Corporate News|Tesla Q2 2023 Conference Highlights

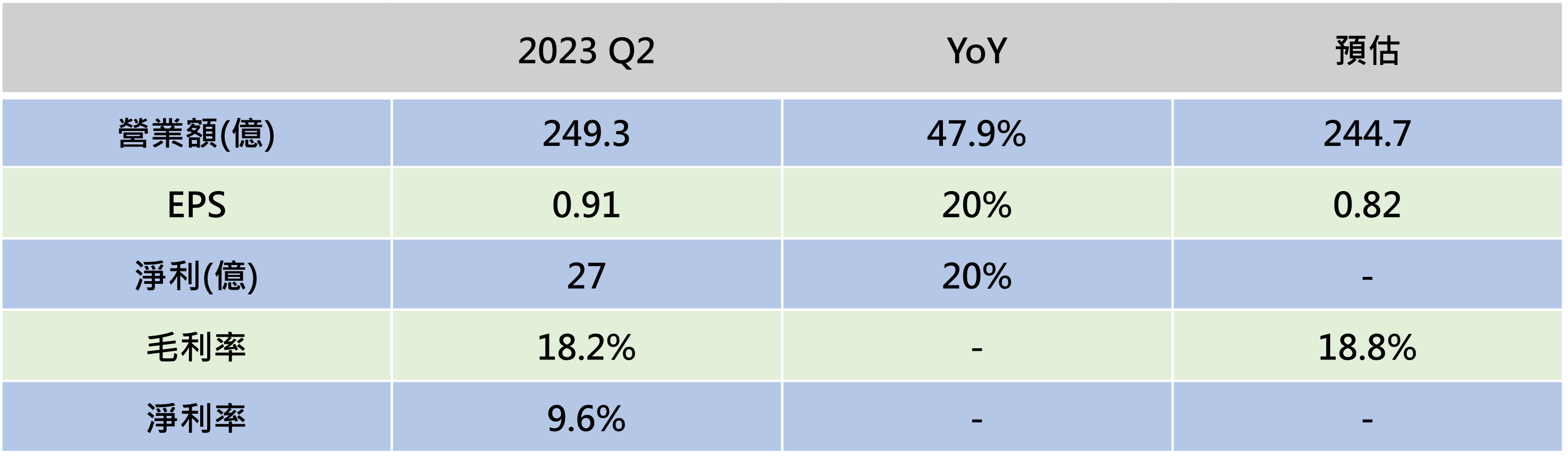

Tesla (TSLA) announced its Q2 operations on July 17, 2024 in a press conference. Q2 revenue of $24.93bn beat analysts' estimates of $24.47bn, a year-on-year increase of 47.9%, of which $21.29bn, or 85%, was from EV sales, a year-on-year increase of 48%. However, due to the impact of the price cuts to capture the market in 2023, the gross profit margin of 18.1% was lower than last year's 25%, and the margin of 9.6% was at a five-year low. Gross profit margin of 18.1% was lower than 25% in the same period last year, and profit margin of 9.6% was at a five-year low. Q2 EPS of 0.91 beat analysts' estimate of 0.82. Although both revenue and EPS achieved double-bit, Tesla's share price fell immediately after the meeting as Elon Musk said in response to a question that Tesla will maintain its existing price-cutting strategy, and will cut prices if necessary, which conflicted with the market's expectation that Tesla will stop price cuts or even raise prices.

With 470,000 new vehicles delivered in Q2, the Model Y is the world's most popular car.

In terms of sales figures, Tesla successfully delivered 476,000 EVs from April to June, up 87% from the same period last year, but its profit of $2.7 billion only grew 20%. Tesla explained that this was mainly due to its product portfolio, a series of price cuts starting from the end of 2022, pickup truck production, and the cost of its 4680 batteries. In terms of product mix, the affordable Moldel 3 and Modle Y sold 446,000 units in the second quarter, with the Model Y officially becoming the world's best-selling car in the second quarter, and even in the face of the bad economy, demand remains strong and is expected to continue to grow in the third quarter.

Tesla Electric Vehicles on Track for 50% Capacity Growth This Year, at Least 1.86 Million Units Delivered by 2023

Elon Musk mentioned in the meeting that he will continue to invest in the near future based on the need to boost production capacity, and expects to remodel the plant this summer, so Q3 margins will likely be adjusted further downward. 2023 capacity growth target of 31% is confirmed to be met, with at least 1.86 million EV deliveries, and hinted at the chance of reaching the milestone of 2 million EVs per year, which, if realized, would result in year-over-year capacity growth of 50%. If this is achieved, production capacity will grow by 50% year-on-year.

In terms of production capacity, the Shanghai plant has officially got rid of the hidden worry of low utilization rate at the end of 2022 in the second quarter, and has maintained full production (full production capacity is estimated to be nearly 1 million units); the Berlin plant in Germany has a production capacity of 370,000 units, which is higher than the previous estimate of 350,000, and mainly produces the Model Y, which is the most popular model nowadays.

Cyber Chuck Deliveries will be made by the end of this year, but not in large quantities, and mass production will begin in 2024.

In the first two days issued Cyber Chuck will be mass production news, this financial report shows that the current production of pickup trucks are still test vehicles, at this stage of the factory production line is still fine-tuning, for this Elon Musk also said that due to the Cyber Chuck will use tens of thousands of new components, is still in the process of adjusting and testing, it is expected that at the end of this year will be a small batch of delivery of the car, the official mass production The official mass production is still in 2024.

Strong growth in energy storage business, gross profit margin of 18% continues to improve

Another highlight is the energy storage business. The financial report shows that Tesla's energy storage system construction exceeded 3.7GWh in the second quarter, an increase of 2,22% year-on-year, with the main contribution coming from the Megapack plant in Lathrop, California, which has brought about a capacity increase of 40GWh after being put into mass production. Currently, the main sales targets of the California plant's energy storage systems are: North America (63%), Australia (23%) and the United Kingdom (5%). It is worth noting that, unlike the decline in gross margin for EVs, the gross margin for the energy storage business was 18% in the current quarter, an increase of 7 percentage points from 11% in the previous quarter.

Tesla's supercomputer Dojo is now in production and is expected to reach the world's top five in terms of computing power by 2024

In the report, Tesla announced that its own supercomputer Dojo has begun production, which will be used to train its own AI in order to reduce the cost of training, Elon Musk said in the meeting: At present, we have not seen a large-scale language model proposed by the automatic driving car, mainly because the automatic driving is more difficult compared with other fields, in order to solve the problem of the automatic driving system, four major elements need to be coordinated with each other (large-scale database, neural network training, car hardware and software), and Tesla has more than 450 million driving data volume, and also has hardware and software capabilities. Tesla has more than 450 million pieces of driving data and has the hardware and software capabilities. The supercomputer Dojo will assist in AI machine learning and computer vision training to improve existing software and develop new features as part of the driver assistance system (FSD). Dojo is expected to have 100,000 A100 GPUs by the beginning of 2024 and will be among the top five in the world in terms of computing power.

Ji-Pu Viewpoint:

Looking ahead to 2023, Tesla will still be one of the leading EV manufacturers and the only profitable EV manufacturer in the world (the other one is BYD). While other manufacturers are still worrying about how to design new EVs or how to produce EVs, Tesla has already been able to cut prices to grab the market share under the premise of guaranteeing profitability. Although the gross profit margin may be eroded in the short term due to the price cut strategy, the overall EV market pie is growing, and as long as Tesla can maintain its market share in the future, the overall profit will continue to increase and the cash flow will also grow positively. In addition, as long as other car makers can't catch up with Tesla's costs, and the U.S. government's insistence on de-Chinaization of the EV market, Tesla's main business will continue to make money in an environment with no competition, thanks to the U.S., the world's second-largest automobile market.

In terms of EV infrastructure, it has been rumored that Tesla's NACS interface will unify the North American market, which will bring hundreds of billions of dollars of growth potential for Tesla's super charging network. In the future, with the continuous increase of Tesla's storage system capacity and the introduction of Tesla's own products into the power grid, it is expected that by 2024 we will see an increase in the share of storage business in revenue (currently only 6.5%). Considering that the storage field is not like the EV business in terms of price cuts, it is estimated that Tesla's overall profit margins will be improved in the future as a result.