Corporate News|FSMC 2025 First Quarter Press Conference

TSMC held a press conference yesterday (17th), the first quarter of 2025 revenue figures out of the recent moment when Taiwan and the U.S. negotiations on reciprocal tariffs, TSMC Chairman and President Wei-Chehia for the first time responded to the Taiwan government is in the process of tariff negotiations with the U.S. government, but TSMC is not involved in it.No impact on customer orders so far, overall demand remains strongThe

Highlights of TSMC's First Quarterly Financial Results

- Consolidated revenue of approximately NT$500 million, QoQ -3.4%, YoY +41.6%

- Gross margin 8%, QoQ -0.2, YoY +5.7

- Business interest rate 5%, QoQ -0.5, YoY +6.5

- After-tax net income of approximately NT$600 million, QoQ -3.5%, YoY +60.3%

- EPS (Earnings Per Share) : NT$94, QoQ -3.5%, YoY +60.4%

TSMC's first-quarter consolidated revenue was NT$839.25 billion, an annual increase of 4.16%, a quarterly decrease of 3.4%; after-tax net income of NT$361.56 billion, an annual increase of 6.03%, a quarterly decrease of 3.5%, a new record high in the same period of the past year; EPS was NT$13.94; in other words, TSMC's first-quarter opening daily profit was NT$4.017 billion. Based on the assessment of the current business situation, the company has released its outlook for the second quarter of this year, estimating that the second quarter of this year's US dollar revenue will range from 28.4 to 29.2 billion US dollars, with an average quarterly increase of nearly 13%; assuming an exchange rate of NT$32.5 to US$1, the estimated gross profit margin will range from 57 to 59%, and the operating profit margin will range from 47 to 49%.

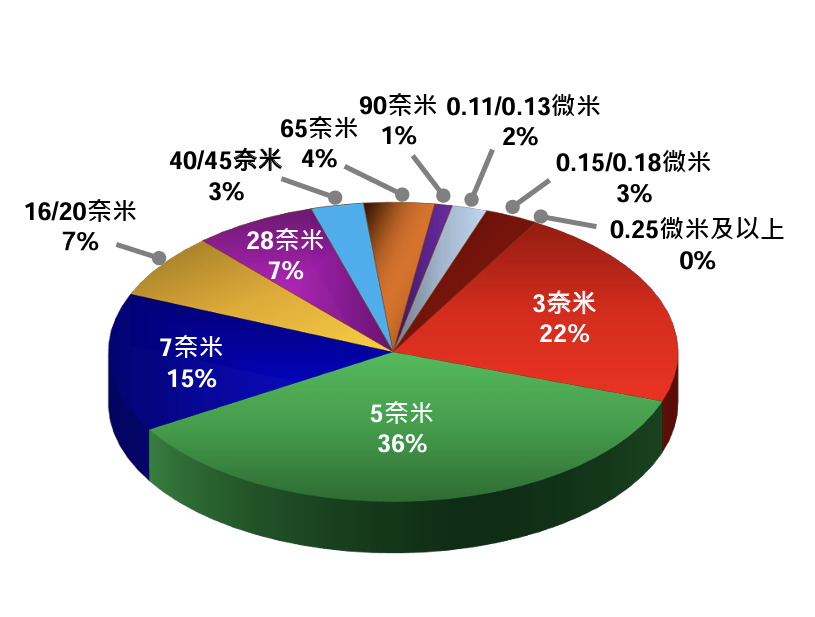

2025Q1 Process Revenue Share

It is worth noting that 3nm process accounted for 22%, 5nm process accounted for 36%, 7nm process accounted for 15%, and advanced process accounted for 73% of the quarterly wafer sales (including 7nm and more advanced processes).

Source : TSMC

2025Overall Outlook

TSMC Chairman Chieh-Chia Wei reiterated his expectation of near mid-double-digit USD revenue growth for the full year (24~26%, ~25%) to remain unchanged.Continues to Outperform Foundry 2.0 Industry, Expects Continued Strong AI Demand and Moderate Recovery in Other MarketsThe

Wei-Chee-Chia emphasized that TSMC's five-year compound growth direction from 2024 onwards also remains unchanged; TSMC's revenue in the second quarter of this year is expected to recover due to strong customer demand for 3nm, and the overall foundry 2.0 will continue to grow due to AI demand.

And this yearCapital expenditures remain unchanged at US$38-42 billion.TSMC's capital expenditures for the first quarter of this year amounted to US$10.06 billion, which is in line with the market's expectation and will challenge the record high; among them, approximately 70% is used in advanced manufacturing processes, 10% to 20% is used in special manufacturing processes, and another 10% to 20% is used in advanced packaging. In addition, according to TSMC's press release, capital expenditures in the first quarter of this year amounted to US$10.06 billion, a slight decrease from US$11.23 billion in the fourth quarter of last year.

Tariff uncertainty

On the issue of tariffs, which is of concern to corporations, although there are many risks and uncertainties associated with tariffs in the near future, we are pleased to report that we have been able to achieve the following results.Have not yet seen a change in customer attitudesMr. Weijer noted that more information on the tariff issue may become available in the coming months and that he will continue to pay close attention to the potential impact on end-market demand and manage the business prudently.

And in a situation filled with uncertainty, TSMC willContinued focus on business fundamentalsTSMC is confident that it will be able to continue to outperform Foundry 2.0's annual growth this year, as it further strengthens its competitive position through technology leadership, manufacturing excellence, and the trust of its customers.

About the Joint Venture

Recently, rumors of the joint venture between TSMC and Intel have been circulating frequently and have led to concerns about whether it will result in the outflow of technology, Wei Zhejia also gave a clear answer at the conference; he said.TSMC is not currently engaged in any joint-venture technology licensing, technology transfer or sharing discussions with other companies.The

Continuing U.S. Investment

Wei Zhejia said that TSMC is increasing its investment in the U.S. It is estimated that after the project investment is put in place, there will beApproximately 30% of 2nm and above capacity will be located in ArizonaTSMC will also create greater economies of scale and help foster a more complete semiconductor supply chain ecosystem in the US. In response to very strong AI demand from the U.S. market, TSMC must expand capacity to support customers such as Apple, NVIDIA, AMD, Qualcomm and Broadcom.However, the timeline is not explicitly given, which will be an important point to observe to allow TSMC to retain flexibility.

Ji-Pu's point of view.

Judging from the prediction that "no company has revised TSMC's production capacity so far" mentioned by Chairman Chieh-Chia Wei at the press conference, the growth momentum of AI this year is still obvious, and it is expected that the revenue in AI will be doubled. It is also expected that 3nm and 5nm capacity will contribute significantly in the second quarter, and for the CoWoS part, it is proposed to accelerate the expansion of capacity this year. However, TSMC is afraid that tariffs, inflation, and other impacts on global economic performance will drag down future demand. In addition, TSMC's previousWhether the company will propose a joint venture and take over Intel's foundry division.(math.) genusJi-Pu has already made the inference in his March articleThe story of the "Liao Zhai Zhi Yi" is a story of the same kind. [News Commentary|Reuters: TSMC Proposes Joint Venture with Phaidon, Supermicro for Intel FoundryThe company's technology licensing program has been in place for a long time. We also emphasized that TSMC has not discussed cooperation or technology licensing with any outside entity or enterprise. In an era where semiconductor chips have been upgraded to a national strategic asset, no decision will be perfect, and the most important thing to consider is how to maintain one's core competitiveness and what choices to make. This time, TSMC said it will deliver a bright result in the background of full of uncertainty, hoping to restore the confidence of the market.