Mar W1|Green Energy News Highlight:Vehicle Center demonstrates self-developed Level 3 self-driving electric bus technology

Jun W1|Green Energy News Highlight:Vehicle Center demonstrates self-developed Level 3 self-driving electric bus technology

The Vehicle Research and Testing Center (VRTC) demonstrated its Level 3 self-driving electric bus technology on Tuesday, which utilizes the existing electric bus platform and combines self-driving decision-making software with controllers, radar, and cameras to assist manual driving, maintain lane centering, set speeds, and keep a safe distance from the vehicle, as well as monitor the driver's status, and when the driver is found to be suspected of being asleep or physically unwell, an alarm will automatically sound, and then if there is no response, the driver will be able to automatically If there is no response, it will automatically control speed reduction and stopping. This week, the Automotive Research and Testing Center (ARTC) demonstrated its latest smart driving technologies, including Level 3 self-driving electric buses with lane maintenance, obstacle avoidance, and driver status monitoring, etc. In the future, the relevant smart driving technologies will be transferred to partner companies.

Wisdom Pu's point of view: In the past two years, although the electric car news is no longer in the spotlight as in the past, but the progress of automotive technology but the capital investment has skyrocketed, autonomous driving in many areas has gradually towards the stage of maturity, new business models appearing in the beginning, Waymo in California has begun to carry passengers, Tesla's Robotaxi is ready to debut in June, the vision of the driverless taxi is already within reach in the distance. The vision of driverless taxis is within reach.

Mar W1|Green Energy News Highlight:Mobile World Congress (MWC) kicks off this week, brands show off their latest technologies

The Mobile World Congress (MWC) kicked off this week, with major brands showing off their latest technologies, and one of the new battlegrounds is "solar", with many companies boldly attempting to integrate solar charging technology into laptops and cell phones, in an attempt to alleviate consumers' charging anxieties.

Cell phone brand Infinix demonstrated a solar energy concept phone at MWC, through the "SolarEnergy-Reserving" charging technology and Calcium Titanite solar cell, which can provide 2W charging efficiency, and will be adjusted through the AI system to control the voltage and heat generation, so that the phone can maintain a high level of power as much as possible.

In addition, Infinix also offers a more flexible solar charging case that allows users to change back to their original case at night or indoors, and then change it when they have a chance to charge it outdoors. The media is also suggesting that the technology could also be used as a conduit for energy supply in the event of a power outage.

ChipPo's point of view: As TOPCon solar cells become mainstream, various panel technologies that are expected to be compatible with them are expected to be brought into play. Calcium-titanium-mineral solar technology has higher power generation efficiency, and has the advantages of thinness, lightness, and transparency to open up the market in the fields of building construction and power generation for wearable room equipment, etc., and the problem of its poorer environmental temperature tolerance is expected to be resolved by the TOPCon composite technology. The problem of poor environmental temperature tolerance is also expected to be solved by TOPCon composite technology.

Feb W1|Green Energy News Highlight: Tesla's Financial Report: Bike Costs Hit Record Low, Model Y Continues to Dominate the Global Car Market

Tesla, the world's leading electric vehicle manufacturer, announced its financial results for the fourth quarter and full year of 2024 on March 30, revealing two key indicators: the cost of bike sales dropped to a record low of below US$35,000 (about NT$1.113 million); and the Model Y has been the world's best-selling vehicle for two consecutive years. The report not only reflects Tesla's cost control ability, but also announces the launch of more affordable new models in 2025, which is a shock to the market.

Cost control pays off. Production cost per vehicle drops dramatically.

According to the financial report, Tesla's "cost of sales per vehicle" fell below US$35,000 for the first time in the fourth quarter, down 12% from the same period in 2023, which was mainly attributed to the improvement of raw material costs and optimization of the production process, which offset marketing expenses such as providing consumers with zero-interest rate loans and long-term leasing programs. If converted to the Taiwan market, this cost price is equivalent to the price of a domestic medium-sized saloon car, which shows Tesla's advantage in large-scale production.

Ji-Pu's viewpoint: After the first class performance of Tesla's car-making business, investors are still optimistic about the company's performance after the trading session, and the two most important arrows are "affordable cars will be mass-produced soon" and "autonomous driving will be on the road soon". In recent years, Tesla has been losing its dominant position in the Chinese market as Chinese EV manufacturers such as BYD, SAIC, and Beiqi have been pushing the company forward. This time, the sales in various regions show that Tesla is also declining in the European market, which is certainly due to the influence of Elon Musk's political inclination over the past six months, but the root of the problem lies in the fact that there has not been any new model to stimulate the sales in the past long time. Tesla's Q3 financial report already showed that gross margin was back to 17.6%, but under the environment of continuous promotions, zero down payment, and even selling the old Model Y at a reduced price, the gross margin was only 16.3% in Q4. However, Tesla also showed that the average cost of building a car had reached a record low of 35,000 US dollars during the meeting. Under this premise, Tesla's announcement of new low-priced models will not only enable it to compete with China's EVs in the global market, but also to do so in a way that will continue to be profitable. In contrast to the high costs of traditional car makers, and the debt of China's low-priced cars, Tesla will first ensure that its EV business will remain competitive in the year to come. In addition, although it seems that Q4 profitability is still low, there is significant progress in FSD, which is the key to long-term growth in the financial report. It is expected that unsupervised self-driving will be on the road in 2025, and what is even more exciting is that FSD commercial services are expected to be launched in Texas in June, i.e., Robotaxi will soon be put into practice. This news is certainly proof that Tesla is realizing more than a trillion dollars in profit potential. From the after-hours stock price increase of 4% in addition to proving the market's affirmation of the future growth potential from the short-term to the medium- to long-term, it is also not difficult to see the change in investors' views on the company's Tesla has been the car manufacturer from the new back to the AI field of leading enterprises, and unlike generative AI competition is fierce, Tesla specializes in the image of the training of the AI is still unique in the blue ocean field.

Jan W2|Green Energy News Highlight:CES 2025 China's Electric Vehicles Become the Spotlight of the Show with a Variety of Tricks

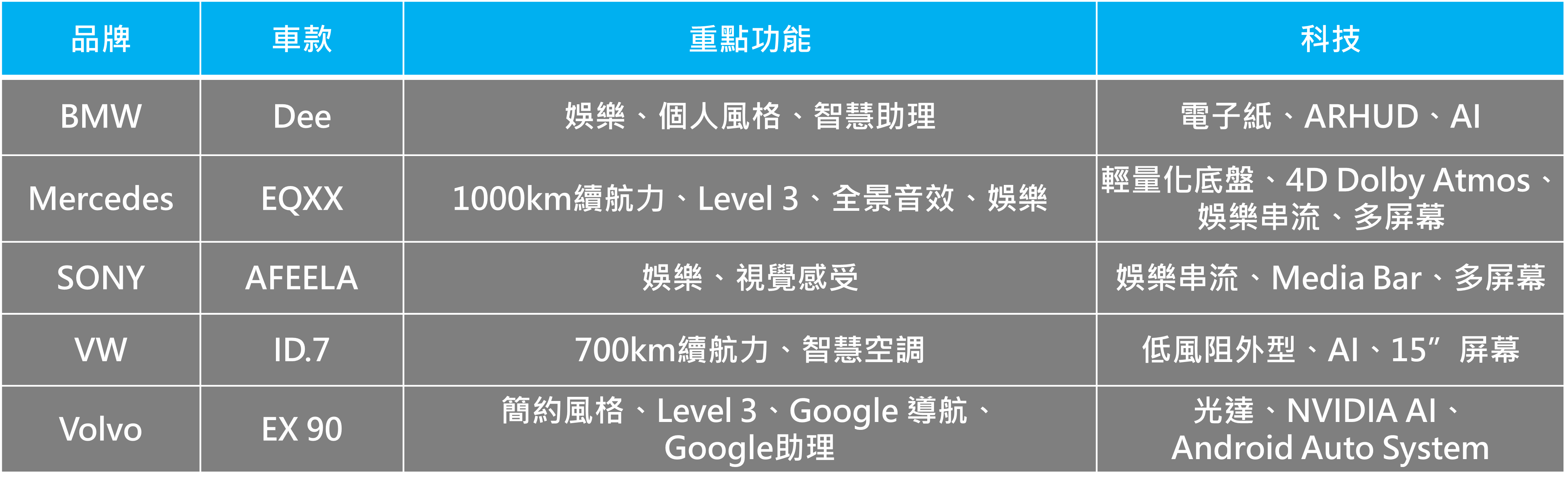

The Consumer Electronics Show (CES) has become almost half a car show in recent years, as electric and smart cars are the future of the industry, and this year's show attracted the attention of the public with a wide range of flashy on-board technology in Chinese cars.

The year 2024 can be said to be the year that Chinese cars will make a comeback, not only giving European, American and Japanese brands great pressure in the Chinese market, but even counterattacking Europe against the trend, forcing the European Union to offer a tariff shield to minimize the impact of the show, and many visitors at the CES 2025 show also wanted to see how "flashy" Chinese EVs really are.

Ji-Pu's view: Chinese EV brands are now at least two years ahead of the industry in terms of technological innovation and design. In CES 2025, from Krypton's advanced center control technology to Xiaopeng's flying car idea, all of them highlight the competitiveness of Chinese brands in the field of smart cars. In particular, the strong invasion of the European market shows that Chinese car companies are not only rolling in the local market, but also gradually penetrating the international market. However, after Trump's inauguration and his crackdown on electric vehicles and green energy, it is predicted that the automotive industry will not only see a dualization of the supply chain, but also a future in which fuel technology will coexist with fuel and electricity.

Dec W2|Green Energy News Highlights: 4 Conclusions from COP29! Taiwan's Carbon Market Opportunity: $300 Billion in Climate Finance

The two-week COP29 conference in Baku has come to an end. This year's conference focused on climate finance, energy investment and other related financial issues, and is known as the "Finance COP". What are the major breakthrough agreements and decisions this year? What is the impact on Taiwan?

4 major conclusions:

- Commitment of $300 billion per year by 2035

- Adoption of Article 6.4 of the Paris Agreement

- Clean Energy Investment Surpasses $2 Trillion

- Impacts and Implications of COP29 on Taiwan

COP29 concluded in Azerbaijan, attracting more than 55,000 delegates from nearly 200 countries. Focusing on climate finance, COP29 promoted a number of landmark agreements, including the New Collective Quantified Climate Finance Targets (NCQGs), investment in clean energy, and Article 6 of the Paris Agreement, which have far-reaching implications for global climate action.

Wisdom: As COP29 comes to an end, we have once again reached an agreement, but it is disappointing to see that global average temperatures will once again reach record highs. To add insult to injury, if you look at the list of participants, you will see that the leaders of the world's largest carbon emitters, China, the United States, India, and Russia, were absent, and only the Prime Minister of the United Kingdom, Mr. Keir Starmer, was present from the top eight industrialized countries. On a happier note, the passage of Article 6.4 of the Paris Agreement will establish a United Nations framework for a global carbon market that will bring "New Money" to climate finance, with an estimated annual revenue of $250 billion.

Nov W2|Green Energy News Highlight: Tesla CEO Musk bets on the right winner in Trump's election victory

Tesla's CEO, Mr. Musk, made a strong effort to stand up for the Republican presidential candidate before the election, and even donated heavily to Trump's victory, which encouraged Tesla's stock price to surge by more than 14% in the morning trading session of the 6th, and he will personally join the committee to lead the government's efficiency, indicating that he will become one of the most influential political and economic advisors to Trump, and will soon reap rich results. Tesla's market capitalization to rise to $1 trillion

In his victory speech, Trump singled out Musk: "I'm telling you, we've got a new star, a new star in the making: Elon [Musk's name]." Trump spoke about Musk for about four minutes, praising his SpaceX company and describing him as a "special guy" and a "super genius".

Wisdom Pool Perspective: Seeing Tesla make up all of its losses since 2024 in just a few days, besides proving that choices are more important than efforts, you can never question the insanity of the market. Tesla, with its combination of Trump's concept and Musk's star power, is indeed the pride of the market right now, and even JPMorgan Chase and other organizations have re-priced Tesla on the basis of its yet-to-be-taken-off revenues from robots, energy storage, and solar charging stations. However, if we put aside the demand for regulatory relaxation that Tesla needs, Trump's election will not directly help Tesla's current electric vehicle sales, which are the main source of Tesla's revenue. Therefore, from a long-term perspective, in the next two years, when the commercialization of self-driving humanoid robots is not yet in mass production, how Tesla can continue to improve the sales of electric vehicles in various regions is what investors should be concerned about. In the face of the market's overreaction, don't be afraid of the highs and the lows, but rather, use the profitability of the company to make a fair assessment of a company that will allow you to sleep peacefully every day.

Oct W4|Green Energy News Highlight:Giving 10 billion kWh of green power to Fidelity: Taiwan's green power supply is absolutely sufficient.

Pfizer CEO Huang Jen-Hsun returned to Taiwan to invest in 10 billion kWh of green power conditions, Minister of Economic Affairs Kuo Chih-Hui responded that he could give him the statement was queried by the legislature as being unrealistic. Kuo said in an interview today that Taiwan's green power currently has about 20 billion kWh, and by 2026 it could reach 55 billion kWh, which is absolutely enough to meet Pfizer's green power demand.

Kuo said that any R&D center or data center that needs green power will have enough green power, and we are building green power based on demand, including wind power and solar power, which can satisfy the needs of enterprises. Facing the queries of the legislators, Kuo said that he did not have any unrealistic response. As to whether the U.S. will impose high tariffs on TSMC and other fabs, and whether TSMC has any ways to deal with this, Kuo responded that the U.S. is in the midst of a general election, and it is inappropriate for us to comment on the U.S. election at this time.

Wisdom Pu point of view: Fidelity is an IC design company, power demand is not large, 10 billion kWh if the general reference to its chip foundry demand, TSMC itself is already the first green power procurement of large households in Taiwan, Taiwan's green power more than eighty-five percent are supplied to it for use in Taiwan in 2023 280 billion kWh of which 9.51 TP3T is green power to say that TSMC itself with more than 10 billion kWh of power.

Sep W2|Green Energy News Highlight:Ministry of the Environment: Carbon fee will not cause green inflation.

Minister of the Environment Peng Kai-ming announced on the 7th that carbon pricing is an important mechanism to reduce greenhouse gas emissions, and that the imposition of a carbon fee will not have a significant impact on the Consumer Price Index (CPI), and denied that the carbon fee will lead to green inflation. The carbon fee to be levied from January next year will target the power industry, gas supply industry and manufacturing industry with annual greenhouse gas emissions of more than 25,000 metric tons, and it is estimated that the fee will be levied on about 500 factories (281 companies, of which 141 are listed companies), and the fee will be levied on the emissions of about 155 million metric tons of CO2-equivalent, which accounts for about 54% of the total emissions in the country. The scope of impact does not include industries that directly affect people's livelihood. The Ministry of the Environment will organize a briefing session to help the industry to submit reduction plans and emphasize that the purpose of the carbon fee is to reduce emissions and not to cause inflation.

Chipotle Perspectives: The Cost of Introducing a Carbon Premium, from publication in 2021. "The 'green premium' refers to the additional cost of using low- or zero-carbon technologies in place of traditional high-carbon technologies. Specifically, this 'premium' is the additional cost that consumers or companies have to bear when switching to greener options. To solve this problem, it is necessary to encourage research and development of carbon-reducing technologies with a carbon fee, create a market environment conducive to low-carbon technologies, and establish a complete carbon pricing mechanism with a full range of supporting measures, all of which must be promoted by the government, and it is still too early to say whether the green inflation will affect the reputation of the people.

Aug W4|Green Energy News Highlight:EU wants to impose a final countervailing duty on China's electric vehicles Tesla Tax Rate 9%

The EU Executive Committee made a final draft of its investigation into China's electric vehicle countervailing duties, recommending that the EU27 agree to impose countervailing duties of 17%~36% for at least five years, and 9% duties on Tesla exports from China.

The countervailing duties of three Chinese EV manufacturers, including BYD, were reduced from 17.4% to 17%, Geely from 20% to 19.3%, and Shanghai Automotive Group from 38.1% to 36.3%. The reason for the reductions was to take into account the submissions made by the investigated enterprises, which "reflects that the Executive Committee's investigations have been conducted in a rigorous manner on the basis of facts and evidence, demonstrating that the EU is fully transparent and not afraid to allow the investigated enterprises to check in detail the accuracy of the (rate) calculations, and does not hesitate to adjust the findings where necessary. This decision "reflects the fact that the Executive Committee's investigation was strictly based on facts and evidence, proves that the EU is fully transparent, is not afraid to allow the investigated companies to check in detail the accuracy of the (tax) calculations, and does not hesitate to adjust the results of the investigations when necessary.

For several joint ventures of German and Japanese automakers in China, the Commission slightly increased its countervailing duty rate from 21% to 21.3%, while the highest rate of 36.3% will be applied to enterprises that do not cooperate with the investigation.

Following a request by Tesla, a major US electric vehicle manufacturer, for the EU to conduct a separate investigation into the subsidies it receives from its China factory, the Commission decided in a draft to impose a countervailing duty of 9% on Tesla's electric vehicles exported from China to the EU, in addition to the general tariff of 10%. Tesla enjoyed the lowest punitive tariff in the case because it cooperated fully with the Commission and because it had a relatively simple investment structure in China and did not raise capital in China, so the decision to impose 9% was made after calculating the extent to which Tesla's China factory was actually subsidized by the Chinese government.

Wisdom Pu point of view: After half a year, the EU executive committee finally confirmed that all electric vehicles from China, including Europe, the United States and Japan within the brand to increase tariffs, due to which there is no lack of BMW, VW, Mecedes and other major German factories, so countries on the implementation of this proposal still need to be observed, but it can be imagined that if the same increase in tariffs of 30%, for the original has been The European car manufacturers do not have a price advantage, is undoubtedly worse. However, for Tesla, which only increases the tariff on 9%, the advantage it already has will be even more obvious, and the sales situation of Tesla in Europe in the third quarter will be the key to observe in the future.

Aug W1|Green Energy News Highlight:Peng Kai Ming: Carbon fee law will be officially launched at the end of August, and the initial rate will not be too high.

Minister of the Environment Mr. Peng Kai-ming announced today that Taiwan's Carbon Pricing Law will come into effect at the end of August. Initially, the carbon fee rate will be kept at a relatively low level, and at the same time, enterprises will be provided with a longer period of time to fill in their own reduction plans, and gradually move towards a total volume control and trading system. Mr. Tian Jianzhong, General Manager of the Carbon Exchange, also said that in line with the policy of the Ministry of the Environment, the domestic carbon trading platform will be launched in October.

The Carbon Exchange co-organized the first "2024 Net Zero Transition and Natural Carbon Credits and Carbon Rights Development Trends Forum" with the SFC and Chung Hsing University in Taichung today. He further explained that Taiwan's Carbon Fee Sub-Law will go into effect at the end of August, and the initial carbon fee will be kept at a lower level, giving companies more time to report on their own reduction plans. Currently, many companies have not yet established the concept of net-zero carbon reduction. The Ministry of the Environment will integrate inter-ministerial resources to accelerate the development of more green-collar talents and encourage small farms to cooperate and integrate resources to strengthen carbon remittance capacity.

Ji-Pu's point of view: The introduction of a carbon fee is an important step towards net-zero carbon emissions in Taiwan, but in retrospect, the impact on the costs of related enterprises is a problem that cannot be ignored. If we take a more comprehensive and long-term view, the carbon fee law that is expected to be announced at the end of August should be regarded as the first part of the law, and the implementation of carbon trading and the final complete carbon pricing will be the second and third parts of the law that need to be continuously promoted by the government in the next few years.

Jul W3|Green Energy News:If carbon fee reaches $1,000...Steel makers: directly announce losses in the second half of the year.

[The Ministry of the Environment (MOE) held the fourth carbon fee rate deliberation meeting to discuss the "impact of different fee levels on the industry", in which six fee rates were simulated, including $100, $150, $300, $500, $800 and $1,000 per ton, to try to calculate the impact on the industry. According to the Ministry of the Environment's simulation, if the maximum charge is $1,000 per ton, the impact on the annual GDP (Gross Domestic Product) will be about $94.2 billion without the discount of the carbon leakage risk factor. Some steel mills said that although the steel industry is a carbon leakage-sensitive industry, and at the same time, they can get a certain degree of carbon fee discount by reducing carbon emissions on their own, the carbon fee will still increase the cost of steel mills, and at the present time, when the overall market situation is still uncertain, if the Ministry of the Environment decides that the fee rate will be more than $300 per ton, or even as high as $1,000 per ton, the mills can directly declare a loss for the next year.Chi-Pu's point of view: Carbon fee rate setting needs to be considered in a wide range of aspects. In addition to the impact on the industry, the degree of future activity in carbon trading also needs to be taken into account. Since Taiwan's carbon trading platform will be established by the end of 2023, it is expected that the improvement of the relevant laws and regulations in the future will promote the business opportunities of autonomous emission reduction, and since the carbon fee will form a chemical reaction with carbon trading, if the carbon fee is set too low, there will be no one in the carbon trading market in the future, which will further affect the motivation of the relevant industries to reduce emissions; however, if the fee is set too high, it will have a direct impact on the profitability of high-carbon emission industries; therefore, it is estimated that the carbon fee will be set at a price lower than the international carbon trading price in the future, which will be lower than the international carbon trading price. Therefore, it is estimated that the carbon fee will be set at a lower percentage than the international carbon trading price as a starting point, and will be adjusted upward as time goes by.

Jun W4|Green Energy News Highlight:After Phoenix, Waymo Taxi Robot Service Opens to All San Francisco Users

Waymo's self-driving taxi service initially offered limited ride hailing in San Francisco, but is now fully available to all users in the area.

In a blog post on Tuesday (25), Waymo said that nearly 300,000 people have signed up for the 'Waymo One' service since it opened its waiting list. After a period of testing, the company began commercial passenger operations in August.

From the article, "We are committed to expanding our services in a responsible and progressive manner. We work closely with city and state officials, first responders, and road safety advocates to ensure that local communities have access to reliable, safe, and environmentally friendly transportation and to positively impact increased mobility."

Wisdom: Since 2024, EV sales are no longer in the center of the aperture as they were in the past few years, with the rise of AI driving a wave of focus and capital shifts being the biggest factor, but aesthetic fatigue after the novelty of technology and the impact of rational shopping at high interest rates are also key reasons. But sales figures aside, the wave of technological revolution in the automotive industry in the past few years, led by electric vehicles, continues to advance under the leadership of Tesla and a new breed of emerging car makers, with Waymo's commercialization in all of San Francisco and Tesla's Robo Texi coming online in August. Autopilot is expected to lead the second wave of EV technology in the fourth quarter of 2024.

May W4|Green Energy News Highlight:France's carbon emissions fell by an unprecedented amount last year, thanks to the restart of nuclear power.

France's greenhouse gas emissions fall by 5.81 TP3T in 2023, which the French Prime Minister has called the result of a successful energy transition. The resumption of French nuclear power plants in 2023 has led to a significant increase in nuclear power generation, which accounts for 65% of the electricity mix, which, together with the 14% contribution from wind and solar, has been the main reason for the reduction in carbon emissions.Between 2018 and 2023, France's total GHG emissions have decreased by about 17% from about 440 million tonnes to 370 million tonnes.In contrast, some experts On the contrary, some experts point out that the 91 TP3T drop in industrial emissions is mainly due to a reduction in economic activity rather than structural improvements. Road transport emissions fell by only 3.41 TP3T, with air traffic emissions dropping by 3.41 TP3T after the ban on short-haul flights in May 2023, and construction emissions fell to their lowest level since 1990.

Wiseguy's point of view: Although the reasons for France's carbon emissions growth in 2023 vary, it seems that France, Germany and other advanced European countries have been playing a leading role in the world in terms of their plans and determination to achieve net-zero carbon emissions. According to the European Green Deal, France needs to reduce 55% of greenhouse gas emissions by 2030. To achieve this goal, the French government expects to increase climate investment to €10 billion by 2024 in the areas of hydrogen, renewable gas, clean transportation and renewable energy, including the development of offshore wind farms, the production of one million electric vehicles by 2027, the construction of four battery plants in northern France, and the construction of commuter trains around major cities. At the same time, the French government announced that the last coal-fired power plants will be shut down by 2027 and replaced by biomass power plants.

May W2|Green Energy News Highlight:New option for grid storage, China's first 10MWh sodium-ion battery storage plant begins operation

Sodium-ion batteries, which have been discussed from time to time in the past, have finally entered the energy storage market. A Chinese company, Southern Power Grid Energy Storage (SPGES), is expected to build a 10MWh sodium-ion battery storage plant in Guangxi Nanning. In an interview, Southern Power Grid Storage said that this storage system will be the first large-scale sodium ion storage plant in China and the first phase of the 100MWh project, which will be able to generate 73 million kWh of low-carbon electricity, reduce 50,000 tons of carbon dioxide emissions, and satisfy the electricity demand of 35,000 households annually.

Jippo's view: Over the past year, sodium-ion batteries have been in the news for their lower cost and higher safety. However, the lower capacity density of the battery has made its application in the field of electric vehicles questionable. On the contrary, for applications such as energy storage systems, because the space for building energy layouts is much larger than that of EVs, the requirement for battery energy density is relatively low, so promoting sodium-ion batteries for energy storage systems is more in line with the overall benefits, and it is expected that sodium-ion batteries will continue to be introduced into energy storage systems in the future in a more cost-effective manner.

Apr W4|Green Energy News Highlight:Tesla removes old roadblocks in China, but a new shadow looms over the U.S.

Last week's whirlwind visit to China by Tesla CEO Elon Musk opened up a viable path for Tesla's FSD deployment in the country. Almost the same week he returned home, he announced that he was laying off the company's supercharging station development team, a move that will likely have a long-term impact on the pace of EV adoption in the U.S. Musk's trip to Beijing cleared the assisted driving hurdle, and Tesla's official website for China changed the status of the FSD technology from "launching later" to "launching soon. Musk then announced that by 2024, it will invest $10 billion in developing self-driving AI training and inference. Musk added that it would be difficult for the industry to compete with Tesla without the same level of spending, and that it was laying off its entire supercharging and new product team, with about 500 people being disbanded. Musk noted that Tesla still plans to develop its network of superchargers, but that some of the new stations would be slowed down, and that it would be focusing more on the expansion of its existing stations in the future. Tesla's superchargers are the largest public fast-charging network in the U.S., and will be open to more than a dozen U.S. car manufacturers by 2023. Now that Tesla is laying off employees, the U.S. market is beginning to worry about whether the layoffs will affect consumers' willingness to buy electric vehicles. Will it affect the quality of charging station repairs?

Wisdom Pool Perspective: The past month has been a roller coaster ride of highs and lows for Tesla shareholders. Tesla's share price first fell to a one-year low after the continuation of sluggish sales at the beginning of the year and news of the company laying off 10% employees. However, after the release of the financial report, the hopeful early announcement of low-priced models and the imminent cap on products with AI underpinnings such as Autonomous Driving (FSD) and Robotaxi drove a wave of rapid upward movement in the 35% until last week's wave of layoffs of 500 employees, which temporarily put an end to the recovery of the stock. Last week, a wave of 500 layoffs temporarily put an end to the stock's recovery. Considering that from the second quarter of 2023, Ford, GM, EV point, etc., from car makers to charging station operators, have indicated that they will join Tesla's NACS charging specification. At that time, everyone thought that in the development of electric vehicles, Tesla was not only the standard for cars, but also the biggest winner of the charging network in the future. After all, according to the past trend, it was already a consensus that the company with the unified specification often became the leader of the field, which is why the layoffs came as a surprise to the outside world. Considering that Tesla's charging network hasn't contributed much to revenue over the past few years (around $4 billion in 2023), and is unlikely to become a major source of revenue in the next three years, it's clear that the cost of expanding new charging stations won't be recouped as quickly as it could have been. If we go back and look at the FSD subscription price reduction and the FSD China opening program, we can see that Tesla is now making a big change to its once-existing technology, which is now being used in China. It can be seen that Tesla is starting to make some choices on several major development goals (AI, charging network, humanoid robot, battery, energy storage, autonomous driving), except for AI, autonomous driving and humanoid robot, which are considered as essential items (or algorithms/ or information collection) in the AI field, Tesla is focusing on suspending some of the items that cannot be recuperated in the short term. We can estimate that Tesla's Q2 2024 sales should be even worse than expected, forcing Elon Musk to adjust the company's tempo towards a quick revenue boost.

Apr W3|Green Energy News Highlight: Tsai Ing-wen: Taiwan's Wind Power Leads Asia-Pacific with More Than 300 Wind Turbines by Year-End

The largest offshore wind farm in the Asia-Pacific region, the Greater Changhua Southeast and Southwest Stage 1 Offshore Wind Farm, held its completion and merger ceremony on the 25th, with Taiwan's President Tsai Ing-wen delivering a speech at the ceremony. Since 2016, Taiwan has successfully constructed 296 offshore wind turbines with a total installed capacity of 2.37 GW. Tsai said that the number of wind turbines is expected to exceed 300 by the end of this year, putting Taiwan at the top of the global offshore wind industry. Tsai mentioned that after eight years of hard work, the "energy transition" has turned from a policy goal into a reality. She emphasized that Taiwan not only has the largest wind farm in Asia, but has also established its own offshore wind power supply chain. Enterprises such as Taiwan's Xingda Haiji and Century Steel already have the capacity to produce underwater foundations, while Oriental Wind Energy has organized Taiwan's largest marine engineering fleet, including Asia's largest marine engineering ship, the "Huanhai Jade", which has already begun work off Changhua. Behind Taiwan's energy transformation is the Taiwanese people's acceptance and challenge of new things, as well as their pursuit of sustainable development. Tsai praised the commitment of Woxu and many domestic and foreign developers, and thanked financial and academic institutions as well as local suppliers for their joint efforts. She also recognized the hard work of the Ministry of Economic Affairs team led by Senior Minister Shen Rongjin and Minister Wang Meihua, including the Energy Department and the PDA, over the past eight years.

Ji-Pu's point of view: After the end of the epidemic, Taiwan's industry has been actively promoting the development of offshore wind energy, and has completed the installation of 296 wind turbines so far. At this stage, Taiwan not only owns the largest wind farm in Asia, but also has made some achievements on the way of nationalization. This not only enhances Taiwan's competitiveness in the global green energy market, but also contributes to economic growth and technological innovation. Even so, we are still lagging behind in the completion of 5.6GW of power generation capacity by the end of 2025, and we need to continue to work hard to accelerate the proportion of energy independence.

Apr W2|Green Energy News Highlight:Japan-US-Philippines summit to build supply chain for nuclear power, semiconductors

On April 12, Taipei time, the leaders of Japan, the United States and the Philippines held a trilateral meeting at the White House. It was agreed that a supply chain less dependent on China would be established, especially in the key supplies of energy and semiconductors. The joint statement expressed deep concern over China's "dangerous and aggressive behavior" in the South China Sea. To strengthen the stability of the semiconductor supply chain, the three countries plan to train professionals in related fields. This includes supporting Filipino students to receive high-quality education and training at major universities in Japan and the United States. Considering the demand for nickel in pure electric vehicles (EVs), the three countries will also work together to establish a stable supply chain of mineral resources covering the Philippines and other countries. The three countries will also cooperate to develop human resources with skills related to civil nuclear energy. NuScale Power, a U.S.-based startup in which Japan's IHI and Nichicon Holdings have investments, plans to build a next-generation "Small Module Nuclear Reactor (SMR)" nuclear power plant in the Philippines.

Wisdom: Geopolitics affects the economy and has been one of the main axes of the East Pacific in the past few years. As China has a leading edge in green energy (including electric vehicles) production capacity and technology, the U.S. is attempting to blockade the country in various aspects in order to meet the needs of the U.S. Considering the relatively low demand for electric vehicles, it would be less expensive to invest in the related fields in advance in such a situation, and in terms of mini-nuclear plants, the fourth-generation SMR system has already entered the mass-production cycle. In terms of small nuclear power plants, the fourth-generation SMR system has already entered the mass production cycle, so combining Japanese capital to build small nuclear power plants in the Philippines will help U.S. companies seek new markets, but whether the relevant Philippine power grid infrastructure can be coordinated needs to be further evaluated and become a hidden concern.

Apr W1|Green Energy News Highlight:Tesla plans to launch its new Robotaxi this August

Tesla plans to unveil its all-new Robotaxi this August, marking another important advancement in the company's efforts to bring self-driving cars to market. The new steering wheel and pedal-less Tesla will go on sale globally on August 8, the company's CEO Elon Musk said in a post on the X platform. Musk mentioned that Tesla has been aggressively upgrading its self-driving technology in the face of slowing car sales growth and pressure from its price-cutting strategy. He has previously announced plans to begin production of the rental car in 2024. As the launch of Robotaxi draws closer, Tesla is stepping up its efforts to promote its self-driving software and has asked employees to invite customers for test drives to demonstrate the company's assisted driving technology, according to a report in the Wall Street Journal last month.

Wisdom: In the past six months, when the demand for electric vehicles was questioned by various parties, Tesla, as a representative of Tesla, has welcomed a wave of corrections, and has recently put forward a number of programs (e.g., FSD price cuts, Rototaxi, etc.) in an attempt to reverse the situation in the face of internal and external problems. Since most of Tesla's revenue still comes from the car manufacturing industry, if it cannot maintain the growth momentum in this industry as in previous years, it is feared that it will have to continue to suffer from the market's revision of expectations for the car manufacturing business until the revenue of other businesses comes up.

Mar W3|Green Energy News Highlight:Demand for electric vehicles is slowing down, and lithium prices have fallen more than 80% in the past year!

As the global demand for electric vehicles enters an adjustment phase, lithium mines, which have attracted attention from various countries in the past few years, have also been affected; as of the beginning of 2024, the international lithium price had fallen to RMB94,000 per metric ton, and although it later recovered to an average of around RMB100,000, compared to RMB600,000 by the end of 2022, it has fallen by more than 831 TP3T.

Taiwan Green Energy Association (TGEA) Chairman, Mr. T.A. Lee, said, "In the past 22 years, lithium battery manufacturers all over the world have been expanding like crazy, including Mainland China, Japan, Korea, Southeast Asia, and even Europe and North America, so this wave of material market has been speculated up. But with the past two years, especially this year, especially obvious, the overall demand for electric vehicles, no matter you can consider that is based on geopolitical factors, or the overall corporate factors, or interest rate factors, the overall sales of electric vehicles in fact, is down, leading to its own use in a large number of lithium carbonate for the power battery industry, its demand for lithium has fallen very much.

Viewpoint: We know that it is difficult to reduce the cost of EVs, which is the source of this wave of declining consumer demand, and the high price of the battery system has always been the most important role in the cost of EVs, accounting for 40~50%. Under this wave of lithium price correction, the current lithium iron phosphate battery is at 480 RMB/kWh, which is about 43% lower than that at the end of 2022, and it can be estimated that the overall EV manufacturing cost has dropped about 17~18% compared with that at the end of 2022. It can be estimated that the overall EV manufacturing cost has dropped by about 17~18% compared to the end of 2022 in the material part; considering the difference in the mass production ability of various factories, coupled with the current average price of mid-range models, EVs are about 10~20,000USD (40%) more expensive than fuel vehicles, therefore, to even out the price gap with fuel vehicles, in addition to the expectation of a continuous drop in battery prices, the battery material should be replaced and cheaper battery materials should be used. Therefore, in order to level the price gap with fuel cars, besides expecting the price of batteries to continue to fall, changing the battery material, using cheaper batteries, or reducing the amount of batteries used and pairing them with a smaller chassis may be a solution.

Mar W2|Green Energy News Highlight: Building a Local Hydrogen Ecosystem CNPC and Sinosteel Lead Hydrogen Energy Positioning Wave

As countries around the world strive to achieve net-zero emissions by 2050, not only has the U.S. announced the establishment of seven hydrogen centers at a cost of $7 billion, and the European Union announced the establishment of a European Hydrogen Bank, but neighboring China, Japan, and Korea have also made frequent moves to accelerate their hydrogen investments, and our own country has begun to attract the attention of local industry players. Due to the large amount of investment in the hydrogen industry, not only do we need to rely on policy subsidies to support the hydrogen industry in the initial stage, but we also need large state-owned enterprises such as China National Petroleum Corporation (CNPC) and China National Steel Corporation (Sinosteel) to invest in the local hydrogen ecosystem, in order to drive private investment, and Taiwanese companies such as ZTE are also taking advantage of the opportunity to seize a position in the hydrogen war.

Chi-Pu's viewpoint: Compared to green energy industries such as solar and offshore wind, Taiwan's hydrogen infrastructure is still at a nascent stage. If we want to achieve the target of 9~12% by 2050, we need to take a three-pronged approach from the policy, industry, and market application areas. Currently, the government's policy on the planning of hydrogen mixing (ammonia mixing) for thermal hybrid power generation is still in the early stage of evaluation, and it needs to be continued to implement in order to cool down the infrastructure and industry to have the opportunity to build and develop; in addition, the cost of the hydrogen refueling station is still in the high point ($100 million), which is relatively difficult to make a profit. In addition, since the cost of hydrogen refueling stations is still at a relatively unprofitable high (starting at $100 million), it is very difficult to promote the use of hydrogen-powered vehicles. The first phase of implementation should be targeted at commercial buses, with hydrogen refueling stations set up at transit stations to ensure high utilization. This should be coupled with more favorable subsidies for energy storage systems, so as to increase the incentives for enterprises to produce fixed energy storage systems.

Mar W1|Green Energy News Highlight:Apple electric car calls it quits after 10 years of research and development

Recently, it has been rumored that Apple has canceled its investment in the 10-year electric car project and will shift part of its resources to the AI field to focus on the development of AI. The outside world analyzes that Apple has no longer regarded the $100,000 self-driving car as the goal of future development, and will instead focus on the integration of artificial intelligence and the iPhone, and will also concentrate its resources on the development of the Vision Pro headset. According to Bloomberg, Chief Operating Officer Williams and Vice President of Electric Vehicle Development Linch told the 2,000-strong Special Projects Group (SPG) at a meeting that they would end the electric vehicle program and offer employees the chance to change roles within the company, but some employees have already been told that they will be laid off.

Chi-Pu's point of view: In the past year or so, the low price strategy of Chinese car makers, coupled with the difficulty of making profits from EVs, has surfaced. In this down cycle, when the novelty of EVs is fading away from the consumers, a number of traditional car makers, such as Ford, General Motors, Fuchs, BMW, Mecedes, and others, have all adjusted their strategies to be conservative in their approach towards EVs, while Toyota, which is not enthusiastic about EVs, is singing a sad song about the development of EVs. Toyota has been lukewarm on EVs, while Toyota has been singing a sad song about EV development. It is clear that at a time when neither technology nor cost can catch up with China's carmakers, it is simpler to shift strategy to save money than to aggressively research and develop to close the gap. Apple has not yet had a prototype car in the automotive field, and it is rumored that it has spent more than a billion dollars in the past, and how much more money it will spend in the future is still difficult to estimate, and in the electric car market, where the average price is already lower than 50,000 U.S. dollars, I'm afraid it will be difficult to make money with hardware in the future, and it is not surprising that the company will cancel its investment directly.

Feb W3|Green Energy News Highlight:Yuenning implements the Ministry of Economic Affairs' 700kg hydrogen fueling station project.

In response to the government's "2050 Net Zero Emission Pathway" and "12 Key Energy Strategies", Yuanning has been actively promoting the development and application of hydrogen energy. 2023, the company has completed the development of the 350kg plant hydrogen supply equipment and started the construction of a 700kg hydrogen refueling station, and has already overcome the bottleneck of hydrogen cooling by utilizing the patented technology of "Vacuum Welding Bond (Vacuum Molecular Diffusion Welding)" and obtained the American Society of Mechanical Engineers (ASME) certification. We have also obtained the American Society of Mechanical Engineers (ASME) certification. The company is a leader in the development and application of hydrogen energy equipment. The Company has made significant achievements in the hydrogen energy field since 2015, successfully developing an integrated hydrogen production, compression, storage and hydrogen refueling system that utilizes high purity hydrogen and advanced compression technology to significantly increase hydrogen refueling efficiency. Mr. T.A. Fung, Chairman of the Board of Directors of the Company, pointed out that compared to large-scale hydrogen refueling stations in Japan, Yuanning's technology is not only cost-effective, but also competitive in terms of compression and purification of special gases, which contributes significantly to the promotion of Taiwan's energy-saving and carbon reduction goals.

Chi-Pu's point of view: Although the Hydrogen Promotion Group, planned by the Ministry of Economic Affairs (MOEA), has been planning for the production, transportation, storage, and application of hydrogen since 2022, and aims to achieve a power generation ratio of 9~12% by 2050, Taiwan's hydrogen industry has only been in the research and development of hydrogen and testing of the related components, and has not yet reached maturity in all areas. Therefore, a lot of resources are needed to build the infrastructure and cultivate the related talents. Hydrogen refueling stations have always been an issue that cannot be avoided in the promotion of hydrogen vehicles. Since large-scale hydrogen refueling stations can cost hundreds of millions of dollars, and the subsequent operation of the station is subject to high hydrogen prices, the choice of a prudent strategy for the deployment of the infrastructure will be a key factor in the smooth promotion of hydrogen energy.

Jan W5|Green Energy News Highlight:Tesla downbeat on this year, warns of 'significant decline' in sales growth, Taiwan chain dusty

Tesla released its Q4 2023 financial report on 1/24. Earnings per share was $0.71, revenue increased by 3.5 % to $25.17B, gross profit further declined to 17.6%, the three major indicators were not as good as analysts expected, closing down 12% after the meeting, and the cumulative decline in January amounted to 23%. Tesla attributed the reason to the price cuts, R&D expenditures, and higher costs brought by the mass production of the Cybertruck. Tesla blamed price cuts, R&D expenditures and higher costs from the Cybertruck mass production.

Mask emphasized that the decline in margins stems from the high interest rate environment. If rates come down quickly, I think margins will be good; if they don't, margins won't be good," he said on a conference call. "It's not that people don't want to buy [Tesla's cars], they just 'can't afford' to buy them in a high interest rate environment."

In addition, our market share is surprisingly low in certain regions, such as Japan, where Tesla should have at least the same market share as other non-Japanese carmakers, but currently does not. In terms of future guidance, Tesla rarely provided a specific delivery target for this year in the report, saying that 2024 will be a year of slow growth and that it expects to miss its long-term target of 50% growth. Tesla also warned that the growth rate may be lower than 2023 before the launch of new models.

Jippo's point of view: Tesla will face different challenges in each of the three major markets in 2024, but the only similarity is that each challenge is not easy to solve. In China, in addition to the economic problems that have brought about weak consumption, Tesla will have to face the encirclement of a large number of Chinese car manufacturers, and Tesla will gradually lose its competitive edge under the siege of Biati, FAW, Chery, and other Chinese electric car brands. In the European market, the weak economy is expected to bring about a reduction in welfare benefits, and it is expected that subsidies for EV purchases will be gradually reduced by 2024. It is currently rumored that Germany will completely eliminate subsidies for EVs in the new year, which will undoubtedly cast a shadow on Tesla's sales. Back to the U.S. market, in addition to the consumer impact brought about by the high interest rate environment mentioned by Mask, since the main Model 3 cannot get the $7,500 subsidy because of the use of Chinese-made batteries, it is tantamount to a price hike for consumers. Until this issue is resolved, it is expected to affect Model 3 sales by 50,000 to 80,000 units for the whole year.

Jan W3|Green Energy News Highlight:Beating Tesla but losing 25% of its share price, EV leader BYD's two major headwinds

BYD, which overtook Tesla to become the world's electric vehicle sales leader in the fourth quarter of 2023, has seen its share price drop by more than 26%, seemingly signaling that investors are no longer optimistic that its price-cutting strategy will continue to drive up profitability in the face of fierce market competition in the future. According to a Wall Street Journal report, the impact of the price-cutting strategy from the end of 2022, BYD's cheapest models sell for less than 100,000 yuan, much lower than Tesla. This ultimately resulted in a gross margin of 14%, but in the face of fierce competition, the market's focus has shifted from traditional hardware technology to autonomous driving and in-vehicle software features. Although BYD has hardcore technologies such as batteries and range, its lack of development in the areas of smart connected cars and autonomous driving technology could put it in a weak position in the medium to long term.

Tesla and some other Chinese EV brands, such as Ideal and Xiaopeng, have gained traction by offering advanced software features and reinforcing their brand image. Overall, BYD is leading the market in terms of sales volume, but its "hard over soft" strategy, low gross margins and relative lag in smart car technology have left it out in the capital market, where it is facing the challenge of changing market trends.

Viewpoint: Under the trend of oligarchy in electric vehicles, it is difficult for BYD to be challenged in the short term because of its current cost advantage. However, in the long term, BYD will continue to maintain its competitiveness after each vehicle manufacturer has the ability to produce mass quantities of vehicles, and in addition to the cost, the differentiation of product identification must be made by technology and consumer experience. Although BYD has recently stopped using software features as its main focus to strengthen its brand image, it is estimated that it will continue to dominate the EV market in the future, given that it is currently leading the industry in terms of vehicle manufacturing level, and will still have sufficient resources and market for adjustments in the event of a change in strategy.

Dec W4|Taiwan Electric: 112/12/31 Wind and Solar Power Penetration Rate Reaches 35.45%, a New High

On the last day of 2023, renewable energy stole the show. According to Tepco, at noon on December 31, the share of wind and solar power reached a record high of 35.45%, meaning that one out of every three kilowatts of electricity came from renewable energy. Green energy not only plays a key role in the electricity supply, but also helps to reduce emissions by allowing water storage units to store energy during the day and reducing the load on thermal power generation. The power of renewable energy optimizes the pattern of power dispatch during air-pollution seasons.

Chi-Pu's point of view: In the past few years, under the policy and subsidy injection, both in offshore wind power and solar power are gradually seeing results, with solar power accumulating up to 12.2GW, and offshore wind power reaching 2.2GW. With the offshore wind power learning curve reaching a breakthrough point, Taiwan's green power will play an even more important role in the future, and help Taiwan enterprises to meet the demands of the international ESG.

Dec W3|Carbon trading totals over $800,000 on day one

The Taiwan Carbon Exchange was officially established on August 7 this year, and the first carbon trading was successfully completed on 12/22. A total of 27 financial holding companies participated in the transaction, and the total trading volume reached 88,520 tons, and the transaction amount was about 800,000 U.S. dollars with an average of about 10 U.S. dollars per ton of carbon rights. Lin Hsiu-ming, Chairman of the Taiwan Stock Exchange, pointed out that the result of the first transaction of voluntary license reduction exceeded that of the first transaction in Singapore, which was more than 10,000 tons. Lin also mentioned that the establishment of the international carbon trading platform aims to internally help Taiwan's industries adapt to the international supply chain, realize carbon neutrality of products and international requirements such as ESG, and provide SMEs with a convenient way to acquire carbon rights, eliminating the need to go overseas to open an account.

Ji-Pu's viewpoint: The establishment of the carbon exchange symbolizes the official entry of carbon pricing in Taiwan in 2024. Promoting the advancement of carbon reduction technology is an important project that must be carried out by enterprises in order to achieve sustainable development in the future, but in the past, due to the cost issue, many enterprises were reluctant to face it. After the major product manufacturers began to require carbon emissions, the supply chain had to respond, coupled with the introduction of the carbon pricing mechanism, Taiwan enterprises will make a choice between carbon rights expenditure and carbon reduction costs, in accordance with the profitability of the enterprise to carry out. As the price of carbon rights gradually increases, the cost of carbon reduction technology will be surpassed by the cost of carbon rights in the long run, which will drive Taiwan's industries to move forward toward active carbon reduction and make systematic contributions to static zero carbon emissions in 2050.

Dec W1|Green Energy News Highlights:COP28 Observations Climate Damage Fund Established, But Still Insufficiently Strong

The 28th United Nations Climate Change Conference (COP28) was held in Dubai on November 30th, and on the first day, it was rumored that more than 200 countries attending the conference agreed to activate the Loss and Damage Fund (LDF) in order to support countries that have been harmed by climate change. In addition to the Loss and Damage Fund, another important issue is that in order to control climate warming, several advanced countries such as the United States, Europe, and Japan have endorsed the important role of nuclear energy in the fight against climate change, and called for the increase of nuclear power generation by 2050 to triple the 2020 level.

Wisdom: The COP28 will be held in Dubai, a country that relies on the oil dividend to rise, and even more ironically, the current president is the CEO of Abu Dhabi Oil Company. Although the meeting continued to present the future plans of each country, if we look back to 2015 after the Paris agreement to this year, except for the epidemic during the CO2 emissions had a brief decline, the rest of the year emissions are still on the rise (2023 is expected to increase by 1.51 TP3T compared to 2022). Coincidentally, as COP28 proceeds, the largest iceberg in history (over 4,000 square kilometers) is preparing to break away from the Antarctic, seemingly signaling that there is still a lot of progress to be made in our efforts to stop climate change.

Nov W5|Green Energy News Highlight:Auto winter blows upstream, Korea's battery industry starts layoffs and investment cutbacks in the U.S.

The high interest rate environment in the U.S. continues to bring about weak consumer demand for commodities, and pessimistic forecasts of declining EV sales are gradually filtering through to the related supply chain. The battery industry, which accounts for the largest share of EV costs, is the first to bear the brunt. LG ES announced in November that it would cut 170 jobs, while another battery major, SK On, announced that it would begin production cuts. As SK On has already announced 1,000 layoffs in September 2023, the cuts are expected to directly affect the EV production capacity of its major partner, Ford Motor.

Ji-Pu's viewpoint: In the past year, due to the encouragement of the IRA Act, most of the battery manufacturers entered into the U.S. in the form of joint venture with the U.S. automobile manufacturers for co-development, in order to get the $7,500 purchase subsidy. This battery plant production reduction can be seen as U.S. car makers feel pessimistic about the future sales of electric vehicles, so slow down the investment in the field of electric vehicles. Since China has maintained a certain degree of leadership in the competition for EV market share, the slowdown of the U.S. automakers at this time is mainly due to the high interest rates on the high cost of EVs consumer lock-in. However, looking back at past history, high interest rates are ultimately a phase in the boom cycle, and a slowdown in R&D investment in EVs at this point in time will certainly put them at a competitive disadvantage when interest rates drop in the future.

Nov W3|Green Energy News Highlight: 270th turbine completed, cumulative installed capacity of offshore wind exceeds 2.1GW

According to the latest news from the Energy Department of the Ministry of Economic Affairs (MOEA), despite facing the rough seas of the Taiwan Strait, Taiwan's offshore wind power still continues to go against the wind, and as of the beginning of November 2023 has successfully installed the 270th offshore wind turbine, with a cumulative generating capacity of 2.1GW.

The Energy Department pointed out that the efficiency of wind power generation was remarkable in the fall, with wind power generation reaching about 869 million kWh in October. Especially in October, the highest instantaneous power generation exceeded 1.5 million kilowatts for 22 consecutive days, and the average output reached 1.03 million kilowatts, which is equivalent to the installed capacity of two Taichung power plant units. In addition, not only did we push ahead with our work during the summer wind farm construction period to ensure stable power generation from the four wind farms, but many of our green energy teams also closely monitored the progress of the wind power projects and worked hard to ensure the smooth integration of power from the wind farms into the grid when the weather permitted. Looking ahead, the Energy Department said the government and the private sector will continue to work together to push the offshore wind power installation target to 5.6GW by 2025, realizing the policy objective of energy transformation.

Viewpoint: Although the number of offshore wind turbines exceeding 270 and the power generation capacity exceeding 2GW are regarded as major milestones in the promotion of green energy development, on the other hand, the recent rumors about the declining investment enthusiasm of foreign vendors are a layer of hidden worries for offshore wind power. Taiwan's development of offshore wind power is currently facing obstacles, including high costs, stringent conditions for nationalization, blocked development by credit ratings, lack of a reasonable guarantee mechanism for surplus power, insufficient flexibility in corporate purchasing and allocation, and lack of interruption guarantee mechanisms. Government support is needed to ensure a healthy investment environment in China.

Nov W2|Green Energy News Highlight:Electric vehicle growth slowing down? BYD's pure electric sales will soon overtake the car.

Following Tesla's sharp decline in gross profit in the current quarter, Panasonic also released its third quarter financial report last week. 2023 April~September Panasonic's net profit surged by 169% to a record high of 288 billion yen, and operating income also increased by 29% to 192.8 billion dollars, however, operating income for the whole year was revised downward to 400 billion yen (2.7 billion dollars), lower than analysts' estimate of 414 billion yen. However, the full-year operating income was revised downward to 4,000 billion yen (2.7 billion U.S. dollars), which was lower than the analysts' estimate of 414 billion yen. It was also mentioned that although the IRA bill has stimulated the purchase of electric vehicles in the U.S., the bill has also led consumers to target electric vehicles priced below US$80,000, which indirectly affects Panasonic's profitability. In addition, Panasonic also announced that it will adjust its future production capacity downward to cope with the decline in demand. At the end of September, Panasonic adjusted its production of automotive batteries by 60% compared to the previous quarter and announced that it will not return to full capacity in the near future, which echoes the view that the sales of EVs are slowing down recently and indirectly confirms Tesla's view that the high interest rate has a long-lasting impact on the sales of EVs.

And on the other side of the ocean, BYD recently announced that in October sales for the first time exceeded 300,000 units a month, of which 160,000 units of pure electric car station, in the past an average of 150,000 units of pure electric car sales, 2023 is expected to tie Tesla sales of 1.8 million targets, is expected to 2024 pure electric car leader will be replaced.

Jippo's Take: As EVs continue to be predicted to grow at a slower pace in recent times, Tesla's supply chain has revised its expectations for the future in a way that confirms the argument. In retrospect, the wave of EV sales will peak in 2022 due to the net-zero carbon emissions trend, the introduction of new technologies, and the economic development dividend. However, with increased visibility on the roads and continued attention in 2023, the perception of "buying an EV is fashionable" is slowly disappearing. In addition, under the environment of high interest rates, the consideration of EVs is gradually shifting from faith to pragmatism, which ultimately leads to a gradual slowdown in the sales of EVs, whose average price is US$15,000~20,000 higher than that of fuel cars; instead of saying that EV growth is slowing down, it would be more accurate to say that the number of flat EVs and their models do not have enough to support the growth of the EV market. BYD ($30,000 average price) and Telsa Model 3 and Model Y ($30,000~$50,000 average price) are still growing, which is the best proof. Therefore, in the next 1~2 years, the growth rate of EVs will depend on whether the price gap between EVs and fuel cars will be closed quickly.

Oct W3|Green Energy News Highlight:Tesla reports warning signs for electric vehicles

Last week at Tesla's third-quarter earnings conference, Elon Musk said that the economic situation was the main reason why Tesla's revenue and profitability did not meet expectations in two key indicators, and predicted that the Cyber Truck, although it will start delivering in the fourth quarter of 2023, will have to wait until the end of 2024 to contribute to the company's revenue, Tesla's stock price fell by more than 15% in a week. 15%. Musk pointed out at the meeting that Tesla had adjusted its expectations for future results due to rising interest rates in the US, which had increased the cost of loans and the monthly expenses of consumers, which had limited their ability to buy new cars.

Wisdom Pu point of view: Tesla sales on the price cuts to grab market share strategy, the average price cuts for all models in the past year has reached 10,000 U.S. dollars, while the same period the average into only 2,500 U.S. dollars, the cost optimization can not catch up with the extent of the price cuts, the impact is that the gross profit margin in 2023 continued to decline from 19.3% to 17.5%, it is worthwhile to pay attention to the lower than 20% Gross margin is a phenomenon not seen in 2019. In the short term, as long as Tesla continues to maintain this sales strategy, gross margins will only continue to dip. However, in the medium to long term, as Tesla continues to deliver as much capacity as it opens, as long as EV penetration continues to increase, Tesla will still be able to maintain delivery growth of more than 50% per year. In addition, Tesla's main source of revenue comes from the U.S., accounting for 49.8%, so in the future, if the U.S. stops cutting interest rates and the economy returns to the right track, Tesla will be able to maintain its annual delivery growth of more than 50%. As long as the price-cutting strategy is suspended, Tesla will be able to optimize its cost by taking advantage of its market share and technology, and will soon see a reversal in both revenue and profit margins.

Oct W1|Green Energy News Highlight:European Union shows goodwill to mainland China's electric vehicles

For several weeks now, the European Union has been rumored to be conducting a counter-subsidy investigation into Chinese electric vehicles in order to assess the need to raise import tariffs. However, there seems to be a divergence of voices within the EU. EU officials have recently moderated their stance, with EU Trade Commissioner Valdis Dombrovskis, who is currently visiting China, stating on the 23rd that: the EU has no intention of decoupling from China, but when openness is abused, it must protect itself, but it will not impose tariffs on China in the short term. On the other hand, France has changed its incentives for electric car purchases to restrict Chinese-made electric cars.

Chip's point of view: Since countries within the European Union have different degrees of connection with the Chinese market, the implementation of tariffs rashly will likely have a direct impact on the three major German car makers by China's commercial retaliation; therefore, it is predicted that in the short term, China's market share of electric vehicles in the European market will continue to go up.

Sep W4|Green Energy News Highlight:Honghai Expands U.S. Manufacturing of Electric Vehicle Batteries

In recent years, the development of electric vehicles has accelerated, and the layout of its key components has become a major strategy. An American company pointed out that Hon Hai's battery cell production plant in Kaohsiung will start mass production next year as scheduled, with an estimated capacity of 1GWh, mainly for the electric bus market. The company invested by Hon Hai plays an important role in providing battery cells. In addition, Hon Hai has set up a Battery Management System (BMS) production line at its plant in Ohio, U.S.A., which further strengthens the layout of its components.

Ji-Pu's point of view: In recent years, Hon Hai and its subsidiaries have been launching EV-related products, from batteries, EV design, electronic control to MIH platforms, demonstrating their ambitions for the EV market. However, there has been no news about the most important customer side in the past few years. In the environment where China is leading in all aspects of EVs and European and American manufacturers are catching up, Hon Hai is stepping up its pace to enter branded factories in order to develop.

Sep W3|Green Energy News Highlight:European Union announces investigation into China's EV subsidies

The European Union (EU) announced on 9/13 that it will launch an investigation into Chinese electric vehicles (EVs), in response to their record-high market share in Europe, to find out whether Chinese carmakers have gained a competitive advantage over European brands due to government subsidies. Speaking in Strasbourg, France, European Commission President Ursula von der Leyen said, "Europe is open to competition, but it is against bottom-feeding competition, and we must protect ourselves against unfair competition.

Ji-Pu's viewpoint: Looking back at the past history, the EU government has always had a good reputation of being fair and strict in the field of anti-monopoly and fair trade. However, the investigation of Chinese car makers this time, whether it can find the unfair competition brought by subsidies is a question, even if it really find and remove the subsidies. Even if the subsidies are found and removed, the fact that China is still ahead of China in vehicle manufacturing technology is still difficult to reverse in the short term. If we don't follow the example of the U.S. and use our policies to directly block Chinese car makers, I'm afraid that in the next few years, traditional European car makers will face a serious challenge to their market share in electric vehicles.

Sep W1|Green Energy News Highlight:How strong is China's electric car? A shocking photo reveals the truth, Europeans are crying.

China's strong position in electric vehicles was revealed at the recently concluded Munich Motor Show, where Chinese automakers occupied more than 40% of the exhibition hall in what is said to be Europe's largest exhibition space, and Chinese brands can be seen from electric vehicle brands, battery systems to electric vehicle parts, and they have made a strong presence. Among them, BYD and SAIC MG even displayed a series of EVs to show their dominant position in the field.

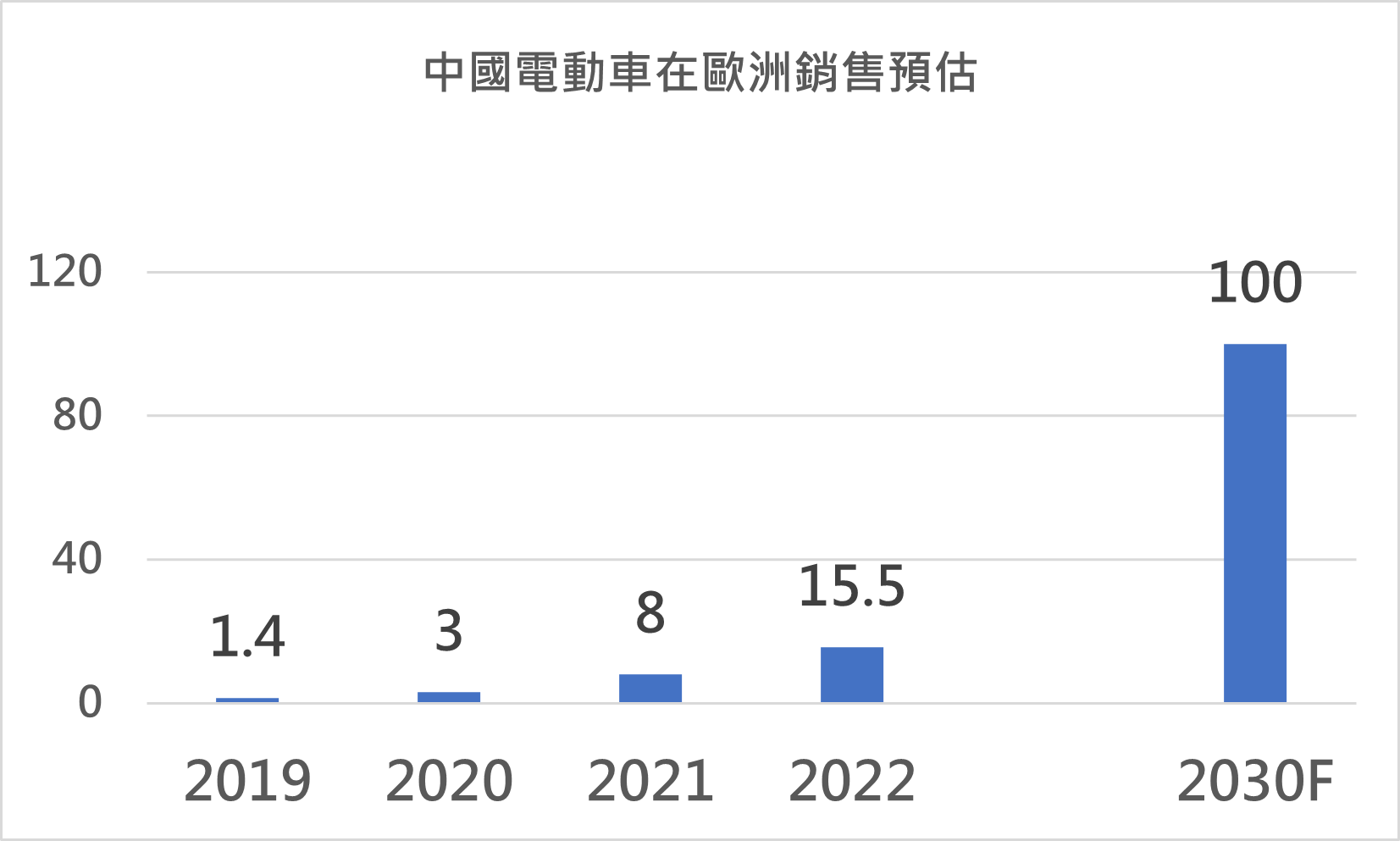

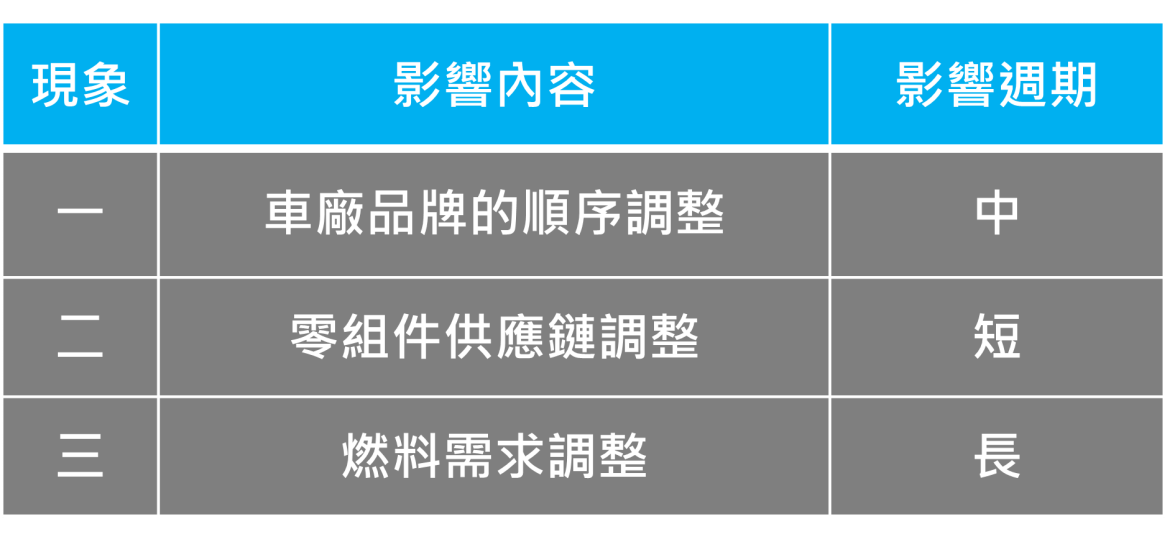

Wisdom: It is an undisputed fact that China leads the world in electric vehicles. While other markets are still in the growth stage, China's domestic market has already entered a white-hot price war in advance. According to the estimation of Automobility, China's annual EV production capacity has reached 10 million units per year, which is far more than the domestic market demand. With the development of oversupply, apart from price competition, it has become inevitable to go to other markets to digest the production capacity. Since the IRA bill proposed by the U.S. last year serves as a barrier that Chinese brands can't easily break through, the European market, which is a more open market, and the Southeast Asian market, which is not subject to large-scale government control, will become the main destinations for Chinese EVs in the next few years.

Aug W4|Green Energy News Highlight: BYD surpasses Tesla to become the electric vehicle leader, overseas layout is the focus for the future.

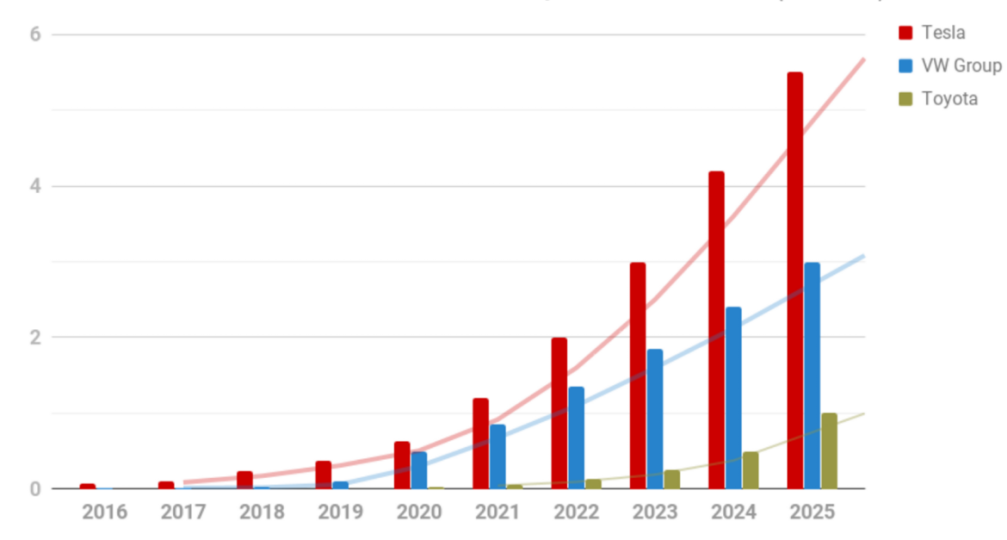

Since 2022, BYD's electric vehicle sales have clearly surpassed Tesla's to become the leader in the electric vehicle industry. This year, BYD's sales will reach 3 million units, further widening the gap with Tesla. BYD's high market share is mainly due to the breadth of its product line, which covers the low-end, mid-range and high-end markets, as well as the launch of strong models in each market segment against major competing brands.

Viewpoint: In terms of market strategy, due to the U.S. policy ban on China's EVs, BYD has made it clear that it will move towards Europe and Southeast Asia in the future. In Europe, due to labor costs and some legal issues, coupled with the fact that the European Union is also considering preventing dumping of China's EVs with legal decrees, the company expects that it will be sold in the form of exports in the short term. As for Southeast Asia, BYD has already set up a plant in Thailand in 2022, and has successfully taken the lead in EV sales in Thailand this year (SAIC is the second). If there is no change in the EV market policy in the whole Southeast Asian market, it seems that the Chinese car maker will be able to duplicate the experience of defeating the car makers of other countries in China, and once again take the share of the market in this region.

Aug W3|Green Energy News Highlight:Futa, Wada win Japan's big EV deal

Taiwan successfully entered the international electric vehicle market. We have developed the core power system for electric vehicles, led by Takeda Electric, and have successfully entered the supply chain of electric vehicles in Japan by joining hands with large enterprises such as Daido Steel, Sinosteel, and Ta Ya. Among them, Mazda and other famous brands have taken the lead in selecting electric vehicle power systems made in Taiwan and will start shipping them this quarter. Mazda has selected Taiwan's EV powertrain for its latest model, the MX30 R-EV extended-range EV. In addition to Mazda, there are also some well-known European and American car makers and another Japanese car maker who are in the process of negotiating with Taiwanese manufacturers.

Mr. Zhang Jinfeng, Chairman of Fountain Set, said that the annual production capacity of Fountain Set's EV parts and components can reach 2 million sets, of which the annual production capacity of the power system is about 40,000 sets. In the future, with the increase of orders, the maximum production capacity will be gradually expanded to 200,000 sets.

Viewpoint: In the past, Taiwan enterprises in the fuel vehicle industry were less likely to enter the Tier 1 suppliers, so although they had good products in many areas, it was difficult for them to enter the automotive front-end market. After entering the era of electric vehicles, the successful cases in the field of electric vehicles in the past two years, including Richfield, Delta, Quanta, Shihlin Electric and other manufacturers, will allow Taiwan's advantage in automotive modules (systems) to be utilized, and this time, Richfield has joined hands with its partners to enter the supply chain of Mazda, which is also another example.

Aug W2|Green Energy News Highlight:Taiwan Welcomes New Hydrogen Economy, Hydrogen Concept Seed Teams Up

After technology giants such as Google, Microsoft, and Apple announced their participation in RE100, the related supply chains are gradually adopting green certificates or using clean energy directly in order to comply with the requirements. Unimicron recently announced a $4 billion investment in the construction of a fixed-fuel power generation system, and the CEO of Bloom Energy, a partner supplier, personally attended the launch ceremony, bringing the once-hot topic of hydrogen energy to the center stage once again last year, and giving Taiwan-based companies in the hydrogen application industry chain a chance to be recognized by the market.

Wisdom Park's view: Hydrogen is a key player in Taiwan's move towards net-zero carbon emissions, and the Ministry of Economic Affairs (MOEA)'s "Taiwan 2050 Net-Zero Transformation" announced in April this year has set the share of hydrogen power generation in 2050 at 9~12%. Currently, Taiwan's hydrogen energy is still in its infancy, with a share of power generation of less than 1%, but it is already commercially available in the supply chain and in the application of the technology, with manufacturers offering products ranging from raw materials, fuel cells and components to complete battery systems. From raw materials, fuel cell components, to complete battery systems, there are manufacturers that can provide corresponding products, and the development is in its infancy.