Corporate News|Telespac's Q2 2023 legal statement

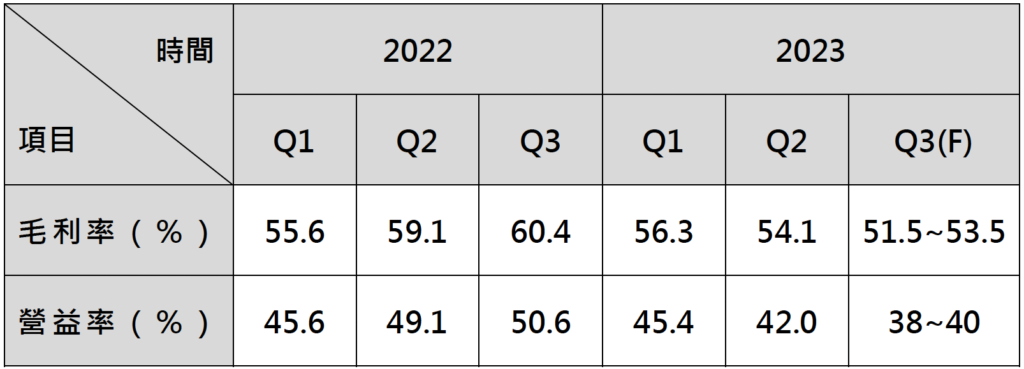

TSMC held a press conference on June 20, 2012, with the participation of Chairman Dennis Liu, President Chieh-Chia Wei, and other senior executives. The company's second quarter earnings per share (EPS) came in at NT$7.01, with a gross margin of 54.1% and a 42% operating margin. Revenues were in line with market expectations, and the gross margin was better than the upper end of previous financial forecasts. However, he cautioned about the economic outlook for the second half of the year. He said he did feel strong demand for artificial intelligence (AI), but the contribution to third-quarter revenue was still modest and could not offset consumer demand headwinds. As a result, he estimated that full-year revenue would drop by 10%. Despite the challenges, TSMC continues to be a technology leader, and demand for AI and other industries is expected to continue to grow over the long term.

- 2023 Full Year Capital Expenditures Estimated Annual Decrease ~10%

TSMC's full-year foundry market and company revenue growth rate are revised downward, with annual dollar revenue forecast to decrease by ~10% in 2023, a mid-single digit downward revision from the previous statement. TSMC's capital expenditures for this year are estimated to be in the range of $32-36 billion, of which 70-80% will be for advanced manufacturing processes, 10-20% for special processes, and the rest will be for advanced packaging and photomasks.

- Conservative outlook for Q3, with revenue estimates in the range of $16.7 billion to $17.5 billion.

In the third quarter, TSMC's revenue is expected to be in the range of $16.7 billion to $17.5 billion, a 6.5 to 11.6% increase from the previous quarter, due to the impact of 3nm production. Gross margins are estimated to be in the range of 51.5 to 53.5%, which is a slight decline from the previous quarter, and the fourth consecutive quarter of decline. However, TSMC believes that despite the short-term challenges, the long-term gross margin target of 53% is still achievable.

- HPC Revenue will be an important driver of revenue growth in the coming years.

Wei Zhejia also mentioned TSMC's development in 2nm, 2nm to maintain the second half of 2025 to 2026 mass production planning, applications are also cell phones and high-performance computing (HPC), and continue to lead the market. 3nm is in the production capacity to climb the stage, this year's revenue contribution to maintain the mid-single digits; Wei Zhejia stressed that TSMC's revenue continues to get bigger, the 3nm share is not yet high, but the absolute amount of contribution more It is worth noting that the absolute dollar contribution is even more noteworthy. Mr. Wei added that in the long run, the trend brought by 5G and HPC will support the company's growth momentum, and TSMC's leading process capability will obviously benefit.

- Capacity Planning

CAPEX has increased a lot in the past few years, and in the next few years, the increase in CAPEX will be lower than in the past, which will make it less capital-intensive in the future. Advanced process 70~80%, special process 10~20%, and the rest are EBO and advanced packaging. The progress of production expansion in each plant is as follows:

- The expansion of the Nanjing plant in China is in line with local customer demand and will comply with regulations.

- The Kaohsiung plant will continue to be built, but will be converted from 28nm to a more advanced process and is expected to continue to invest in Taiwan.

- The Japanese factory 16/22/28 will be launched at the end of 2024.

- The German plant in Europe will provide a special process for the car, which will be subsidized by the local government.

- The Arizona plant in the US is currently experiencing a shortage of technical staff and will be planning to bring in technical staff from Taiwan to telecommunicate with local staff, with N4 expected to be launched in 2025. The delay in the Arizona plant has impacted some of the capital expenditures, but only a small portion, and some of the capital expenditures are expected to be incurred in the future.

- CoWoS capacity will expand to twice its current level by 2024, with supply and demand remaining tight until the end of 2024.

- AIBringing in the demand for wafers

AI trend is more favorable to the company's development, the company continues to enhance the demand for advanced manufacturing processes, the current AI-related revenue is estimated to account for 6% of the company's consolidated revenue, the next five years, the annual compounded growth rate of at least 50%, the revenue share will climb to low double-digit levels. As for the AI servers that the market is looking forward to, Wei Zhejia said that in the short term, although the CSP (cloud service provider) customers due to AI demand crowding out general server spending. However, in the long run, AI will gradually turn into real contributions, and the capital expenditure of CSP customers will return to normal levels. Compared to the previous mining boom, the end-use applications of AI servers are very solid, and TSMC believes that AI will not be like the ups and downs of mining demand, but will be a stable demand that will continue to drive overall market growth.

Table 1: TSMC's Gross Margin and Profit Margin Performance

Source:Open Information Observatory; Organized by Wisdom Industrial Trend Research Institute 2023/07

Ji-Pu Viewpoint:TSMC is in the2023After-tax net income for the second quarter of 2012 was1,817.2Although in line with market demand, the annual revenue growth rate was revised downward for the second time, from a decline of 4.6% to a decline of 4.4%.1%~6%Revised down to recession10%. In addition toAIThe other is not good! In the wafer industry, we are still hovering around the issue of the overall economy and de-stocking. TSMC's inventory is maintained at the close of the first quarter as stated in the law, and inventory will be balanced again in the third quarter, but the timing of the rebound is still dependent on the performance of the overall economy. TSMC has a leading position in the foundry field, so when the general economy begins to change, TSMC should see it first, and therefore still holds a positive view on TSMC's long-term operating performance.