Corporate News|Taiwan TSMC Q3 2023 Press Conference

TSMC held an online press conference this afternoon to announce its third quarter 2023 financial results. Capital expenditures for the year remain unchanged at US$32 billion, which is the same as TSMC's expectation at the press conference in late July and has not been revised downward. Mr. Huang pointed out that this year's capital expenditures will be approximately $70% for advanced processes, $20% for mature and special processes, and $10% for advanced package testing, plate making, and other projects.

Highlights of TSMC's Q3 Financial Results

- Consolidated revenue of approximately NT$300 million, QoQ +13.7%, YoY -10.8%

- Gross margin 3%, QoQ +0.2, YoY -6.1

- Business Interest Rate 7%, QoQ -0.3, YoY -8.9

- After-tax net income of approximately NT$211 billion, QoQ +16.1%, YoY -29%

- EPS (Earnings Per Share) : NT$14, QoQ +16.1%, YoY -24.9%

Compared to the same period last year, Q3 2023 revenue decreased by $10.8% and net income after tax and earnings per share decreased by $24.9%, while compared to the previous quarter, revenue increased by $13.7% and net income after tax increased by $16.1%. During the meeting, TSMC emphasized that the development of the 2-nanometer advanced manufacturing process is progressing well, and that the process will be extremely suitable for HPC (High Performance Computing) attack and smartphone related applications, and is expected to start mass production from the second half of 2025. TSMC emphasized at the meeting that the 2nm advanced process is progressing well and will be extremely suitable for HPC (High Performance Computing) and smartphone related applications.

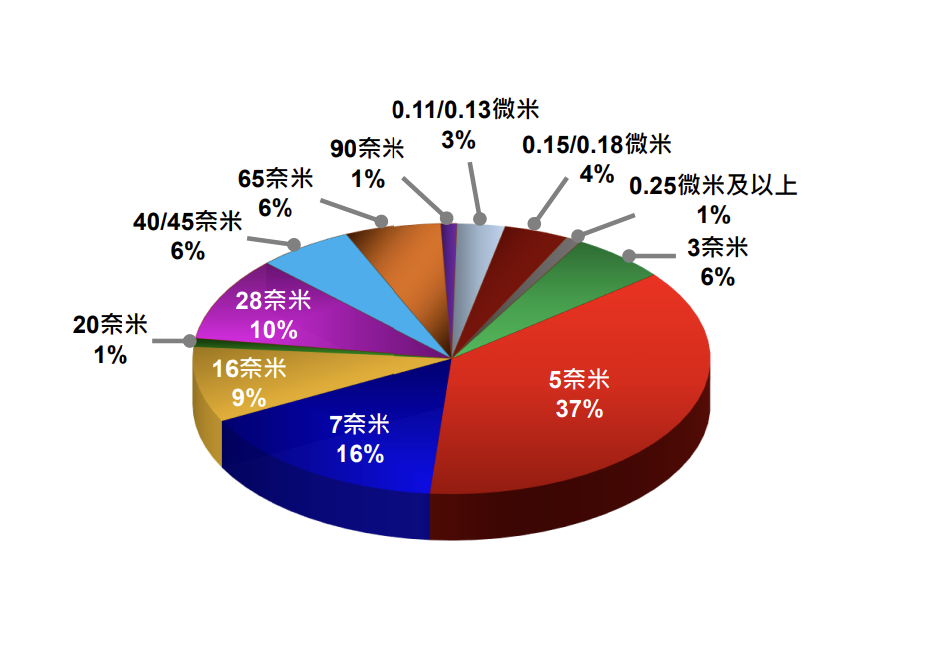

Advanced Process Shipments in Q3

It is worth noting that in the third quarter, shipments of 3nm process accounted for 6%, 5nm accounted for 37%, and 7nm accounted for 16% of wafer sales, and the revenue from advanced process has reached nearly 60% of the quarterly wafer sales.

TSMC Q3 Sales Analysis

Source : TSMC

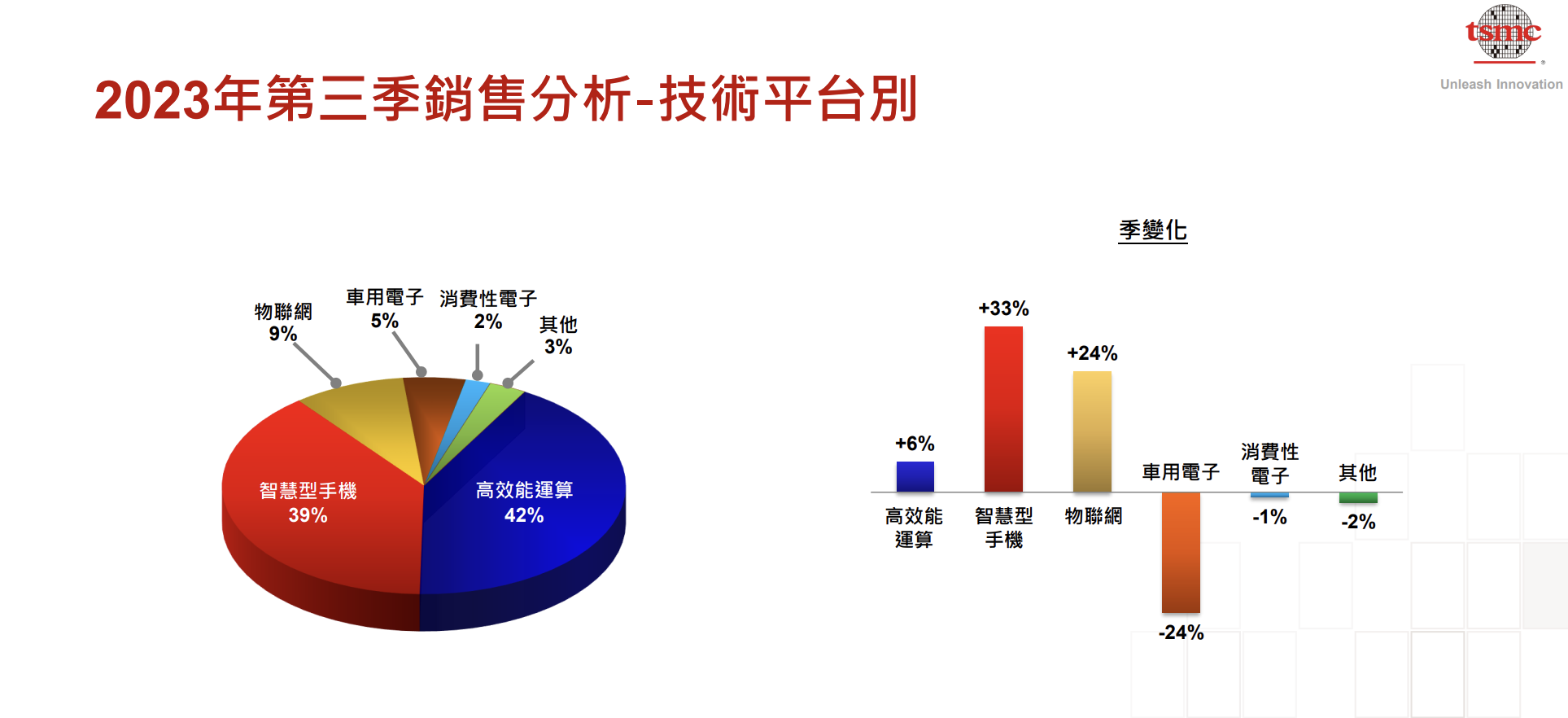

Q3 Platform Revenue Contribution, Business Outlook

HPC grew 6% QoQ and accounted for 42% of Q3 revenue. smartphones grew 33% QoQ and accounted for 39% of Q3 revenue. internet of things (IoT) grew 24% QoQ and accounted for 9% of Q3 revenue. automotive declined 24% QoQ and accounted for 5% of Q3 revenue, and consumer electronics declined 1% QoQ to 2% of Q3 revenue. and the business On the outlook front, Q4 revenue is expected to be in the range of $18.8B to $19.6B, an increase of about 11.1% QoQ. Gross margin is expected to be in the range of 51.5% to 53.5%, while operating margin is expected to be in the range of 39.5% to 41.5%.

TSMC Q3 Technology Platform Sales Share

Source : TSMC

New version of wafer ban has limited impact

Referring to the overseas production program, President Chieh-Chia Wei said that the production program at the China plant will be back on track by 2024, and that the company has recently received an extended waiver from the U.S. on the wafer bill ban. It is currently applying for equipment installation and is expected to continue operations beyond 2019. The Arizona expansion plant has also received strong support from the state and federal governments, with five infrastructure utilities and equipment installation issues already underway. TSMC's strategy is to expand global manufacturing and increase customer trust, which in turn seeks talent from around the world.

TSMC was also asked at the press conference whether the recent escalation of U.S. wafer export restrictions on China would have an impact on the company. TSMC responded that the new version of the wafer ban would have limited impact on TSMC.

Ji-Pu's point of view.

TSMC's third-quarter revenue was supported by demand from major brands in the industry, partially offset by ongoing inventory adjustments by customers," said Mr. Wei. Customers remain cautious in inventory control due to the continued weak economic conditions in the overall market and the slow recovery of demand in China. As a result, it is expected that the inventory absorption will continue in the fourth quarter, and it is estimated that IC design inventories will decrease and return to healthy levels by the end of the fourth quarter. N3E has been validated and achieved performance and yield targets, and is scheduled for mass production in Q4. 3nm is likely to become another large-scale process technology with long-term demand, and N2 and its derivatives will further extend TSMC's technology leadership. Revenue for the first three quarters declined ~16%, and the full-year revenue is expected to decline less than 10%, suggesting that Q4 is in good shape. Regarding when the bottom will fall out of the boom, President Chieh-Chia Wei said that it is "very close to the bottom", but there are still some uncertainties as to whether there will be a strong recovery in the boom in 2024.