Corporate News|Tesla's Q1 2024 law says

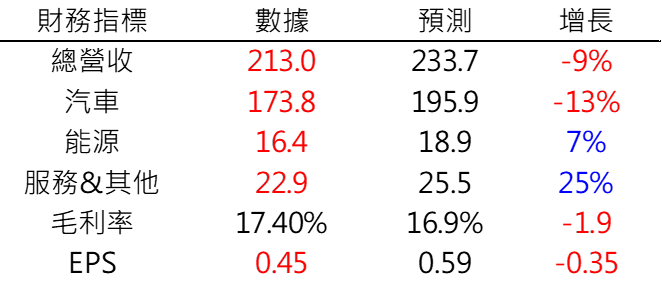

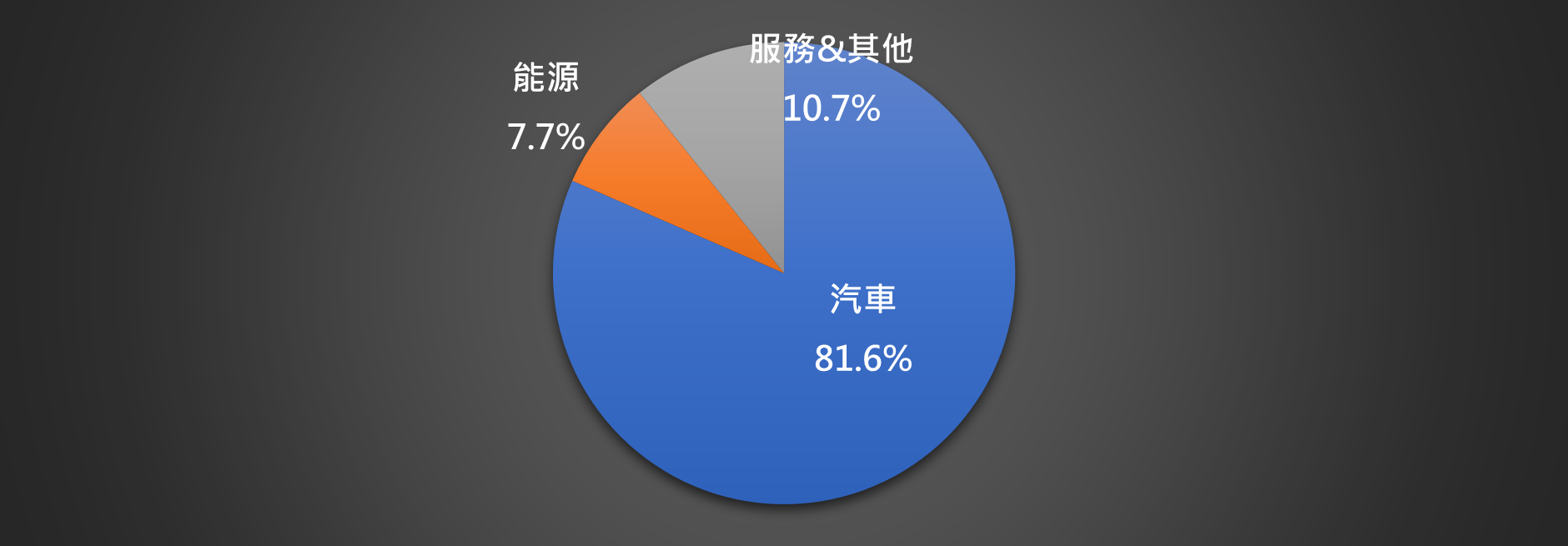

Tesla released its Q1 2024 report today, with overall revenue of $21.0 billion, below analysts' expectations of $23.37 billion YoY, a decrease of 9%, of which automobiles accounted for the highest share of 81.6%, while the service and energy businesses each accounted for 10.7% and 7.7%. Gross profit margin of 17.4% was down 1.9% compared to Q1 2023, and EPS of 0.45 was lower than analysts' expectations, and down 0.35 from last year. Gross margin 17.4%, down from Q1 2023, down 1.9%, EPS 0.45, below analysts' expectations, down 0.35 from last year Even so, Elon Musk mentioned at the meeting that the $25,000 car (Model 2) is expected to be released earlier than expected to the beginning of 2025, and after this news was announced, the stock price rose by 12% after the trading session, which has become the few highlights of Tesla's performance since 2024. As for the full year growth in 2024, the company maintains the statement made in last quarter's lawsuit, "Overall growth will be lower than 2023, but Tesla will perform better than other car makers' declines". In addition, Elon Musk also expressed his disappointment at the meeting that the current market adjustment of EV strategy by various car makers is becoming conservative, which is different from the company's layout. However, Tesla still maintains the judgment that EV will be the future trend, and will continue to offer more incentives to promote EV, including lowering the price of the FSD, lowering the price of the Model 3, and launching a low-priced EV, etc.... .......

Q&A Session Highlights (some questions answered by Vaibhav Taneja/Elon Musk)

- In addition to cost control, the decline in profit was mainly due to the Model 3 production line upgrade in Fremont and the shutdown of the Berlin plant.

Tesla has been upgrading the Model 3 production line at its Fremont (California) plant for a while now, and the upgrade is still underway. Upon completion, Tesla's full production capacity is expected to be increased to 3 million units per year, but there is no definite timeframe for completion. The shutdown of the Berlin plant also had a downward impact on Tesla's profit for the current quarter, but since the shutdown is a short-term issue, the impact is expected to be limited in the long run. In addition, the cost of Model Y in Austin and Berlin is close to that of Fremont, which can meet the requirement of cost optimization while guaranteeing the quality. Lastly, Tesla expects to save around $1 billion from the recent labor streamlining, which is expected to help margins in the long run.

- New, lower-priced model (Model 2) expected to launch in early 2025

Tesla is currently accelerating the launch of low-cost models, the actual launch date has not been finalized yet, but there will be an update announced on 8/8. The new models are expected to share production capacity of the Model 3, which is being upgraded, so there is no need for an additional production line, and the production base is expected to be in Fremont.

- 4080 battery module production has been increased

The 4080 battery capacity has increased by 18~20% compared to 2023Q4, and the current annual capacity is 7GWh. Cybertruck uses 4080 batteries for assembly, and the current supply consumption is within a few weeks.

- Cybertruck production capacity of 1000 units per week has been achieved by April 2024

The Cybertruck, a new vehicle to be launched in 2023, reached the milestone of 1,000 units per week for the first time in April, thanks to the efforts of its engineers. Due to the use of new technologies on the Cybertruck, it will be a challenge to increase production capacity in the future, and it is expected that mass production will be completed by the end of 2024 to early 2025.

- The Optimus is capable of performing simple assembly tasks.

Optimus is well on its way to performing some simple assembly tasks. Tesla is now planning to introduce robots to perform some of the EV assembly work by the end of 2024, and is still working out the details of where to place the robots in the assembly processes or factories. Tesla believes that the robotics business has more commercial potential than the company's other businesses combined, and that the company's robots have the ability to reason and calculate better than other companies.

- Regulatory oversight of automated driving (FSD) is already under discussion in many regions

In terms of legal regulation, some states in the U.S. have already loosened their regulations, and the company is currently communicating with several states (ex: San Francisco has already been approved by some localities, and LA is also in the process of negotiation). Although the laws and regulations vary from region to region, the driving behavior is actually very similar, and there is no chance that you will know how to drive in one place and forget how to drive in another place. Therefore, the continuous evolution of automated driving and the ultimate achievement of higher safety are the key elements to pass the regulation.

- FSD is safer, future car usage efficiency will increase due to neural network end-to-end computing

In terms of safety, if you look at the data, you can see that FSD driving behavior is about twice as safe as human driving. In the long run, if we don't introduce automatic driving, it's like killing people (quote), and in the future, automatic driving will definitely penetrate into our lives. In the future, Tesla will not be a car company, but an AI company with AI as its core business. In the future, Tesla will operate a fleet of robots (Robotaxi) and provide services like Airbnb and Uber combined. So that users can not only use the phone to easily call the self-driving car, but also to free their hands of idle cars to profit, and limit what level of users can use their own cars. The company can get a lot of data from this ecosystem, just like Google can get a lot of data through search, Tesla will use a lot of vehicle user information to train self-driving ability.

- Tesla will have a powerful automotive neural network in the future.

Just as AWS and other cloud platforms are distributed and users can send their demands to these servers, the future of automotive neural networks will follow this same model (an estimated fleet of 100 million units), with all of these electric vehicles having reasoning and computing power (arithmetic). It is estimated that there will be 100GW of computing power spread across the vehicles, the car will no longer be just a car, but a supply of computing power, and the number of hours of car use will increase from 10 hours a week to 50 hours a week (both in terms of travel and computing power).

- Tesla is one of the leaders in AI and is now using neural networks to train autopilot

Tesla currently has several models to train neural networks that collect large amounts of data from users to upgrade safer driving behavior. Among them, millions of videos are used to train for emergency situations (ex: what to do if someone suddenly jumps in front of the car). The data is analyzed accordingly. In addition, Tesla's closed simulation system can also reproduce the events that may happen on the road, and ultimately avoid accidents. Currently, there are engineers in San Francisco, LA, and Austin conducting relevant analysis, and people are also collecting relevant data in field tests. At this stage, the plan is to increase safety testing on a weekly basis and provide feedback on whether critical events have improved. Once improvements are identified, updates will be made for early adopters and thousands of internal employees to try out and provide feedback on the testing. For external testing, Tesla has a data dashboard that ranks the importance of critical events and expects to follow up on all events with further training based on this feedback. Currently, these trainings are continuous positive feedback cycles: problem discovery, problem fixing, evaluation, and feedback.

The company has a very good system in this area, there is no need to do too much intervention in engineering, in a sense, our engineers are not like coding programmers, the system can already do automatic learning for data. For example, we all know that images at intersections are very important, now we can automatically collect relevant data and use neural network learning to increase driving safety. Currently, a complete event training takes a few weeks to complete, including collecting millions of image data, analyzing the data, training, and so on.... But in the future, with increased training capabilities, the time will be shortened, and hardware devices, GPUs, supercomputers such as Dojo, and so on, will help us to continue to make progress.

Ji-Pu Viewpoint:

On the whole, Tesla's financial data in this press conference was not outstanding, no matter revenue, gross profit, EPS, or even the three major areas, all of them failed to meet analysts' forecasts. However, the continuation of the low-priced Model 2 (tentative) program and the news that it is expected to be announced in early 2025 still satisfied investors' expectations and led to a surge after the trading session. It can be seen that Tesla's short-term growth still hinges on the growth potential of electric vehicles. Therefore, it has become an urgent task for Tesla to find a way to make up for the shortage of EVs below $30,000 as soon as possible, so as to solve the pain point of having no cars for sale in the low-priced range. However, if you look at the conversation in depth, as well as the focus of the question and answer session can be seen, in addition to the production capacity and cost issues, in fact, was mentioned most of the contents of the FSD, robotics, car networking computing and other AI-related issues, which includes the use of robots are ready to assist in the construction of vehicles, but also emphasized that the Optimus already has the ability to reason logically; and for the training of the FSD has already been used to AI to help improve the efficiency; and in the automotive neuronics to help enhance the efficiency; and in the automotive neuronics to assist in the construction of vehicles, but also to help improve the efficiency of the FSD training. In terms of automotive neural network (end-to-end) computing, a complete ecosystem can be carved out to increase the speed of data collection and help automobile users gain profits by sharing computing power among automobiles, so as to increase the efficiency of the use of automobile computing power. Even in the question and answer session with reporters, Tesla directly and honestly said that Tesla is an AI company, and it is a company that is at the forefront of the AI field. It is not difficult to realize that the most important thing for Tesla to maintain its growth in the long run is not the sales profit of its automobile business, but its vision and practice in the AI field. However, no matter whether it is the FSD or the neural network computing ecosystem, it needs a huge number of users to increase the speed of data collection. Therefore, it is not difficult to imagine that Tesla's continuous price cuts in selling cars and the launch of Robotaxi to form a fleet of cars are for the long-term AI development planning.