Corporate News|FSMC 2025 Q2 Press Conference

TSMC 2025 Q2 Presentation and Commentary

TSMC held a Q2 2025 press conference today and announced its Q3 outlook. During the meeting, it was announced that the annual revenue growth rate for the year was adjusted from 25% to around 30%, which is in line with the market expectation. Capital expenditures for the year will remain unchanged at US$38-42 billion.

Highlights of TSMC's Q2 Financial Results

- Single-quarter revenue of ~NT$933.79B, QoQ +11.3%, YoY +38.6%

- Gross profit margin 58.6%, QoQ -0.2, YoY +5.4

- Operating interest rate 49.61 TP3T, QoQ +1.1, YoY +7.1

- After-tax net income of approximately NT$398.27 billion, QoQ +10.2%, YoY +60.7%

- EPS (Earnings Per Share) : NT$15.36, QoQ +10.2%, YoY +60.7%

TSMC's 2Q25 EPS of NT$15.36 beat market expectations of NT$14.55. In dollar terms, Q2 revenue was NT$30.07B, up 44.4% YoY and 17.8% QoQ.

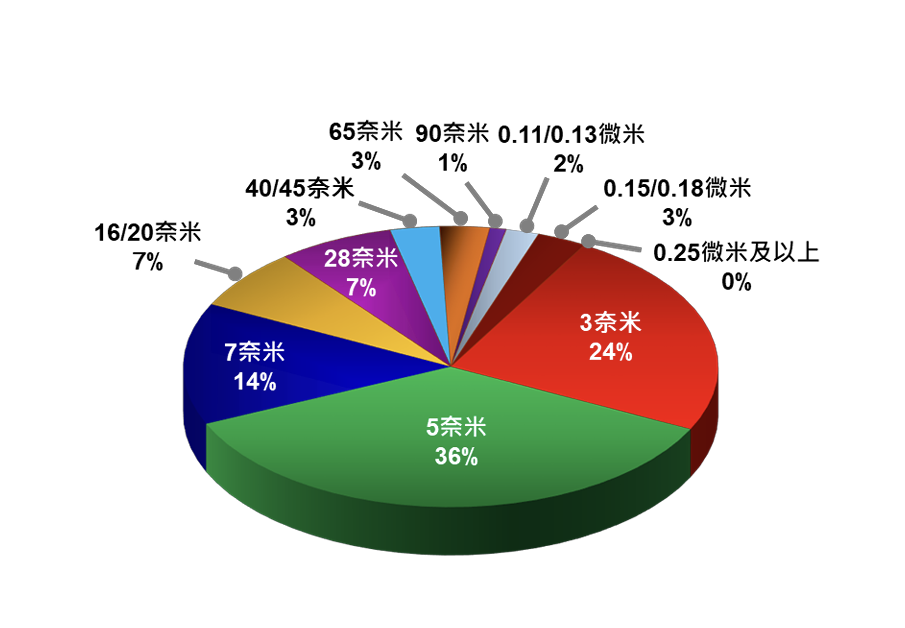

2025 Q2 Process Revenue Share

Shipments of 3nm process accounted for 24%, 5nm accounted for 36%, 7nm accounted for 14%, and advanced process (7nm and above) accounted for 74% of the overall sales.

TSMC 2025 Q2 Revenue Share

Source : TSMC

Third Quarter Corporate Financial Results

TSMC estimates Q3 US dollar revenue to fall between $31.8 billion and $33 billion, gross margin to fall between 55.5 and 57.5%, and operating profit margin to be between 45.5 and 47.5%. In addition, the meeting's chief financial officer, Mr. Huang Jen-chiu, pointed out that the exchange rate in the first quarter was NT$32.88 per US dollar; in the second quarter, the NT dollar strengthened by 4.4% to 31.05 and reduced revenue and gross margin by 4.4% and 1.8 percentage points each; if the exchange rate in the third quarter is 29, it will strengthen by another 6.6%. In the second quarter, the NT dollar appreciated by 4.4% to NT$31.05, which reduced revenue and gross margin by 4.4% and 1.8 percentage points respectively. If the exchange rate is 29 in the third quarter, the NT dollar will appreciate by another 6.6%, which will further reduce revenue and gross margin by 6.6% and 2.6 percentage points respectively (every time the exchange rate appreciates by 1%, the revenue will be reduced by 1%, and the gross margin will be reduced by 40 percentage points). However, in the long run, gross margin is still expected to reach over 53%.

Overseas Expansion and Prospects

During the meeting, Mr. Wei pointed out that the six advanced wafer fabs to be built in the U.S. state of Arizona, with a total investment of up to $165 billion, will cover 30%'s 2-nanometer and more advanced process capacity.

The first wafer fab already mass-produced 4nm in the fourth quarter of last year, with yields comparable to those of the Taiwan fabs. In order to accelerate the expansion of the fabs to meet customers' needs, the second fab will also be mass-produced several quarters earlier. Fab 3, which is now in construction, will introduce 2nm and A16 process; Fab 4 is also scheduled to adopt 2nm and A16 process; and Fabs 5 and 6 will adopt more advanced technologies. The construction and mass production plans of these fabs will be based on customers' needs.

Strong demand for AI

The demand for AI also continues to be strong, causing TSMC's production capacity to run out of steam. As Mr. Wei mentioned, TSMC's 3nm production capacity is really tight, and the situation will continue for several years. In fact, 5nm is also very tight, and overall, 7nm and below advanced process technologies are all in very tight production capacity.

Ji-Pu's point of view.

TSMC's press conference concluded with a financial report and outlook that exceeded market expectations almost across the board. TSMC said it is benefiting from strong AI and High Performance Computing (HPC)-related demand, and revised upward its full-year revenue growth by 30%, which not only reflects strong demand, but also the leverage of doubled CoWoS production capacity and increased price effects. Although full-year revenue growth has been revised upward, it also implies a possible quarterly decline in revenue in the second half of the year (both quarters). To summarize the risks in the second half of the year, in the absence of obvious rivals in the N3/N2 manufacturing process, the pulling power of Apple's IPHONE may be insufficient, the U.S. tariff warning on Taiwan's 32% is still in place, and the export control policy on AI chips is also repetitive, so the rhythm of order taking may be disturbed. The current exchange rate loss and the impact of the cost of overseas expansion can be temporarily eliminated from the increase in the ASP, but we still need to continue to observe the overall strategy in the future.