Corporate News|FSMC Q4 2023 Press Conference

TSMC held a physical press conference yesterday (18th) after a four-year hiatus, and Liu Deyin hosted the event for the last time as a board member. He repeatedly emphasized that AI will bring strong momentum to TSMC, and that 3nm will lead to triple growth. TSMC's Chairman, Mr. T.Y. Liu, also emphasized that what we see in the market today is just the tip of the iceberg.

Highlights of TSMC's Q4 Financial Results

- Consolidated revenue of approximately NT$300 million, QoQ +13.6%, YoY -0%

- Gross margin 0%, QoQ -1.3, YoY -9.2

- Operating interest rate 6%, QoQ -0.1, YoY -10.4

- After-tax net income of approximately NT$238.31 billion, QoQ +13%, YoY -19%

- EPS (Earnings Per Share) : NT$2, QoQ +13%, YoY -19%

Compared to the same period last year, Q4 2023 was roughly flat, with net income after tax and EPS falling short by $19%. Compared to the previous quarter, Q4 revenue increased by $14.4% and net income after tax increased by $14.4%. Earnings beat market expectations by $1.5%, primarily due to strong 3nm revenue growth.

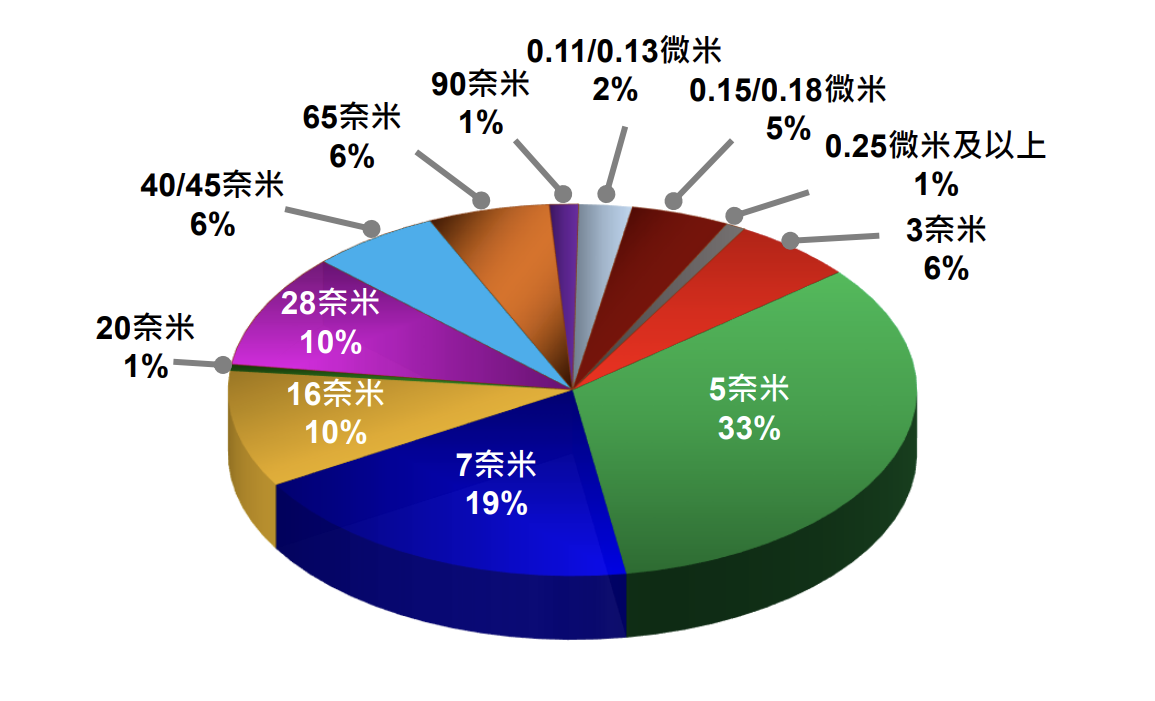

2023Annual Process Revenue

It is worth noting that 3nm process accounts for 6%, 5nm for 33%, 7nm for 19%, and 58% of the total process.

TSMC's Annual Process Revenue Percentage

Source : TSMC

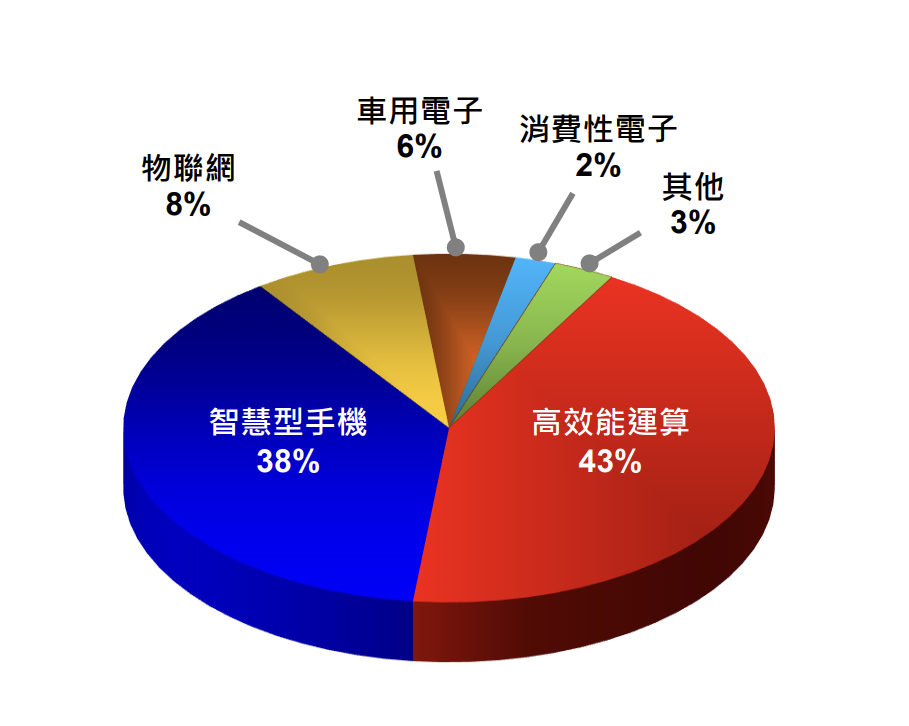

2023Platform Revenue Contribution, Business Prospects

HPC accounted for 43% of revenue in 2023, smartphones accounted for 38%, IoT accounted for 8%, automotive business was 6%, consumer electronics accounted for 2%, and other parts accounted for 3%. In terms of the business outlook for the future, it is estimated that the revenue for the first quarter of 2024 will be between $18 billion and $18.8 billion, with a decrease of 6.2% quarterly. President Chieh-Chia Wei said, 2024 can be expected to healthy growth, this year, excluding memory semiconductor industry revenue is expected to grow 10%, the annual revenue growth will be better than the wafer foundry industry 20% level, about 21% to 26%.

TSMC Q3 Technology Platform Sales Share

Source : TSMC

AIBusiness Opportunities

TSMC highlighted AI market opportunities during the conference. After the conference, CFO Huang Renzhao pointed out that the definition of AI opportunities currently being discussed focuses on "AI servers" and excludes terminal devices such as cell phones and computers, and that "it's still difficult to estimate at this point in time."

Weijia pointed out that the compound annual growth rate (CAGR) growth of AI-related chip demand in the next five years will reach 50%, "AI will bring structural demand in 2023, and TSMC's process is the key to AI applications. TSMC's manufacturing processes are key to AI applications. As AI utilizes more complex models, it requires semiconductor support with greater computing power. From this perspective, Mr. Wei also believes that TSMC's value is increasing. Liu Deyin also revealed that since the rise of AI, the demand from servers and end customers are increasing, and it is estimated that the number of AI processors will grow rapidly in 2027, and the content of semiconductors such as NPUs (neural network chips) will continue to increase. When all of these factors are added together, AI will be a large part of TSMC's growth. Under these circumstances, AI models will need to be supported by more powerful chips, and advanced process capacity will double this year and continue to grow until 2025.

3Nano Revenue Increases, 2nm to be Mass Produced in 2026

In the advanced process segment, 3nm will see strong growth and start mass production in the second half of 2023, while N3E is already in mass production in the fourth quarter of 2023, and N3P/N3X will start contributing revenue in 2024. 3nm revenue is expected to grow by more than three times in 2024, benefiting from demand from smartphone and HPC related customers.

In addition, TSMC expects to launch 2nm in 2025 and start mass production in 2026. More and more customers are emphasizing on the power efficiency (performance/power consumption) of the chip, especially HPC and smartphone customers are highly interested, and more HPC/smartphone customers are participating in the development of the chip compared to the same period of N3.

TSMC's Japanese plant to open in February, European plant to start construction in Q4

Liu pointed out that the Kumamoto plant in Japan will open on February 24 this year, mainly producing 12/16 and 22/28 process, and is expected to start mass production in the fourth quarter of this year, while the Kumamoto II plant is still in the evaluation stage, and said that the plant is likely to lead to 7 or 16 nm process; the European part of the plan to work with TSMC's joint venture partners to establish a special process wafer fab in Dresden, Germany, with a focus on automotive and industrial applications, and is expected to start construction in the fourth quarter of this year. In Europe, TSMC plans to build a special process wafer fab in Dresden, Germany with a joint venture partner focusing on automotive and industrial applications. Construction is expected to begin in the fourth quarter of this year, and TSMC continues to maintain close communication with the federal, state and municipal governments in Germany. The Arizona Plant 2 is already under construction, but the process nodes are still under discussion, depending on the U.S. government's planning, and the final result will depend on the market conditions and the conditions offered by the U.S. government, with an estimated completion date of 2027 or 2028.

Ji-Pu's point of view.

- HPC's revenue contribution has exceeded that of cell phones for two consecutive years, and although Apple is still TSMC's largest customer (with a revenue contribution of 24%), the percentage can slowly be seen as a paradigm shift.

- Three nano (the most advanced production point), whether it is N3E or N3P/N3X, etc., in this year are in the stage of volume capacity to climb, because it makes Wei Zhejia President of this year's gross profit to maintain above 54% with confidence.

- TSMC's recovery in the entire semiconductor market is due to AI chips. The president of TSMC said that the CAGR of the AI-driven HPC market in the next two years will be more than 50%, which directly represents that the AI server industry has entered a high-growth stage! Morgan Stanley (Morgan), a US-based foreign investor, also gave the contribution of AI to TSMC's revenue in the next few years as 8% in 2024, 9% in 2025, and 14% in 2027.

- This year's capex estimate has been revised down to $28-32 billion compared to $32-36 billion in early 2023 for the current year. However, it is a bit higher than the $26-30 billion expected by many markets. The construction of plants in AZ, Kumamoto, and Germany have all reached a certain stage and are continuing to progress. Therefore, on behalf of the company, there are no other investment projects for the time being, but the company adopts a prudent, conservative, and optimistic attitude towards the market recovery expectations.

- TSMC's performance in 2023 and bullish growth in 24 is indicative. We expect that this year's quarterly performance is likely to be better than the previous quarter, but whether it represents a full recovery of the global semiconductor industry will depend on the performance of the total end-products (consumer market).

In December 2023, Mr. Liu announced that he would retire in June 2024, and he gave a graduation speech at the press conference, which came as no surprise. The stable and kindly President, Mr. Chieh-Chia Wei, who was born in technology, will take over the reins of the company and I believe that TSMC will continue to lead the world with its technology.

Dr. Deyin Liu, Chairman of Ji-Pu Industrial Trend Research Institute, would like to pay tribute to TSMC and Taiwan Semiconductor for their outstanding contributions over the past 30 years, and wishes to create a more beautiful chapter of life in the years to come.