Company News|Broadcom Q3 2023 Earnings Report

Broadcom, which supplies chips to Apple and many other technology companies, announced its financial results on August 31, with last quarter's revenue and profit slightly better than market expectations, driven by the Internet, while margins remained strong. But the outlook for the current quarter was weaker than analysts had expected, signaling weak demand for semiconductor components.

Broadcom specializes in the design and manufacture of a wide range of networking semiconductors, including communication chips, Wi-Fi, Bluetooth, RF devices, TV set-top boxes (STBs), and data center networking equipment. The company's Ethernet products, including switches, routers, and ASICs (customized specifications) for large-scale data centers, have seen a surge in orders in the wake of the AI wave, and have been a major growth driver in recent times.

Broadcom FY23Q3 revenue slightly better than expected by iPhone pulling goods

For the quarter ended July 30, Broadcom's revenue rose 5% to $8.876 billion, beating Wall Street consensus and Broadcom's own estimate of $8.85 billion.

- Gross Profit Margin 75.1% (Decrease of 0.6 percentage points QoQ and 0.8 percentage points YoY)

- Profitability 62.4% (+0.4pp QoQ, +0.9pp YoY)

- Earnings per share (EPS) came in at $10.54 (+2.1% QoQ, +8.3% YoY), ahead of the market's expectation of $10.43 1.1%.

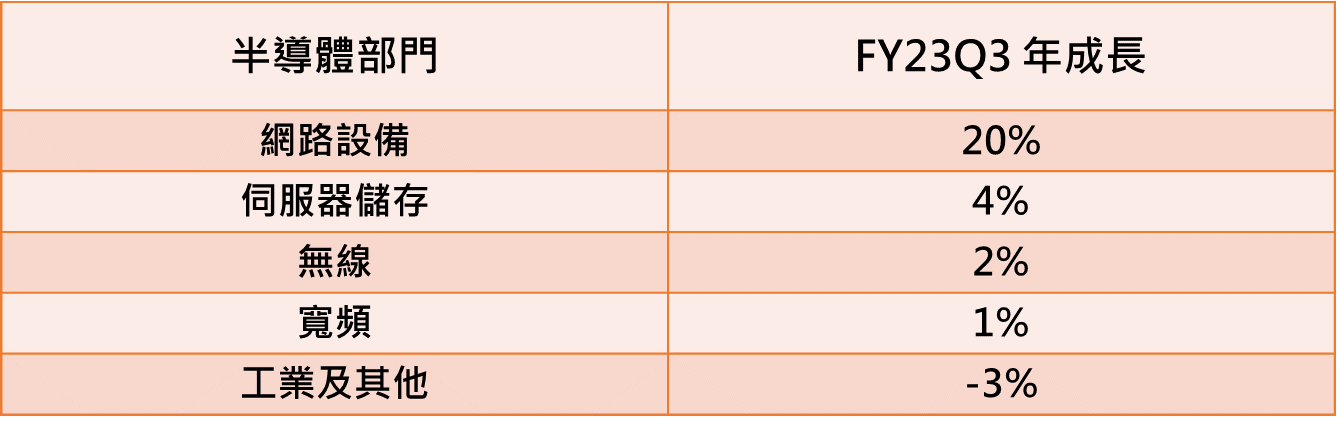

Broadcom's FY23Q3 revenue was slightly better than expected due to the fact that its major customer Apple (AAPL) will soon enter the peak season, the iPhone 15 will be released on September 13, Taiwan time, the demand for building inventory will lead to the rise in Apple's pulling power, driving the wireless business of the semiconductor division to higher-than-expected revenues of about 2%. However, the rest of the end-markets have not seen any improvement, FY23Q3 revenue growth is entirely from AI-related product sales. However, the remaining end-markets have not shown any improvement, with all of FY23Q3 revenue growth coming from AI-related product sales. Among the five major end-markets, only the network equipment business for cloud data centers maintained double-digit annual growth, while other end-markets, such as server storage and broadband, declined to single-digit annual revenue growth.

Broadcom lowers FY23Q4 revenue estimate on weak consumer electronics market

Entering FY23Q4, Broadcom gave a more conservative revenue forecast, only 4.4% to $9.27 billion. In comparison, the Wall Street average expectation of $ 9.28 billion, some analysts predicted even as high as $ 9.8 billion. Broadcom's estimated growth rate is the slowest in 2020, indicating that Broadcom's iPhone 15 sales are expected to be cautious. Server storage and broadband business is likely to slow further to annual decline, networking business revenue is only expected to maintain annual growth of about 20%, reflecting the AI boom brought about by the demand for networking equipment, and consumer electronics market weakness continues to limit the overall growth of Broadcom. Although Broadcom is a key player in connecting computers in giant data centers, spending in this area is uneven.

All the growth in Broadcom's semiconductor division is related to AI devices

Broadcom CEO Chen Fu-yang said that large cloud computing providers have strong demand for next-generation technology, and that overall the chip market is experiencing a "soft landing" with fewer purchases by large enterprises and communications equipment suppliers, with growth in the current quarter still being driven by AI-related spending. In addition to supplying a variety of different chips, Broadcom is also involved in software used by large enterprises, which makes Broadcom's financial report become a wind ball of technology industry spending.

Ji-Pu's point of view.

Broadcom's AI glow at this stage has been overshadowed by a broader downturn, with the semiconductor business also suffering from weak corporate demand and a slow recovery in the consumer electronics market. In addition, Broadcom's software business is being hit by the pain of corporate IT budget cuts across the software market in both Europe and the US. However, Broadcom's network equipment business continues to grow steadily with the introduction of AI applications, and can customize network equipment for data centers that train and adjust artificial intelligence to meet the requirements of lossless transmission, low latency and scalable network architecture for AI training and deployment. In addition, VMware's acquisition is currently subject to regulatory review in China, the approval of which will provide Broadcom with new operational growth momentum. Broadcom continues to be a leader in generative AI connectivity, and the overall market is expected to pick up in the second half of 2024.

Table 1: Broadcom FY23Q3 Sectoral Revenue Distribution

Source : Broadcom; Collated by Chipotle Industry Trend Research Institute 2023/09

Table 2: Broadcom Semiconductor Division Year-on-Year Growth in Terminal Market Revenue

Source : Broadcom; Collated by Chipotle Industry Trend Research Institute 2023/09