Corporate News|2022 TSMC Fourth Quarter Press Conference

TSMC, the leading foundry, held a corporate presentation on January 12, 2023, announcing its fourth-quarter outlook and first-quarter 2023 business outlook. As the semiconductor supply chain continues to de-stock, the timing of a recovery in operations has become a focus of attention for the corporation.

Fourth Quarter Last Year and Percentage by Category

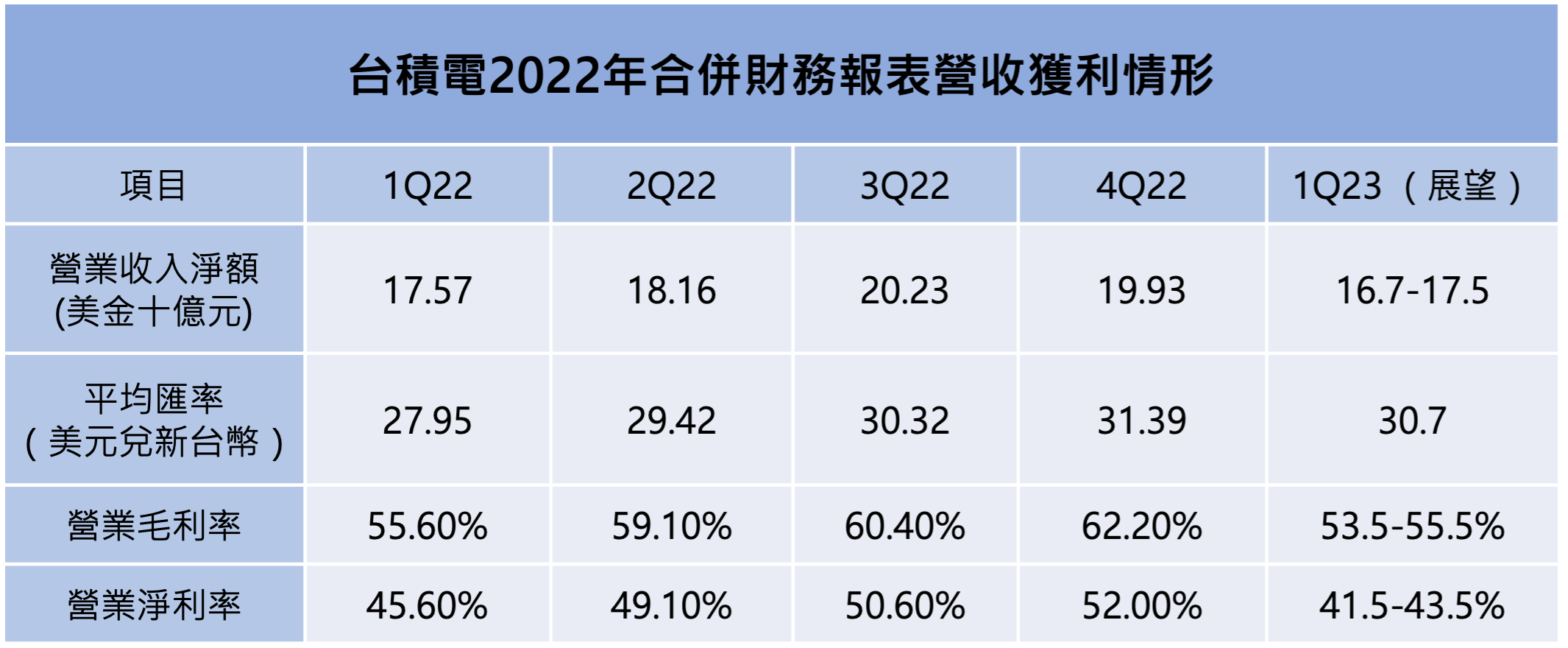

TSMC reported consolidated revenue of NT$625.53 billion for the fourth quarter of 2022, a quarterly increase of 42.8%; net income of NT$295.9 billion after tax, and earnings per share of NT$11.41, both representing a quarterly increase of 78.0%, and an annualized increase of 2.0%. Gross margins were 62.2%, operating profit margins were 52.0%, and the after-tax net income margins were 47.3%. In terms of Q4 revenue by category, TSMC noted that 5nm shipments accounted for 32% of Q4 2022 wafer sales, while 7nm shipments accounted for 22% of Q4 2022 wafer sales. Overall, revenue from advanced processes (including 7nm and beyond) accounted for 54% of Q4 2022 wafer sales, which is comparable to that of Q3 2022. equivalent to the third quarter of 2022.

Outlook for the first quarter of this year decreased by about 14.2% Overall revenue for this year is expected to grow slightly.

TSMC's CFO Huang Jen-Chao said that due to the impact of weak end-market demand and customer de-stocking, revenue for the first quarter of this year is expected to be about $16.7 billion to $17.5 billion, which is a decrease of about $14.2% based on the median value of $17.1 billion. Based on the median value of $17.1 billion, the quarterly decrease will be about 14.2%. Huang said that due to the lower capacity utilization rate, and 3nm mass production has not yet reached the impact of the economic scale, the first quarter gross margin will be about 53.5% to 55.5%, operating profit margin will be about 41.5% to 43.5%. TSMC's President, Mr. Chieh-Chia Wei, said that the semiconductor industry this year, excluding memory, is expected to be the largest in the world. TSMC's President, Mr. Chieh-Chia Wei, said that this year's revenue from the semiconductor industry, excluding memory, is expected to decrease by 4%, and that the revenue from the foundry industry is expected to decrease by 3%, but that TSMC's revenue this year is expected to grow marginally.

2023Capital expenditure for the year was slightly lower than last year

VP of Finance and Spokesperson, Mr. Huang Renzhao, said that capital expenditures for 2023 are estimated to be between $32 billion and $36 billion, a slight decrease from last year's $36.26 billion. Mr. Huang said that this year's capital expenditures include 70% for advanced manufacturing processes, 20% for special manufacturing processes, and 10% for advanced packaging and photomask production; in addition, the company will continue to invest in research and development (R&D), and it is estimated that this year's R&D expenditures will increase by 20%.

Overseas Capacity Expansion Update

TSMC is considering building a second plant in Japan and is also evaluating the possibility of building a plant in Europe," Mr. Wei said today. The Arizona plant will produce 4nm in 2024 and 3nm in 2026, and TSMC announced plans to expand the plant and begin construction of the second phase of the project at last year's move-in ceremony for the Arizona plant.

Chart 1: TSMC's Consolidated Financial Statements Revenue and Profit in 2022

Source: TSMC

Ji-Pu Viewpoint

TSMC's fourth-quarter consolidated revenue was slightly lower than expected, but gross margins and operating profit margins exceeded the standard. Fourth-quarter consolidated revenue and after-tax net income simultaneously hit record highs, and last year's full-year net income attributable to the parent company for the first time exceeded the 1 trillion dollar mark, with a net income of $39.2 per share, reflecting the market conditions last year (in the past), but the short-term downtrend in the electronics industry downturn low pressure, continues to spread. TSMC's advanced manufacturing process strength has always been the lifeblood of the leading rivals and the source of profitability fundamental, TSMC 3 nm using the fin type field-effect transistors (FinFET) and Samsung is the use of the surrounded gate field-effect transistors (GAAFET), it is expected that TSMC's next-generation 2 nm will be the use of the surrounded gate field-effect transistors (GAAFET). Samsung claims that their GAAFETs will have been around for two generations by the time they reach 2nm, so they have a longer learning curve and will be able to outperform TSMC. We believe that the yield of GAAFETs is very difficult to achieve, and it is doubtful whether they will be able to overtake TSMC, but if the yield is still not up to par, then we expect to see Samsung return to FinFETs for 3nm, which should be a good chance.

Related information:

TSMC's Legal Conference: Key Questions and Answers at a Glance