Corporate News|TSMC Q4 2024 Press Conference

TSMC held a press conference yesterday (16th), and the fourth quarter 2024 revenue figures were released. Chairman Chieh-Chia Wei revealed that this year's revenue milestone of US$100 billion will be reached, and that with strong demand for AI and working with quality semiconductor companies around the globe, it is expected to challenge the revenue performance of US$200 billion.

Highlights of TSMC's Q4 Financial Results

- Consolidated revenue of approximately NT$600 million, QoQ +14.3%, YoY +38.8%

- Gross margin 59%, QoQ +1.2, YoY +6.0

- Business Interest Rate 49%, QoQ +1.5, YoY +7.4

- After-tax net income of approximately NT$800 million, QoQ +15.2%, YoY +57%

- EPS (Earnings Per Share) : NT$45, QoQ +15.2%, YoY +57%

Compared to the same period last year, Q4 2024 revenue increased by 38.8%, net income after tax and earnings per share increased by 57%, while Q4 2024 revenue increased by 14.3%, and net income after tax increased by 15.2%. For the full year of 2024, annual revenue amounted to 2,894.3 billion 8 million Taiwan dollars, an increase of 33.9% compared to last year. TSMC had previously estimated that the annual dollar revenue would grow close to 30%, and now the annual revenue in Taiwan dollar is close to 34%, which can be said to be quite an impressive report card.

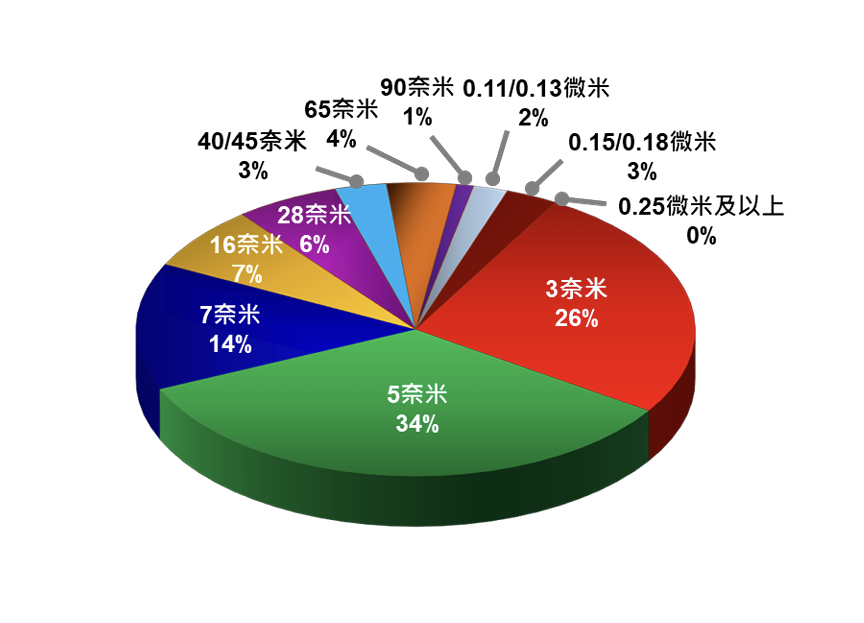

2024Q4 Process Revenue Share

It is worth noting that 3nm process accounted for 26%, 5nm accounted for 34%, 7nm accounted for 14%, and advanced process accounted for 74% of the quarter's wafer sales, including 7nm and beyond.

Source : TSMC

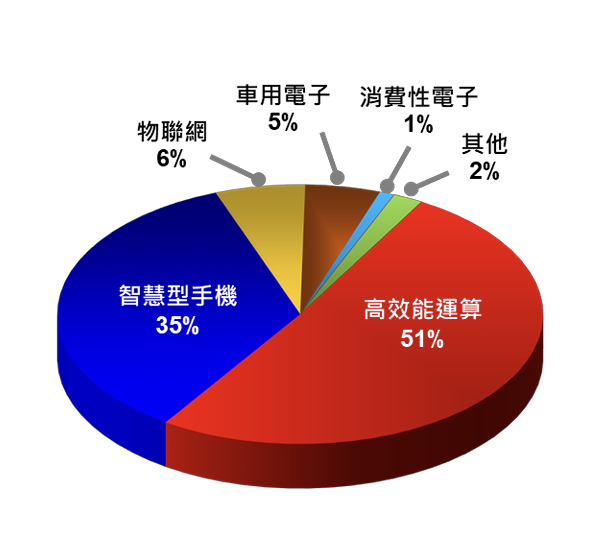

2024Platform Revenue Contribution, Business Prospects

HPC accounted for 51% of 2024 revenue, smartphones accounted for 35%, IoT 6%, automotive 5%, consumer electronics 1%, and other parts 2%. In the future business outlook, although the first quarter is a slow season for cell phones, but benefited from the strong demand for AI chips to offset some of the impact, it is expected that the first quarter of 2025 revenue will fall between $25 billion and $25.8 billion. In the first quarter of 2025, revenue is expected to fall in the range of $25.0 billion to $25.8 billion, a quarterly decrease of about 4-7%. TSMC said that although the first quarter of 2025 revenue shows a quarterly decrease, driven by AI, it is still a strong year and is expected to grow healthily, and it is estimated that full-year dollar revenue will grow by more than 20%, which will continue to be an all-time record high. In terms of gross margin, it will be affected by six factors, including: advanced process development and capacity enhancement, pricing, cost optimization, capacity utilization, technology mix, and foreign exchange rates. TSMC estimates that, based on a USD/NTD 32.8 conversion rate, the gross margin for the first quarter of 2025 will range from 57 to 59%, with the profit margin ranging from 46.5 to 48.5%.

Source : TSMC

AIBusiness Opportunities Continue to Burn

In the press conference, TSMC highlighted the AI market opportunity. TSMC forecasts that AI demand and high-end semiconductor technology will be the key growth drivers for the company, and it will continue to optimize its technology, increase its production capacity, and strengthen its cooperation with global customers. As demand for AI rises, related investment will account for 15% of global investment in 2024 and is forecast to continue to grow through 2025. TSMC is currently focusing on the development of AI training chips and high-bandwidth memory (HBM), and plans to further strengthen its technology support for 5G, AI, and high-performance computing (HPC). Inventory of fabless semiconductors is expected to recover to healthier levels by the end of 2024, and wafer fabrication 2.0 is forecasted to grow up to 10% by 2025.

2025Further increases in capital expenditure

TSMC invested US$29.8 billion last year to support customer growth and expects to further increase capital expenditures to between US$38-42 billion by 2025. About 70% will be spent on advanced process technologies, about 10-20% on special process technologies, and another 10-20% on advanced packaging, testing, and photomasks.

CoWoSCut off? It's a rumor.

During the conference, a legal person also asked about the recent rumors of TSMC CoWoS being cut orders, and Wei Zhejia responded humorously, "Rumors are just that: rumors". He further stated that the order cuts have not occurred and that customer demand continues to increase.

Ji-Pu's point of view.

The Biden administration's frequent use of export controls before leaving office has caused the market to worry about whether the ban will impact TSMC. Although TSMC has not yet completed all the analysis, the preliminary impact does not appear to be significant," Wei said. After communicating with the U.S. government, he learned that the U.S. is most concerned about AI-related parts, and that TSMC does not have many AI customers in China, and that automotive and consumer products are more likely to be licensed, so the impact of the ban on TSMC's operations is relatively limited. TSMC also said in the press conference that all semiconductor companies, except for China, are TSMC's customers.

The U.S. is likely to require TSMC to mass-produce 2nm advanced process in the U.S. in the future, and even set up R&D centers in the U.S. Why not go to the U.S. right away for the most advanced process? Does it have anything to do with the N-2 policy? Wei Zhejia responded, not relevant, because the entire process of the most advanced manufacturing process is very complex, the distance between the laboratory and the R & D staff must be very close to work, so it must be mass production in Taiwan.

As for TSMC's global layout, it has completed the production schedule of its first fab in Arizona, U.S.A. ahead of schedule, and has already entered mass production using 4nm in the fourth quarter of 2024, while the second and third fabs are proceeding according to plan, and will use more advanced technologies such as 3nm, 2nm, and A16 process technologies.