Corporate News|FSMC 2024 Q1 Press Conference

TSMC held a Q1 2024 press conference yesterday (18th), and its capital expenditure for 2024 remains unchanged at US$28 billion to US$32 billion. Although there are still uncertainties in the global economy, TSMC's growth for this year is expected to remain at 21% to 26%, and operations are expected to grow quarter-over-quarter this year.

Highlights of TSMC's Q4 Financial Results

- Consolidated revenue of approximately NT$400 million, QoQ -3.8%, YoY +12.9%

- Gross margin 1%, QoQ +0.1, YoY -3.2

- Business Interest Rate 42%, QoQ +0.4, YoY -3.5

- After-tax net income of approximately NT$900 million, QoQ -5.5%, YoY +8.9%

- EPS (Earnings Per Share) : NT$7, QoQ -5.5%, YoY +8.9%

Compared to the same period last year, Q1 2024 increased by 12.9% compared to the same period in 2023, but decreased by 3.8% compared to the previous quarter.The financial results came out better than expected. Q1 gross margin was 53.1%, operating profit margin was 42%, after-tax net income was 225.49B, a decrease of 5.5%, and earnings per share (EPS) was 8.70RMB; both increased by 8.9%. Q2 revenue is expected to be in the range of $19.6B-$20.4B, with gross margins in the range of 51%-53% (median 52%). Gross margin is estimated to range from 51% to 53% (median 52%), down 1.1% from Q1, mainly due to the impact of the 0403 earthquake and higher power costs.

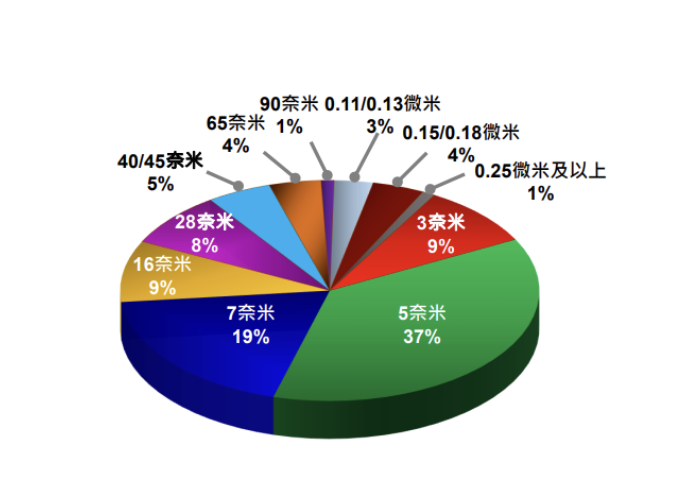

2024Q1 Process Revenue Share

It is worth noting that 3nm shipments accounted for 9%, 5nm shipments 37%, 7nm shipments 19%, and advanced processes (7nm and above) accounted for 65% of the overall sales.

TSMC 2024 Q1 Revenue Share

Source : TSMC

Semiconductor Market Outlook Revised to 10% Y/Y Growth

TSMC expects the overall semiconductor market to experience a more moderate and gradual recovery in 2024. Due to the uncertainty of the geopolitical situation, TSMC announced at the conference that it would revise its outlook for the overall semiconductor market in 2024 to an annual growth rate of 10%, and that the wafer fabrication industry would see a decrease in the annual growth rate to 15%~19% from the original forecast of 20%. The company still expects this year to be a year of healthy growth, with quarterly growth in revenue, and expects annual revenue growth of 24% to 26% (in US dollars).

AIDemand Explosion

During the conference, TSMC highlighted the surge in AI-related demand and the continued evolution of AI technology. Increasingly complex AI models require more powerful semiconductor hardware to support them, underscoring the company's leadership in advanced process and packaging technologies. Nearly all AI innovators are working with TSMC to address the never-ending demand for computing power.

Due to the strong demand for AI, the current production capacity is still unable to meet all customers' needs, and it is expected that the capacity will be increased to double the original capacity by the end of this year. TSMC President Richard Weil emphasized that the company is doing its best to increase production capacity to alleviate the shortage of AI chips, which is expected to be reached next year, in the hope of ensuring that all customers are supported to succeed in the market. TSMC forecasts that the revenue contributed by GPUs, AI gas pedals, and CPUs for data centers and servers will more than double this year, reaching 11% to 13% of the company's total revenue in 2024, and in the next five years, it is expected that AI chips dedicated to data centers and servers will grow at a compound annual growth rate of 50%, becoming the strongest driver of HPC platforms, and will account for the company's largest share of the total HPC platforms in 2028, and will be the most important driver of HPC platforms. In the next five years, AI chips for data centers and servers are expected to grow at a compound annual growth rate of 50%, becoming the strongest driver of HPC platforms, and accounting for more than 20% of the company's overall revenue by 2028.

0403Impact of earthquakes

After the earthquake on April 3, TSMC's fab had no structural damage, no power outages, and no damage to important equipment such as extreme ultraviolet (EUV) exposure machines. However, a certain number of wafers were damaged during the production process, and it is estimated that most of the production loss will be recovered in the second quarter, and it is also estimated that the impact of the earthquake will reduce TSMC's gross margin in the second quarter by 0.51 TP3T, mainly due to wafer scrap and material loss, and that TSMC's major customers have already understood and supported TSMC to make up for the production loss in the second quarter. The preliminary estimate is that the related seismic loss, net of insurance claims, will be recognized in the second quarter of 2024 at approximately NT$3.0 billion.

Overseas Expansion Progress

TSMC has announced that it will build its third fab in Arizona, U.S., to produce sub-2nm advanced process wafers, and is expected to begin production in 2030. The total investment in the three Arizona fabs will exceed US$64 billion. The first fab has already entered the engineering wafer production stage using 4nm process technology this month and will begin mass production in the first half of 2025 as planned. The second fab will utilize 3nm/2nm process technology for wafer production and is expected to begin production in 2028.

The first fab in Kumamoto, Japan will utilize 12/16nm and 22/28nm process technologies and will enter mass production in the fourth quarter of this year as scheduled. The second special process technology fab in Kumamoto will utilize 40nm, 12/16nm, and 6/7nm process technologies and is scheduled to begin construction in the second half of 2024 and enter mass production by the end of 2027.

The special process fab in Dresden, Germany is expected to begin construction in the fourth quarter of this year.

Ji-Pu's point of view.

In response to President Chieh-Chia Wei's statement that the global foundry industry is expected to grow at 10% per annum, which is a downward revision from the previous estimate of 20%, TSMC's ADR last night and today's share price reflect that, although TSMC's healthy growth target for this year remains unchanged. TSMC's capital expenditures for this year will remain in the range of $28 billion to $32 billion, of which approximately 70 to 80% will be spent on advanced process technologies, 10 to 20% on special process technologies, and 10% on advanced packaging, testing, mask manufacturing, and other projects. In addition, TSMC also mentioned in this press conference that since the cost of overseas expansion, such as the Arizona plant, is much higher than that of Taiwan, TSMC plans to narrow the cost gap through several methods. First, TSMC will adopt "strategic pricing" to reflect the value of geographic flexibility, a pricing strategy that has been discussed with customers and agreed upon by them. Second, we will work closely with local governments to ensure their support. Third, we will utilize our fundamental advantages of leading manufacturing technologies and large-scale manufacturing bases, which are unmatched by any other industry, to narrow the cost gap in the above three ways. Overall, we believe that TSMC's downward adjustments to its foundry growth should be considered a homogeneous rebound, like an over-estimation of previous adjustments, rather than a downturn in the overall semiconductor industry.