Corporate News|Taiwan TSMC Q3 2024 Press Conference

TSMC Q3 2024 Presentation and Commentary

TSMC held its Q3 2024 press conference yesterday (17th) and announced its Q4 outlook, forecasting revenue to increase 11%-14.5% QoQ and full-year capital expenditures to be slightly above US$30 billion, roughly the same as previously forecast (US$30 billion to US$32 billion).

Highlights of TSMC's Q3 Financial Results

- Single-quarter revenue of about NT$900 million, QoQ +12.8%, YoY +39.0%

- Gross margin 8%, QoQ +4.6, YoY +3.5

- Business Interest Rate 5%, QoQ +5.0, YoY +5.8

- After-tax net income of approximately NT$600 million, QoQ +31.2%, YoY +54.2%

- EPS (Earnings Per Share) : NT$54, QoQ +31.2%, YoY +54.2%

TSMC ended the third quarter with $23.5 billion in revenue, exceeding their expectations, and the third-quarter results were fueled by strong demand for smartphones and AI, particularly TSMC's industry-leading 3nm and 5nm technologies, said TSMC Chairman Chieh-Chia Wei.

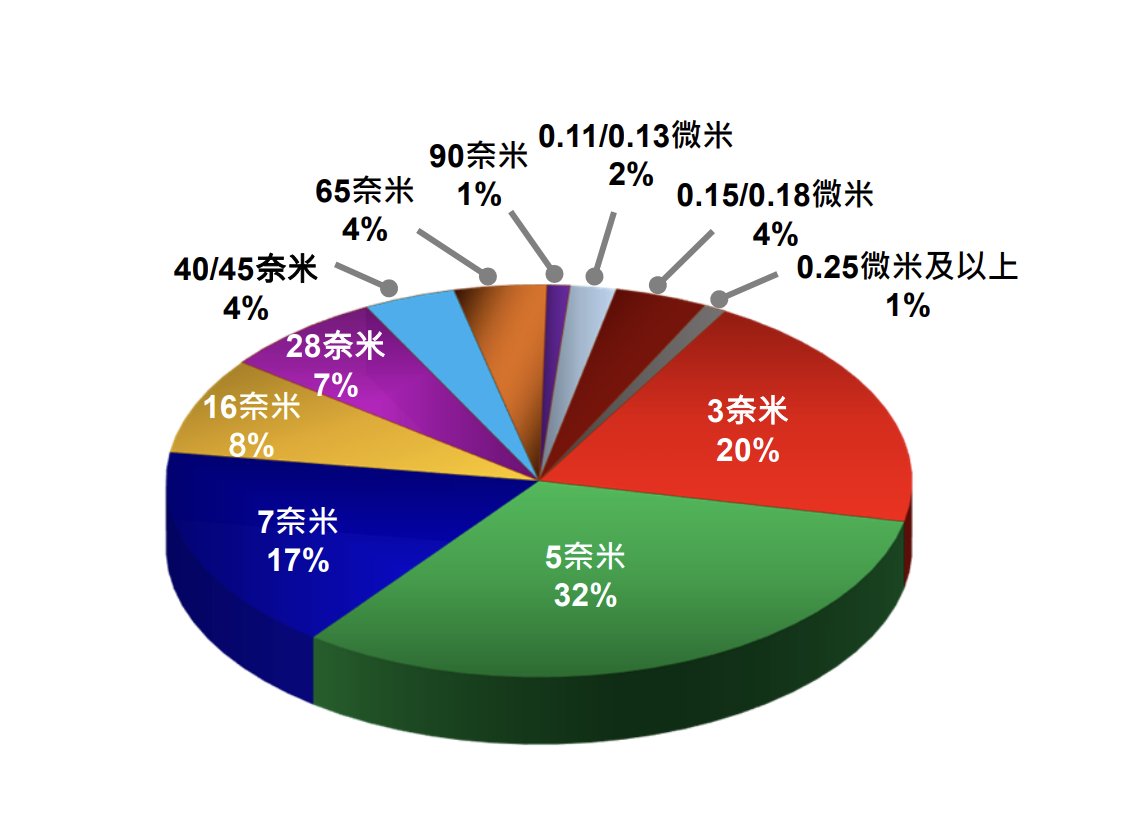

2024Q3 Process Revenue Share

Shipments of 3nm process accounted for 20%, 5nm accounted for 32%, 7nm accounted for 17%, and advanced process (7nm and above) accounted for 69% of the overall sales.

TSMC 2024 Q3 Revenue Share

Source : TSMC

Fourth Quarter Outlook and Plant Construction

TSMC expects Q4 US dollar revenue to be in the range of $26.1 billion to $26.9 billion, or NT$835.2 billion to NT$860.8 billion; gross margin to be in the range of 57 to 59%, and operating profit margin to be in the range of 46.5 to 48.5%. TSMC expects to build three plants in the US, with the first 4nm plant well under way, and expected to be in volume production in 2025, and the second and third plants expected to be in volume production in 2028 and 2030, respectively, also focusing on advanced processes. The first 4nm plant is progressing well and is expected to be in mass production in 2025, while the second and third plants are expected to be in mass production in 2028 and 2030, respectively, and are also focused on advanced manufacturing processes. Japan is doing well in terms of fab construction and government subsidies. The Kumamoto fab is expected to start mass production in 2024Q4; the second fab focuses on mature processes and will start mass production by the end of 2027 for automotive, consumer, industrial, and HPC applications; and the 12/16nm fab in Germany focuses on automotive and industrial applications and is expected to start mass production by the end of 2027.

CoWosHigh energy demand

In a press conference, TSMC also indicated that it is experiencing capacity constraints for its advanced packaging technology, CoWoS. TSMC's CoWoS advanced packaging is capable of connecting graphics processors, CPUs, and high bandwidth memory (HBM) chips together. Customer demand continues to outstrip the company's production capacity, which is estimated to double in 2024 and 2025 compared to the previous year.

Ji-Pu's point of view.

All the foreign investors' ratings have risen, and the next day the Taiwan stock market opened at a new high, which shows that the market has given a very high rating to this law.

- TSMC's performance exceeded expectations due to the growing demand for AI and the traditional peak season for mobile phones. Regarding the question of whether AI demand will become a bubble, TSMC said that the AI trend has just begun, and repeatedly emphasized in the press conference that revenue will show "healthy growth" in the next few years. However, given the continuous expansion of production capacity and the limited growth of cell phones in the next few years, it is worthwhile to continue to observe whether AI gas pedal chips (the overall shipments of which are less than those of cell phone APs) will be able to fill up the capacity of advanced manufacturing processes.

- In the press conference, TSMC explained that although the gross profit margin of the company in 2025 may be affected by the dilution of the gross profit margin of overseas plants, the conversion cost of manufacturing process technology, electricity, etc., the gross profit margin of 1% may be affected, but because the utilization rate of the production capacity is still maintained at a high level, it will offset part of the negative impact; regarding the dilution of the gross profit margin of 2-3% in the overseas plants, TSMC said that the profitability of the overseas plants will be lower than that in Taiwan, but it will gradually improve because Japan and the United States will not have only one plant operating in the future. However, it will gradually improve, because Japan and the United States in the future will not be only a single plant in operation.

- When asked if it would consider acquiring Intel's plants, TSMC gave a clear negative answer. Although the gap between Intel and TSMC is a bit wide at the moment, the fact that TSMC answered so firmly in the face of capacity constraints demonstrates that, in addition to its confidence in its own plant construction schedule and yield improvement, it is still a threat to Intel that should not be underestimated. This can be observed by looking at the CAPEX in 2025.

- Other outsourcing situations depend on market conditions, such as CoWoS packaging. We believe that this means that there is still a big gap between the supply and demand of CoWoS packaging capacity, but the amount of outsourcing has become larger, and whether it will depend on the demand in the following year is still to be observed.

- Chiplet is a strategy adopted by HPC customers, but it won't affect the adoption of 2nm, which is currently seeing unprecedented demand compared to 3nm. We believe that 2nm is a process generation (FinFET->Nanosheet) to change the structure, but it seems that the yield is very high progress ahead of schedule, it is expected to be on schedule (end of 2025) mass production.

- TSMC said last quarter that it would redefine the new "Foundry 2.0" and include packaging, testing, photomasks, etc. (excluding memory) in the Foundry. TSMC said last quarter that it would redefine the new "Foundry 2.0" and include packaging, testing, masks, etc. (excluding memory) as part of the foundry for advanced manufacturing processes. Regarding the trend of advanced packaging revenue in the next five years, TSMC said that it currently accounts for 7-9% of the overall revenue, and the gross margin is slightly lower than the company's average, while the growth in the next five years will exceed the company's average. Regarding the growth of the "Foundry 2.0" business, the growth rate of advanced packaging and advanced manufacturing processes will be significantly higher than that of mature packaging and manufacturing processes.

TSMC delivered a good report card at the conference and emphasized that the company's revenue will show healthy growth in 2025 and even in the next five years. TSMC estimates full-year dollar revenue growth of nearly 30% per year, an upward revision from its previous estimate of between 24% and 26%. Driven by technology leadership and AI applications, TSMC will continue to play a critical and integral role in the semiconductor industry, continuing to help customers succeed while being a valued partner.