBC report, sources have revealed that Intel held a "contentious" board meeting last week, with the focus centered on Jischinger's failure to effectively deal with strong rivals like Phaidon (Nvidia) and a lack of confidence in his plan to turn losses into profits. Rumor has it that Jischinger actually left the company involuntarily, having been ousted by the board due to poor performance.

Ji-Pu Professional Review:

In the past, Jischinger's return to the company has faced a number of circumstances that were left over from previous administrations, including not seeking a license to make chips for Apple's mobile devices and abandoning the acquisition of Phaidon, all of which were decisions made by Intel's earlier leadership that put the company at a competitive disadvantage. This led to the launch of a four-year, five-point aggressive strategy during the downturn, as well as attempts to capture the AI gas pedal market (with the launch of Gaudi and other series of products), and efforts to capitalize on the company's strengths in the foundry market with the launch of Intel Fundry, among other things. However, in the face of high competition and rapid changes in the global chip market, the company's stock price has dropped by 61% during its tenure, and its market capitalization is more than 30 times smaller than that of its competitor Prada, which is indeed partly a crime of non-war. In April 2024 to modify the product path Intel 20A process production Arrow Lake processors will be canceled, replaced by outsourcing production; Q2 end of capital austerity, layoffs 15%. These signals in fact Intel released in the advanced semiconductor competition to do the last struggle, the external need to face the pressure of the former giant to catch up with the backwardness of the internal shareholders and board of directors. Board of Directors.

Jissinger's departure also means that the strategy from the epidemic to the present is unsuccessful, we are relatively less concerned about the reasons for his retirement, but very curious about the future direction of Intel's strategy in semiconductor design and manufacturing. Many in the market have proposed three hypotheses, such as:

Intel may give up advanced semiconductor manufacturing and quit competing with TSMC?

Secondly, there is another theory that Intel will outsource a large number of high-end products to TSMC?

Third, there is also a suggestion that Intel should split up its foundry business as soon as possible, etc.?

yetIntel's fundamental problem is that it has the technology but no major customers outside of its own products to fill the capacity.In the past, the company has been in the quagmire of advanced semiconductor capital expenditures, where its own wafer manufacturing relies heavily on internal demand, and the manufacturing department is difficult to realize independent operation due to heavy losses and insufficient scale, x86 product output shrinks, and the Server CPU portion of the market has been reduced by Pfizer and AMD, and the volume of external customers accelerates the climb of yields, and the next-generation process funding is even more enormous, resulting in a vicious cycle.For now, expanding OEM to TSMC should be the short-term strategy. We don't see Intel abandoning the path of advanced manufacturing based on its respect for giants and the U.S. continuing to value its own advanced manufacturing.We haven't seen any strategic planning from the interim Co-CEO or the future confirmed helmsman in the short term, but it's very likely that they will be aiming at the A18 or A7 process as a last ditch effort.

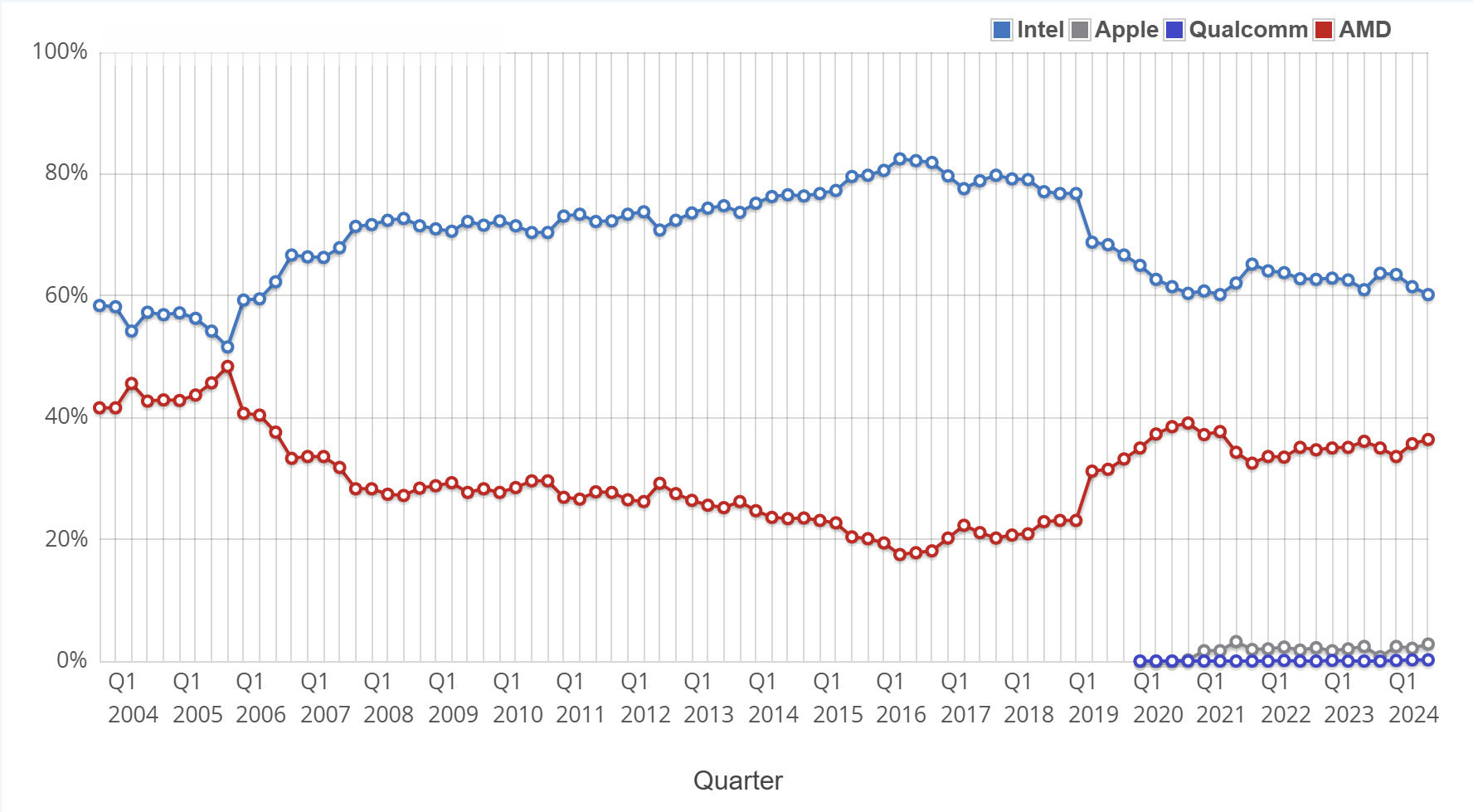

We are pessimistic about the spin-off of foundries.Since Intel's problem is that it doesn't have customers, splitting up the fab could accelerate the rapid decline of the company without a parent to fill the black hole in its operations.In addition to reviewing the 2009 AMD split chip manufacturing business, because AMD still has a considerable degree of competitiveness in this part of the next year quickly found investment from the government of Abu Dhabi to co-found Glorfonds, but AMD to 2012 to empty its shares until January 2019 to cancel the exclusive cooperation agreement, full reverse to TSMC, but it took a whole decade. We can review the situation of AMD in those ten years (as shown in Figure 1), will it really be better for Intel to go pure design company? In addition, the OEM business is not only about technical difficulties, but also about how to avoid potential conflicts of interest or competition with customers, which is also a big issue. Whether or not we can avoid Hilda and target CSP customers who develop their own AI chips may be a direction (but the current volume is not much, which is also a difficult issue).

Chart 1: Historical Market Share of CPUs

Source: Passmark

There has been a lot of discussion in the semiconductor community about the retirement of Jischinger, but we're focusing on the question of "who will take over in the end". The U.S. government has demonstrated its high hopes for Intel by providing a large grant of nearly $8 billion, while at the same time restricting the sale and spin-off of Intel Foundry. This represents the core principle of keeping high-end semiconductor manufacturing in the U.S., and I believe the Trump administration will follow this principle in dealing with Intel's general direction in the future. Watching Intel, the semiconductor giant, go from dominance to backwardness, to decline and even possible split (e.g., NAND business) or merger and acquisition, I believe that there are many people who hold the mentality of watching the game. ButWe don't think the U.S., Taiwan, or TSMC would want Intel to quit high-end wafer manufacturing.The U.S. should adhere to the principles described above; Taiwan has many software and hardware vendors firmly tied to Intel, and no one wants to sink with this past invincible fleet; and TSMC has different potential considerations, as it will be exposed to monopoly risk if Intel is taken away from it (similar to the competition between Intel and AMD in the early days of the CPU competition). Therefore, due to Intel's current situation and the expectations of the outside world (US government, investors, etc.) for its revitalization, there is a high probability that "experienced" veterans will be recruited to continue the reform and reinvention. As for the future direction of Intel, there is still a lot of uncertainty, and we still need to see what the future Board of Directors and CEO will do.